Prospective buyers wearing protective masks wait in line outside the sales office for the Campton residential project in Hong Kong, June 2, 2020. (PHOTO / BLOOMBERG)

Prospective buyers wearing protective masks wait in line outside the sales office for the Campton residential project in Hong Kong, June 2, 2020. (PHOTO / BLOOMBERG)

HONG KONG - The world’s most expensive real estate market hasn't slowed despite economy slowing.

Dozens of would-be buyers lined up in the rain last week for a chance to bid on 94 apartments in The Campton project in central Kowloon, with prices starting at HK$6.8 million (US$872,400) for a one-bedroom condo. All but one of the units were snapped up in eight hours, bringing in HK$880 million for the developer, China Vanke Co.

Despite a contracting economy, existing home prices have risen 1.2 percent this year, and are the highest since November, based on the Centaline index

“When the political system and economy are unstable, cash depreciates quickly,” said a woman named Li, who joined the line in the Tsim Sha Tsui neighborhood. Li only wanted her surname used. “I want to use up the money for an apartment to preserve value.”

On the surface, it doesn’t seem like the best time to buy a property in Hong Kong. Concerns about capital outflow and tensions in a city trying to recover from the pandemic persist as economy is expected to see a record 7 percent contraction this year.

Better bet

For some residents, uncertainties make real estate a better bet than other assets. Last month, Sun Hung Kai Properties Ltd. sold 97 percent of its 298 apartments worth almost HK$2 billion in one day, according to the developer.

ALSO READ: HK home prices rigid even as COVID-19 tanks economy

Li, a housewife in her 40s, believes the housing market can withstand a deteriorating economy because the supply of homes will never catch up to demand.

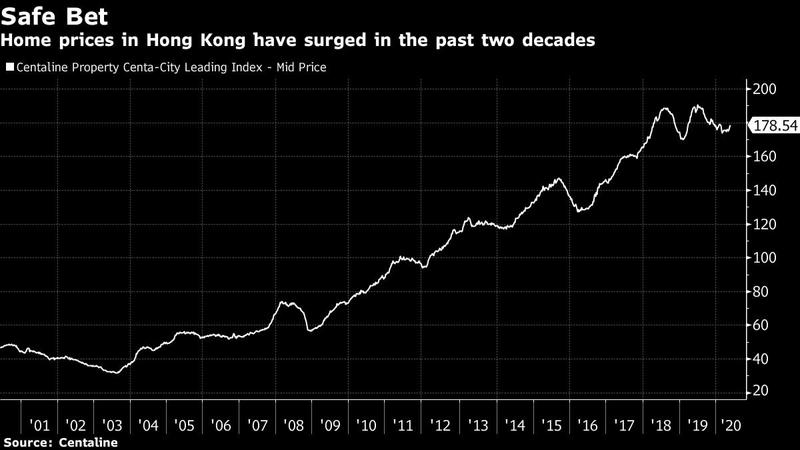

“Hong Kong is a very small place,” she said outside the Vanke project sales center. “If you look at home prices 20 years ago and now, properties bought then are all making huge profits.”

The numbers back her up. Property prices have surged 230 percent since 2000, data from Centaline Property Agency Ltd. show, bolstering the view of many Hong Kong residents that property will always be a haven. Despite a contracting economy, existing home prices have risen 1.2 percent this year, and are the highest since November, based on the Centaline index.

Even as prices and sales have dropped in many global markets such as London and Singapore, Hong Kong recorded 6,885 property deals in May, a 12-month high as the city eases pandemic measures. Hong Kong remains the world’s most expensive place to buy a home, according to a report by CBRE Group Inc. published Monday. An average property in Hong Kong costs US$1.3 million, topping Vancouver, Los Angeles, Paris and New York.

“Prices have proved remarkably resilient, especially if you consider that the Hong Kong market has become a byword for unaffordability,” said Simon Smith, head of research and consultancy at Savills Plc. Smith cites persistently low real interest rates and the city’s relatively successful handling of the pandemic to explain the market’s resilience.

In the long-run, limited supply, high demand stemming from a low rate of home ownership and close-to-zero interest rates will support the market, according to a Morgan Stanley report dated May 26 by analysts including Praveen Choudhary.

READ MORE: HK home prices up 0.4% in March, but pressure remains

Risks remain

That’s not to say the property market isn’t without risks. Businesses are shutting down and unemployment is at its highest in a decade. While job losses have mostly been in low-skilled sectors such as retail and catering, the spread of unemployment to professionals will affect their ability to repay mortgages. Savills expects residential home prices to drop 5 percent in 2020.

A pedestrian wearing a protective mask walks past residential buildings in Hong Kong, Feb 20, 2020. (BILLY H.C. KWOK / BLOOMBERG)

A pedestrian wearing a protective mask walks past residential buildings in Hong Kong, Feb 20, 2020. (BILLY H.C. KWOK / BLOOMBERG)

The recession and plunging retail sales have also taken their toll on real estate stocks, though they rallied last week. The Hong Kong Hang Seng Properties Index, which includes the city’s biggest developers, has declined 18 percent this year versus a 12 percent drop in the benchmark. Developers focusing on residential real estate such as Sun Hung Kai Properties have fared better than commercial landlords.

Uncertainties have already prompted some residents to plot emigration. Non-resident bank deposits surged to a record in Singapore last week, an early sign that some people in Hong Kong are moving their money.

Singapore’s central bank on Sunday said media reports of large flows of deposits from Hong Kong were incorrect while reporting strong year-on-year growth in April in foreign currency deposits in the city-state, reports Reuters.

"Total foreign currency non-bank deposits in Singapore's banking system stood at S$781 billion at the end of April this year, 20% higher than a year ago," the Monetary Authority of Singapore (MAS) said in a statement on Sunday with reference to Singapore dollar.

For now, home buyers seem willing to look past the risks.

“Hong Kong is one of the most livable cities in China, if not Asia,” said Smith. “If it maintains its status as a global first-tier city, a gateway to China and an international financial center, there is no reason why both the commercial and residential markets shouldn’t continue to thrive.”