This undated photo shows residential buildings in Tai Koo Shing, Hong Kong. (EDMOND TANG / CHINA DAILY)

This undated photo shows residential buildings in Tai Koo Shing, Hong Kong. (EDMOND TANG / CHINA DAILY)

If working from home during the pandemic has shown anything, it’s that apartments and houses are our castles, like it or not.

The world’s least-affordable residential prices look likely to keep floating in their own bubble, even as the coronavirus pummels the economy to its worst levels on record

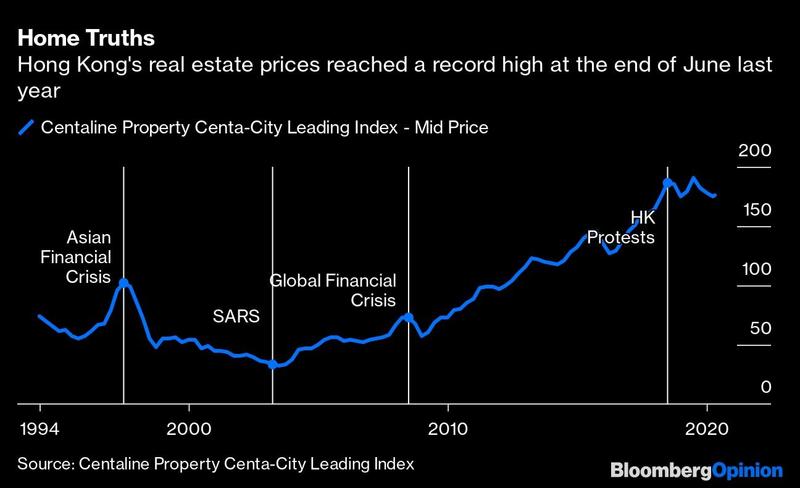

Hong Kong is emerging from a semi-lockdown (restaurants open, schools shut, workers everywhere on the home-office spectrum) and it’s clear that investors see refuge in housing, too. The world’s least-affordable residential prices look likely to keep floating in their own bubble, even as the coronavirus pummels the economy to its worst levels on record.

Real estate in the territory is running at two speeds — a battered retail and office sector with fortunes tied to the broader economy that contracted 8.9 percent in the first quarter co-existing with a resilient housing market that seems impervious to the disaster around it.

READ MORE: HK home prices up 0.4% in March, but pressure remains

No commercial property transactions in the three months that opened 2020 involved a buyer from Chinese mainland, the first time that’s happened since 2009, according to CBRE Group Inc., which tracks deals over HK$77 million (US$10 million). It’s a stark contrast to a few years ago, when Chinese investors were snapping up offices and retail space for eye-popping prices. But as the mainland moves off its virus sudden stop and Hong Kong cautiously opens up, there’s still little good news for owners of commercial real estate.

Office vacancy rates for grade A properties are hitting 7.3 percent, not much off the 8.2 percent high in June 2009 during the global financial crisis. Prices are struggling, slumping to HK$23,385 per square foot in the first quarter, according to Colliers. That’s a 9.3 percent drop from a peak in September 2018, when mainland banks and insurers still saw Hong Kong as the primary launchpad to expand globally. Capital controls on the mainland firms like HNA Group Co. that binged on debt to acquire assets globally, followed by the US-China trade tensions and HK's social unrest last year, put an end to much of that.

Office vacancy rates for grade A properties are hitting 7.3%, not much off the 8.2% high in June 2009 during the global financial crisis

Capital values for retail have been hit even harder than offices, down 14 percent to HK$33,964 per square foot from HK$39,478 at the end of last year. They’re 27 percent under highs of HK$46,344 per square foot in March 2014, when the city was in the midst of a tourist boom. With virus restrictions easing, there are glimmers of hope for the city's shops. Yet border controls with the Chinese mainland remain in place and the travel industry is cratering worldwide; only a brave forecaster would say that the heady days of around 65 million visitors chalked up in 2018 will soon return.

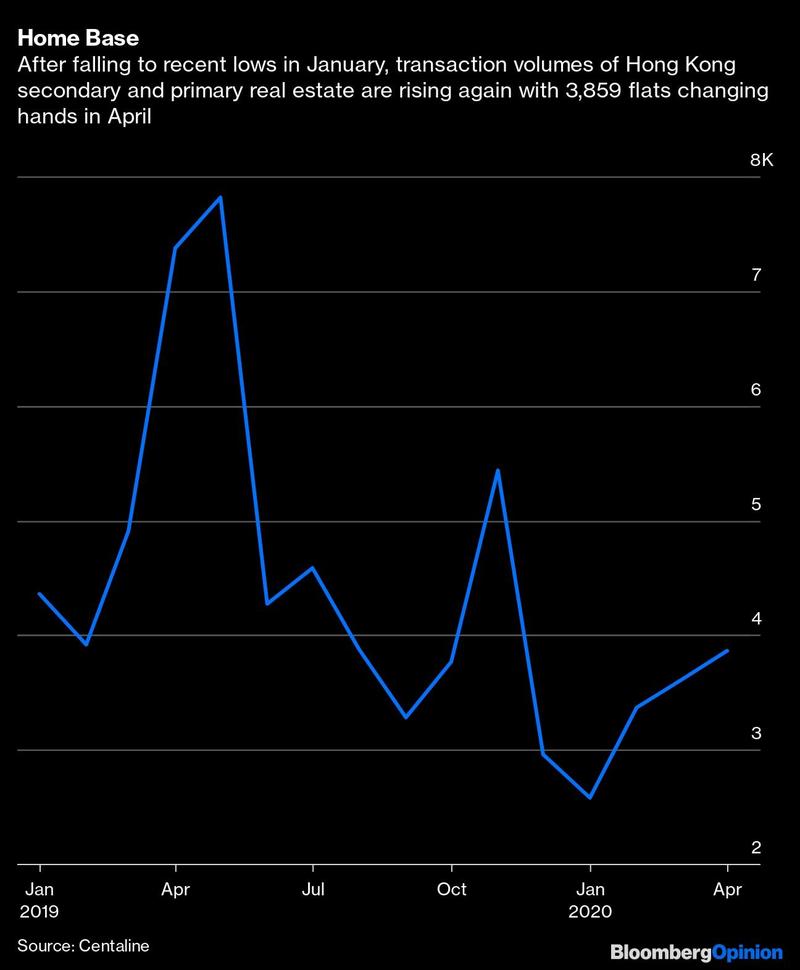

Hong Kong housing, on the other hand, has kept its Teflon-like qualities. Home prices have fallen just 7.7 percent since last June’s peak, before the protests gained steam. Residential transaction volumes are down 9.7 percent since then, but up almost 50 percent since the year began.

ALSO READ: 'Too early to cheer' a rebound in HK home prices

Home transactions should pick up again because the city still suffers from a supply shortage. Hong Kong’s target for housing in the next 10 years is for 430,000 apartments. Assuming they’re all built, that still comes to 10 percent less than projected demand, according to Bloomberg Intelligence analyst Patrick Wong. Citigroup analyst Ken Yeung reckoned in a note Monday that the worst is over for home prices, which could rise between 5 percent and 10 percent by the end of 2020.

Pricking this bubble, even if anyone was trying, wouldn’t be easy. Take jobs. The 4.2 percent first-quarter jobless rate is bound to go higher. But it will be more reflective of restaurant and hotel employees than those in finance or the middle class who are more likely to buy their dwellings. The government’s plan to dole out “helicopter money” to Hong Kongers and direct bailout funds to hard-pressed companies that keep their workers seems to be stopping mass unemployment.

The real reason that Hong Kong home prices can’t seem to crash is the US Federal Reserve.

For all of Hong Kong’s economic ups and downs, home prices have risen a whopping 210 percent since the end of 2008, when the US began cheapening money to cope with the global financial crisis. Because the Hong Kong currency is tied to the US dollar, the city has to mirror Fed moves.

Now, with Fed rates close to zero, and looking to stay that way, Hong Kong housing has an all-new allure for investors who sat on the sidelines through the trade war and protests. The one-month interbank rate, against which most mortgages are priced, is at its lowest since April 2018, and well under the 5 percent of 2007. Few homeowners are stressed. The loan-to-value ratio of mortgages is just 56 percent, the highest since late 2014, but hardly a picture of households scrambling to pay banks.

In a world where liquidity has made prices irrational and in a market with insufficient supply, it's hard to see Hong Kong housing prices losing their fizz just because the economy tanks. At least on this investment, there’s no place like home.