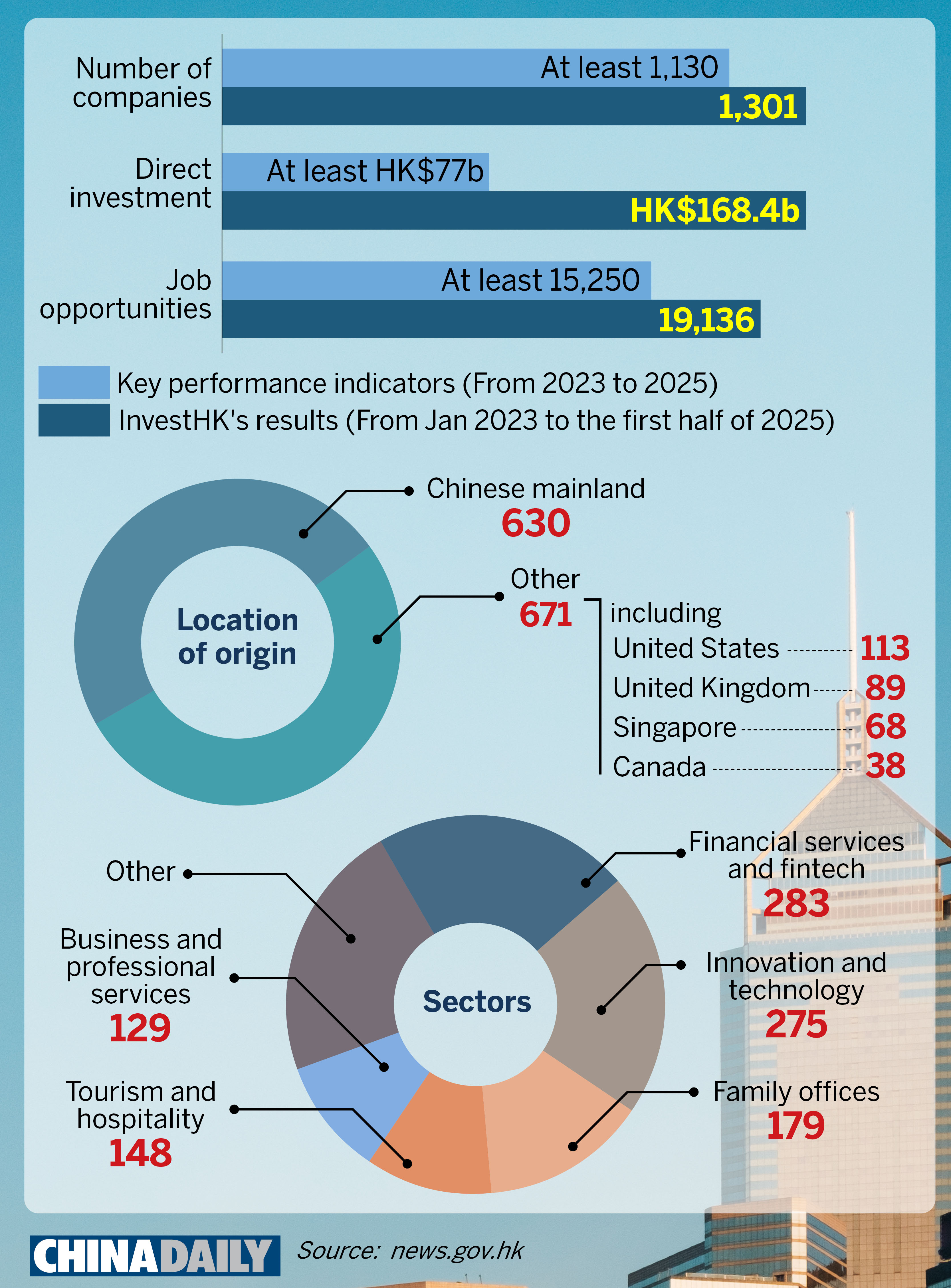

The Hong Kong Special Administrative Region has attracted more than 1,300 overseas and Chinese mainland companies to set up or expand their operations in the city over the past two-and-a-half years, surpassing government targets and reinforcing its status as Asia’s leading business hub despite global headwinds.

InvestHK — the SAR government’s investment promotion arm — announced on Monday, these firms brought more than HK$160 billion ($20.38 billion) in direct investment in their first year of operation, more than doubling the HK$77 billion target set in the 2022 Policy Address. The companies have created over 19,000 new jobs for Hong Kong.

The mainland, from where 630 companies originate that have chosen to set up or expand their operations in Hong Kong, is the largest source market, accounting for nearly half of the total. Other key origin markets include the United States (US), the United Kingdom (UK), Singapore, and Canada.

ALSO READ: InvestHK to showcase Hong Kong’s biotech edge in US

More than 20 percent of the new entrants are in the financial services and fintech sector, with another 20 percent in innovation and technology, while the rest cover sectors such as family offices, tourism and hospitality, and business and professional services.

In the first half of this year alone, 380 companies opened or scaled up their operations in Hong Kong, bringing an estimated direct investment of HK$39.1 billion to the city in their first year. These firms are expected to create more than 3,000 new jobs, a surge of over 130 percent compared to the same period last year.

This demonstrates that Hong Kong is a premium and capable location for businesses, as well as a platform for companies to access larger markets, said Alpha Lau Hai-suen, director-general of investment promotion at InvestHK.

READ MORE: InvestHK promotes Hong Kong's role as global financial hub in Canada

She emphasized that the city has been committed to strengthening its competitive industries by introducing new policies to create opportunities. For instance, the Stablecoins Ordinance, which will take effect on Aug 1, is expected to bring new vitality to the city’s financial sector.

Lau said she expects stablecoin-related firms to open offices in Hong Kong shortly after the ordinance comes into effect, given that there are already such companies in talks with InvestHK’s financial team.

In response to concerns over the impact of international trade tensions on Hong Kong’s efforts to attract investment, Lau said the city is well-positioned to turn these potential risks into opportunities, as it provides the stability and certainty that businesses need amid rising global uncertainties.

In addition to wooing enterprises, the city also established its New Capital Investment Entrant Scheme (New CIES) — part of Hong Kong’s push to enrich the talent pool and attract capital inflows — which has received more than 1,500 applications since its launch in March 2024, with over 670 applicants approved. If all applications are approved, it is expected to bring more than HK$46 billion into the city.

READ MORE: InvestHK: HK a trusted gateway for global capital seeking opportunities

The program provides a fast track to Hong Kong residency for the rich and their families who invest at least HK$30 million into eligible categories, such as stocks, bonds and real estate. Meanwhile, HK$3 million from that amount must be allocated to the CIES Investment Portfolio, which is designed to support Hong Kong’s technology and industry development.

The number of applications has surged since the assets criteria were relaxed, along with other enhancement measures, in March.

Joseph Chan Ho-lim, undersecretary for financial services and the treasury, said monthly applications have doubled to more than 150 compared to the program’s first year, which reflects growing confidence in the program among investors.

Contact the writer at irisli@chinadailyhk.com

Contact the writer at gabylin@chinadailyhk.com