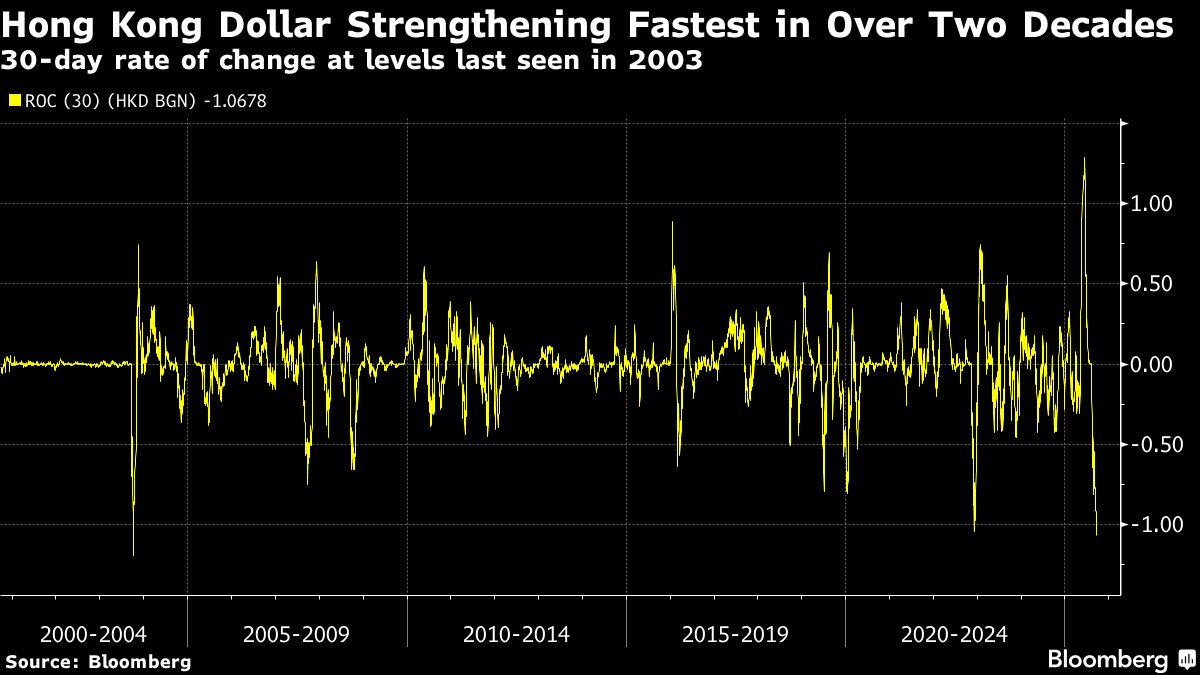

The Hong Kong dollar has strengthened at a pace little seen in over two decades, buoyed by strong equity inflows and favorable money market conditions.

The city’s currency has climbed about 1 percent against the dollar over the last 30 days, a rate-of-change seen just once since 2003, according to data compiled by Bloomberg. Chinese mainland investors have ramped up their purchases of stocks in the Hong Kong Special Administrative Region and demand for the currency has also risen as quarter end approaches.

The so-called aggregate balance, a measure of how much cash banks hold with the Hong Kong Monetary Authority, has fallen around 70 percent from its peak in early June to close to HK$54 billion ($7 billion).

“Hong Kong dollar supply is lower,” said Carie Li, a global market strategist at DBS Bank. “Equity inflows also continued to support the Hong Kong dollar.”

ALSO READ: Hong Kong dollar finally bounces from weak end after HKMA moves

The rebound is all the more stark as last month the currency was at its weakest allowed in its fixed trading band of 7.75 to 7.85 against the US dollar, which led to intervention from the HKMA. Investors then rushed to unwind bearish carry trade bets against the currency as local funding costs surged, while strong demand for local stocks also helped.

The Hong Kong dollar traded around the 7.77 level Monday and at one point its 30-day gain was the most since 2003.

“Going forward, USD/HKD is likely to revisit 7.75 should there be a clear dollar downtrend, continuous equity inflows or a further narrowing of the US-HK interest rate gap that triggers more carry trade unwind,” Li said.