Hong Kong, with its unique status as the gateway to the Chinese mainland for businesses, should not rest on its laurels — it should continue to diversify economic growth engines to attract more global enterprises, talent and investment to the city — say economists and business advisory leaders.

The special administrative region has continued to shine as a leading global business and finance hub despite geopolitical tensions, the tariffs row and a moderate economy.

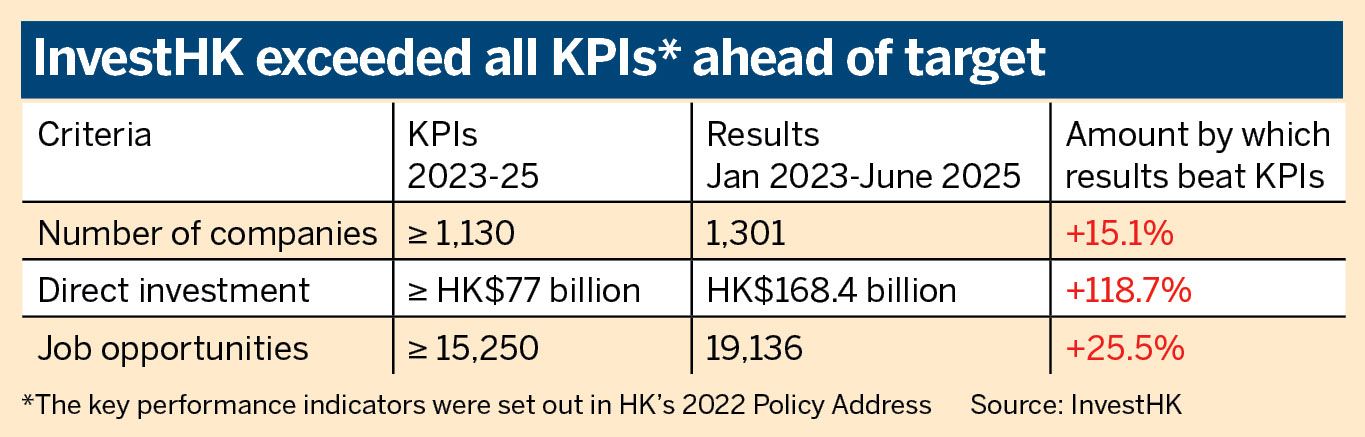

Invest Hong Kong — the Hong Kong Special Administrative Region government’s investment promotion agency — helped more than 1,300 overseas and mainland companies set up or expand their businesses in the city between January 2023 and June 2025, bringing in direct investment of more than HK$168 billion ($21.40 billion), and creating over 19,000 jobs in their first year of operation.

READ MORE: Over 1,300 mainland, overseas firms attracted to HK in 2.5 years

InvestHK’s showing has exceeded all the key performance indicator requirements listed by the SAR government.

Billy Mak Sui-choi, associate professor at Hong Kong Baptist University’s Department of Accountancy, Economics and Finance, says Hong Kong’s business environment has improved despite economic restructuring in certain sectors.

The increase in the number of enterprises settling down in the SAR can be explained by its continued economic growth, the recovery of its tourism industry, and the city’s potential as a global finance, and innovation and technology hub, he says.

Among the 1,300 overseas and mainland companies that have set up shop or expanded in Hong Kong, 630 are from the mainland, followed by those from the United States (113), the United Kingdom (89) and Singapore (68). Up to 22 percent of them are engaged in financial services and financial technology, followed by innovation and technology (21 percent) and family offices (14 percent).

“Hong Kong’s business environment will remain attractive, particularly for finance and technology players, as we have built up economies of scale in terms of capital and talent, which will be a virtuous circle in luring more global companies and talent to the city,” Mak tells China Daily.

To boost competitiveness, he believes Hong Kong has to create a bigger economic pie. “We can focus on the synergistic development of the Northern Metropolis and the Hetao Shenzhen-Hong Kong Science and Technology Innovation Cooperation Zone to get more global innovation and technology players here, and enhance the growth of the I&T sector.”

However, Mak warns of “black swan” factors that must not be taken lightly, such as the policies of the US and European governments toward Hong Kong that may affect the city’s business standing.

Cyrus Cheung Lap-kwan, deputy president of CPA Australia Greater China for 2025, agrees that diversifying into new markets and industries is essential for sustained growth.

“By exploring sectors like technology, green energy and biotechnology, Hong Kong can lift its economic resilience and innovation capacity. Developing the cultural and creative sectors, medical services and education services can contribute to a more diversified and resilient economy, creating jobs, and promoting innovation across multiple fields.”

ALSO READ: Foreign businesses banking on GBA as ‘heart of economic miracle’

Cheung says the company redomiciliation regime initiated by the Financial Services and the Treasury Bureau will help to attract more global enterprises and investment to Hong Kong.

The SAR’s global competitiveness has gone up, with the International Institute for Management Development having raised the city’s ranking by two places to third globally in the World Competitiveness Yearbook 2025. The achievement marks Hong Kong’s return to the global top three spots for the first time since 2019.

In the last 25 years, the SAR’s investment promotion agency had facilitated over 7,700 overseas and mainland companies setting up or expanding their operations in Hong Kong, creating over 95,000 jobs and bringing in direct investment exceeding HK$440 billion ($55.42 billion).

Contact the writer at oswald@chinadailyhk.com