Shops are closed to avoid damage by protesters at Pacific Place shopping mall, owned by Swire Pacific Ltd, in Admiralty on June 12, 2019. (ROY LIU / CHINA DAILY)

Shops are closed to avoid damage by protesters at Pacific Place shopping mall, owned by Swire Pacific Ltd, in Admiralty on June 12, 2019. (ROY LIU / CHINA DAILY)

Five decades ago, Swire Pacific Ltd was a founding member of Hong Kong’s benchmark stock index. Now the family-run company risks losing its membership as Chinese mainland technology firms increase their sway in the special administrative region’s equity market.

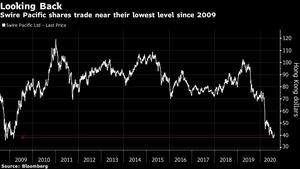

The stock has lost 43 percent in 2020, the biggest decline among the Hang Seng Index’s 50 constituents, reducing its market value to HK$58 billion (US$7.5 billion). That’s made it the least valuable member on the gauge

Swire Pacific’s shares have taken a hammering as last year’s protests and the coronavirus pandemic hurt both its airline business as well as retail and real estate operations.

The stock has lost 42 percent in 2020, the second-biggest biggest decline among the Hang Seng Index’s 50 constituents, reducing its market value to HK$59 billion (US$7.6 billion).

ALSO READ: Swire cuts HK rents as protests slam retail, tourism

Market capitalization and turnover are among factors the compiler of the Hang Seng Index considers when reviewing membership. The results of the next review will be announced after the market closes on Friday. About US$30 billion in pension fund assets and exchange-traded funds track the index.

“Swire Pacific is one of the stocks that are likely to be excluded from the HSI,” said Kenny Wen, strategist with Everbright Sun Hung Kai Co Ltd. “Even if the property market outlook turns stable, we don’t see any signs of recovery for its aviation and marine businesses in the near term.”

“Whether we’re in the index or not, we’re in Hong Kong. We’re not going anywhere,” Chairman Merlin Swire said in an online press briefing to discuss the company’s interim earnings.

Swire slumped to a first-half net loss of HK$7.74 billion, mainly due to the impact of the pandemic on Cathay Pacific Airways Ltd and significant impairment charges, it said in an earnings statement released earlier in the day.

ALSO READ: Cathay warns biggest crisis to persist after US$1.3b loss

Adding pressure is the flood of mainland technology firms listing in the Hong Kong Special Administrative Region. Three such companies -- Alibaba Group Holding Ltd, Meituan Dianping and Xiaomi Corp -- will be eligible to join the Hang Seng Index after its compiler allowed firms carrying unequal voting rights and dual-class shares to join the benchmark. The move is seen as a crucial update for a gauge overstuffed with old economy banks and insurers.

HSBC Holdings Ltd, another British firm that was a founding member of the Hang Seng Index, is the worst performer on the gauge this year. The lender currently has the third-largest weighting on the gauge.

READ MORE: HSBC, Jardines back proposed security law for HKSAR

Along with Swire Pacific, other firms that face the risk of losing membership are Sino Land Co and CK Infrastructure Holdings Ltd, due to their relatively low free-float-adjusted market cap and small trading volume, according to CGS-CIMB analysts.