The HSBC Holdings Plc headquarters building, center, stands illuminated at dusk in Hong Kong on April 27, 2020. (ROY LIU / BLOOMBERG)

The HSBC Holdings Plc headquarters building, center, stands illuminated at dusk in Hong Kong on April 27, 2020. (ROY LIU / BLOOMBERG)

HSBC Holdings Plc and Standard Chartered Plc’s Hong Kong shares are among top gainers of bank stocks across the region on optimism faster economic growth and higher interest rates will stoke profits.

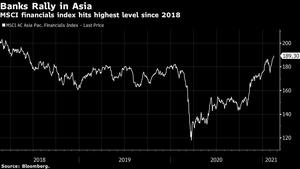

HSBC shares jumped as much as 6.9 percent, while Standard Chartered gained 6.3 percent on Tuesday after a two-day market close. The MSCI AC Asia Pacific Financials Index rose nearly 1 percent, to its highest level since June 2018 and on course for an eighth straight day of gains.

HSBC shares jumped as much as 6.9 percent, while Standard Chartered gained 6.3 percent on Tuesday after a two-day market close

“Cyclical stocks, particularly the financial sector, can be seen riding the wave of rising yields going into the Tuesday session,” said Jingyi Pan, a market strategist at IG Asia Pte.

A significant slowdown in virus cases and progress on vaccine rollouts have boosted the prospect of a pickup in global growth. US Treasuries breached key levels this week as a global debt selloff sent yields to their highest in about a year. Rock-bottom interest rates have weighed on bank earnings, even as central bank stimulus measures have boosted markets and liquidity.

ALSO READ: HSBC considers moving top executives to Asia

HSBC and Standard Chartered are both due to report their earnings next week and investors are optimistic about the resumption of dividends.

In Japan, the biggest banks have climbed at least 20 percent this year, almost erasing losses in 2020 triggered by the pandemic.

“Banks/financials generally do well when market rates rise -- which they have been recently - on global reflation expectations,” said Chetan Seth, Asia-Pacific equity strategist at Nomura Holdings Inc.

READ MORE: HSBC revives plan to cut 35,000 jobs to boost growth