Foreign businesses are banking on the Greater Bay Area as the ‘heart of the economic miracle’, boosted by favorable government policies, a sound industrial network and a conducive investment climate. Zhou Mo reports from Shenzhen.

Huizhou is fast moving up the ladder, taking a key step forward in its aspirations to be a world-class green petrochemical production hub with the launch of ExxonMobil’s mega ethylene project.

The Texas-based energy giant’s $10 billion plant swung into action earlier this month in the industry-tourism-rich city — one of the nine Guangdong cities in the Guangdong-Hong Kong-Macao Greater Bay Area.

The project’s first phase, which took five years to complete, offers a suite of cutting-edge facilities, including a flexible-feed steam cracking unit with an annual output of 1.6 million metric tons of ethylene, two high-performance linear low-density polyethylene units with a yearly output of 1.2 million tons, the world’s largest single low-density polyethylene unit with an output of 500,000 tons per year, and two differentiated high-performance polypropylene units with a total annual output of 950,000 tons.

As one of China’s vital foreign investment projects and the first major petrochemical facility built solely by a United States enterprise in the country, the plant underscores the Greater Bay Area’s status as a premier destination for foreign investment.

READ MORE: Beijing: HK attracting increased investment from foreign entities

Despite geopolitical complexities and global economic uncertainties, scores of foreign businesses took root in the region in the first half of this year.

Notable developments included the topping out of the first phase of German electric motors and frequency inverters manufacturer SEW-Eurodrive’s South China manufacturing base in Foshan last month, with trial runs due to start by year-end. French construction product manufacturer Saint-Gobain began construction of its manufacturing base in Jiangmen in April, while German health technology company Siemens Healthineers broke ground on a new research, development and manufacturing center in Shenzhen in January.

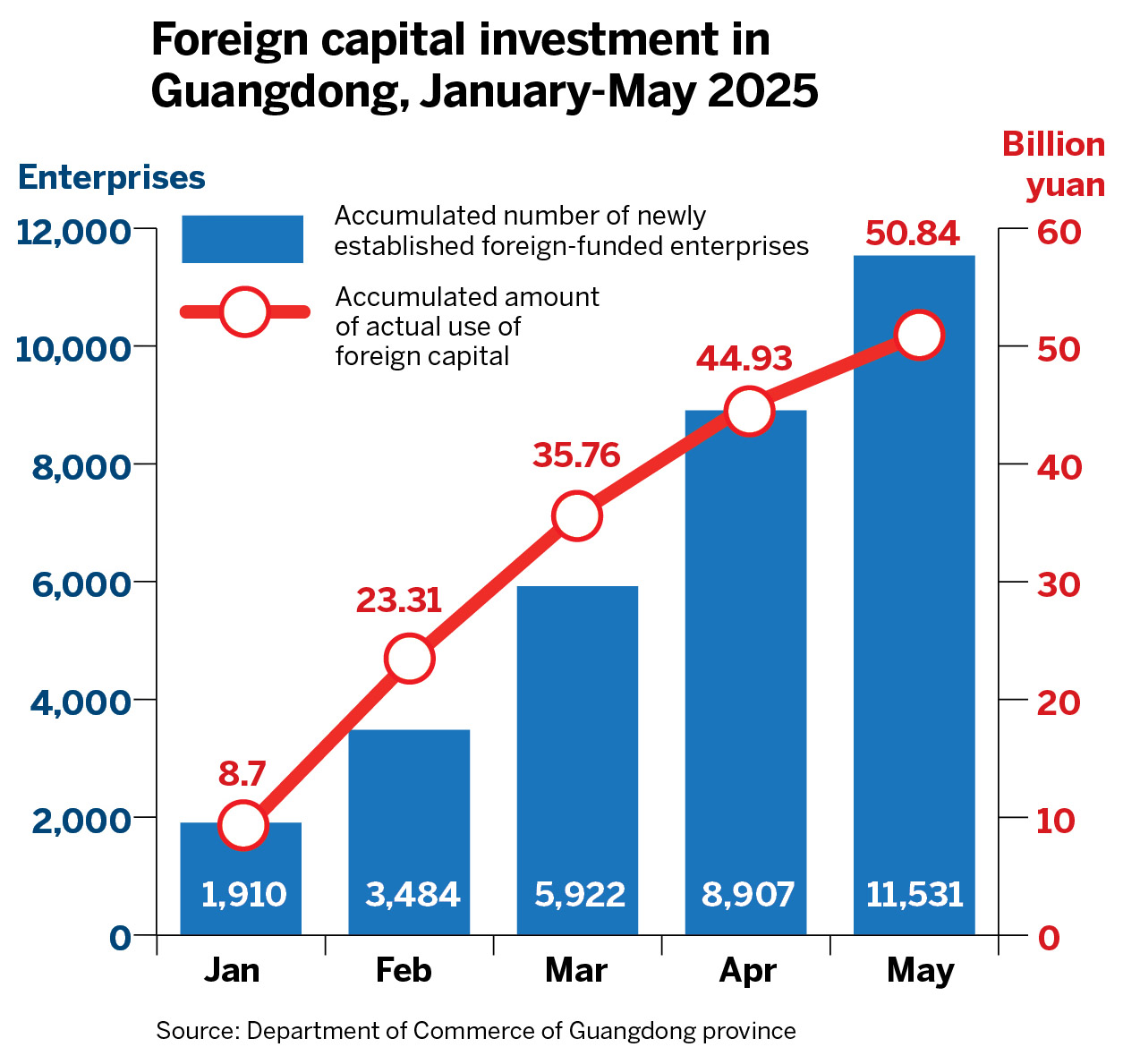

As the influx of foreign entrants gathers pace, the number of newly established foreign-funded enterprises in Guangdong reached nearly 12,000 in the first five months of 2025 — a year-on-year increase of 23.4 percent — according to the province’s Department of Commerce. Actual use of foreign capital expanded 6.1 percent on a yearly basis to 50.84 billion yuan ($7.08 billion).

Spanish bank Banco Santander is setting up a branch in Shenzhen, marking its third in China after one in Shanghai that opened in 2008 and another in Beijing in 2014.

Growing appeal

The sustained inflow of foreign capital and the accelerated materialization of major projects in the 11-city cluster is a compelling example of the region’s growing allure for foreign businesses despite international economic headwinds and a shifting industrial landscape.

Overseas enterprises pick investment destinations by evaluating a multitude of factors, such as land costs, human resource expenses, technological capabilities and manufacturing capacity. Having robust industrial supporting capabilities is another decisive element.

The nine Guangdong cities of the Greater Bay Area boast strong industrial support capabilities, with the province possessing 40 out of 41 major industrial categories nationwide, according to Zhang Yuge, director of the Department of Hong Kong, Macao and Regional Development at Shenzhen-based think tank, the China Development Institute.

“The region’s well-developed industrial ecosystem offers immense allure for foreign businesses,” he says.

More importantly, the nine cities excel in three areas — marketization, internationalization and openness. Such superiority is closely intertwined with their unique geographical advantage of being adjacent to Hong Kong and Macao, helping them to draw upon and adapt the institutional strengths and operational models of the two special administrative regions.

“The synergy forms a distinctive advantage in attracting foreign investment,” says Zhang.

Supportive environment

The growing appeal of the Chinese mainland cities in the Greater Bay Area among foreign companies is partly attributed to their favorable policies, backed by efforts to create a conducive business atmosphere to lure foreign investors.

In Shenzhen, foreign-funded enterprises with annual “newly added actual foreign investment” exceeding $50 million in 2023 and 2024 are entitled to incentives ranging from 1 to 3 percent of the investment value, depending on the type of industry, with rewards capped at 50 million yuan. Newly added actual foreign investment refers to the net increase in foreign capital that has been put to practical use within a particular area during a defined period.

Multinational corporations that have established regional headquarters in Shenzhen can receive a one-off reward of 5 million yuan if their newly added actual foreign investment reached $10 million annually during the two-year period.

Guangzhou has set up a white list of key foreign-invested enterprises to enhance government services for them. A dedicated workforce is tasked with facilitating overseas firms’ operations in the provincial capital.

“The mainland cities of the Greater Bay Area have moved beyond relying mainly on cost advantages to attract foreign investment. Foreign capital is now increasingly directed toward high-end manufacturing and producer services, signifying that the region is achieving high-level opening-up, driven by high-quality development,” says Xin Jizhao, secretary-general of the Guangdong Academy of Greater Bay Area Studies.

According to Xin, the proportion of foreign investment in Guangdong’s manufacturing sector has been on the rise. In the first four months of this year, the actual use of foreign capital in the province’s manufacturing sector reached 13.05 billion yuan, marking a 23.6 percent year-on-year increase and accounting for 29 percent of the province’s total.

“The transformation and upgrading of traditional industries, along with the development of emerging sectors, has yielded fruitful results,” says Xin. “Projects investing in the Greater Bay Area have introduced new technologies and products in recent years, featuring high-end and green characteristics.”

ALSO READ: Macao SAR entrepreneurs urged to unify amid challenges

In the first four months of 2025, Guangdong’s actual use of foreign capital in electronic information manufacturing surged eightfold on a yearly basis, while in the manufacturing of green petrochemicals and specialized equipment it was up 81.2 percent and 3.5 times respectively.

César Fragozo, executive vice-president of China Chamber of Commerce and Technology Mexico, says that while Mexican enterprises currently have a limited presence in terms of investment projects in the Greater Bay Area, he’s brimming with optimism.

“Most of the trade we started with China many years ago began in the Greater Bay Area. We consider this area to be the heart of the whole economic miracle.”

As Sino-Mexican economic and trade ties deepen, a growing number of Mexican enterprises are shifting their focus to the region. The chamber is forging bridges to help companies explore collaborative prospects, anticipating the emergence of more substantive investment initiatives that will elevate bilateral economic ties to new heights, he says.

Contact the writer at sally@chinadailyhk.com