With duties having varying impacts on products, Chinese exporters look to alternatives

Amid the roar of machinery at a motorcycle factory in Luoyang, Henan province, hundreds of wooden crates marked with delivery details of customers in Europe, Africa and Asia are loaded onto trucks.

Produced by Luoyang Northern Ek Chor Motorcycle Co, Dayang brand motorcycles are popular both at home and overseas.

Last year, over 200,000 motorcycles and three-wheelers were shipped from the factory to destinations around the world.

READ MORE: China's foreign trade sustains stable expansion despite external headwinds

Li Bin, deputy director of the company's overseas marketing department, said that although the United States is not one of the company's main export markets, business is still affected by the ongoing uncertainty over US tariff policies.

"In the first quarter of this year, our company's exports grew by over 20 percent compared with last year. The impact of the tariff war may lead to a slight decline in growth in the second quarter," said Li.

However, he added that as long as the company is sincere with its customers and dedicated to producing quality products, there is the potential to broaden global markets.

In recent years, the Association of Southeast Asian Nations members have collectively surpassed the US to become Henan's largest trading partner, according to statistics from Zhengzhou Customs.

The province has also seen steady growth in imports and exports with countries and regions participating in the Belt and Road Initiative along with emerging overseas markets under the Regional Comprehensive Economic Partnership.

When the US imposed an initial increase of 34 percent on Chinese products in the first round of tariffs, customers in the US factored in adjustments to retail prices, Li said. Although many US consumers have a special liking for three-wheel motorcycles, increased prices due to the tariffs will inevitably reduce sales, he said.

"It also compels us to delve deeper into the path of comprehensive internationalization," Li said.

Considering the unpredictable duration and cycles of the tariff war, the company's priority now is to explore niche markets, expand its domestic and international markets, and build a larger customer base, he said.

The motorcycle manufacturer is also considering collaborating with overseas companies to establish local operations.

"For example, in Mexico, if we assemble locally, according to previous policies, we could save 10 percent on tariffs," Li said.

Quality matters

The US tariffs have brought significant uncertainty to foreign trade enterprises, with many companies facing increasing pressure to take proactive measures to address the situation.

Deng Lin, chairman of Liling Caifeng Fireworks Co, in Zhuzhou, Hunan province, acknowledged the immediate challenges posed by the "unstable" US tariff rates, which have disrupted new orders and slowed production.

"Our products, aside from being sold domestically, have the United States as a primary export market," he said.

Deng said clients are pausing orders to negotiate with the US government on the tariffs.

He added the company is currently expanding its presence in the domestic market, while exploring opportunities in other markets including Europe and Southeast Asia.

Deng participated in the 19th International Symposium on Fireworks and the First Hunan (Liling) Fireworks Industry Expo on April 21 in Zhuzhou, hoping to cultivate new clients.

Hunan exported 4.84 billion yuan ($666 million) of fireworks and firecrackers last year, accounting for 58.6 percent of the country's total fireworks exports, according to Changsha Customs.

The US remains the biggest fireworks export market for the province, with 1.7 billion yuan of the product exported to the country in 2024, marking a year-on-year increase of 28.1 percent.

During the expo, fireworks manufacturers said the superior quality and variety of Chinese products had helped them maintain a competitive edge that can see them withstand the impact of the new tariffs.

Li Yanping, Chairman of Hunan Hengda Fireworks, said the fireworks sector remains relatively confident about overcoming the US tariffs. When everything is settled, global consumers will still purchase Chinese products, she said.

"People won't stop celebrating with fireworks. Fireworks symbolize resilience and joy — a universal human need," she said.

Benefits of diversification

Wuxi Rapid Scaffolding (Engineering) Co is a national high-tech enterprise specializing in the research, development, production, sales, design, and leasing of various scaffolding products.

In 2024, the company, headquartered in Wuxi, Jiangsu province, achieved sales revenue of 380 million yuan.

Sun Ziling, head of its marketing department, said North America accounts for about 15 percent of the company's total business.

"The current impact is relatively minor. Whether there is a need to abandon the North American market and shift our focus to domestic market, we need to wait until the specific tariff collection begins (to see)," she said.

In addition to the domestic market, the company's business extends to over 80 countries and regions, with subsidiaries in Singapore, Malaysia, and Dubai, the United Arab Emirates.

"Since the beginning of this year, our sales in Southeast Asia have increased by approximately 10 percent year-on-year, and sales in Russia have increased by about 35 percent year-on-year," said Sun.

Apart from leveraging mature cross-border e-commerce platforms like Alibaba.com and 1688, the company has started building its presence on overseas social media platforms such as LinkedIn and Facebook. Through content marketing to build brand trust, the company has attracted the attention of many overseas consumers.

"This approach allows us to maintain traditional foreign trade efficiency while also using the flexibility of a direct-to-consumer model," said Sun.

As the tariff hikes start to bite in the US, more customers there are starting to pay attention directly to Chinese suppliers.

Chinese cross-border business-to-business e-commerce app DHgate recently secured second spot in downloads on the Apple App Store in the US, just behind OpenAI's ChatGPT.

Taobao, the online marketplace owned by tech heavyweight Alibaba Group, has surged to the top of the Apple App Store's downloads in 16 countries, and is among the top 10 in 123 countries.

Experts said the increased overseas traction of Chinese e-commerce platforms demonstrates China's strong capabilities in manufacturing. Chinese products have gained an upper hand in terms of cost and price compared with their counterparts around the world, they said.

In the first quarter of this year, the volume of cross-border e-commerce goods exported from the international airport in Dalian, Liaoning province, has seen a significant increase in small items, according to Dalian Customs.

These items include fishing gear, storage boxes, and stationery, along with traditional exports such as clothing and mechanical parts.

Cao Rui, president of Made-in-China.com, noted some Chinese cross-border e-commerce platforms have gained significant popularity in North America, with consumers flocking to these online marketplaces to buy products directly from Chinese suppliers. "It proves that the demand has not decreased, rather, orders have been redirected," she said.

ASEAN links stronger

In the first quarter, ASEAN continued to be Liaoning's second-largest trading partner.

Under the supervision of customs, Anshan Zizhu Heavy Special Steel Co recently loaded 25 metric tons of steel sheet piles for export. The steel products were transported by rail and sea from Dalian Dayaowan Port to Manila in the Philippines.

"In recent years, infrastructure projects in Southeast Asia have been steadily progressing, and we have been continuously developing new products, actively expanding cooperation with Southeast Asian countries," said Tang Qunzhong, the company's general manager.

Anshan Zizhu's products have been exported to seven ASEAN countries, including Malaysia, Cambodia, and the Philippines.

"With the China-ASEAN preferential origin policy, our products enjoy an average tariff preference of 7.5 percentage points in the Southeast Asian market, saving customers tens of millions of yuan in tariff costs last year," Tang said.

The industrial chain connection between Liaoning and ASEAN has grown closer in recent years. According to Dalian Customs statistics, in the first quarter of this year, Liaoning's trade with ASEAN reached 24.26 billion yuan, a year-on-year increase of 19.7 percent, and a historical high.

Trade with Vietnam, Malaysia, and Cambodia increased by 9.6 percent, 32.7 percent, and 54.5 percent, respectively.

Platform support

China's exports reached 6.13 trillion yuan in the first quarter of this year, representing year-on-year growth of 6.9 percent, General Administration of Customs data shows. Exports to over 170 countries and regions all experienced growth.

"Based on our observations, the tariff policies in the United States have actually led to a significant increase in traffic from some emerging markets," said Cao of Made-in-China.com.

Established in 1998, Made-in-China.com is a comprehensive service platform for foreign trade, committed to tapping business opportunities for Chinese suppliers and overseas buyers. By the end of 2024, its online directory contained more than 9.2 million product listings of Chinese suppliers.

Cao said that the platform's data shows a notable first quarter increase in the volume of orders from Spanish, French, German, and Portuguese-speaking markets, indicating significant potential for growth.

To help businesses adapt to market changes, platforms like Made-in-China.com have been implementing various measures to enhance sales.

"We have introduced services in 16 different languages, with smaller language markets now accounting for one-third of the website's visitor volume," Cao stated.

The platform will continue to enhance the language service capabilities of its AI tools to help Chinese enterprises overcome language and cultural barriers and tap into the potential of these markets.

Data from the platform indicates that light industrial products have been significantly impacted by tariff barriers, Cao said. The hardest hit companies are those whose US exports account for more than half of their total exports.

While most foreign trade enterprises are inclined to explore new international markets, a large number of them have also started shifting their focus to the domestic market, said Cao.

ALSO READ: Despite turbulence, foreign firms keen on investment in China

"Emerging markets pose certain risks due to less mature purchasing power and commercial credit compared to European and American markets … companies need to adapt to the rules and risks of new markets and get accustomed to new trade models," she said.

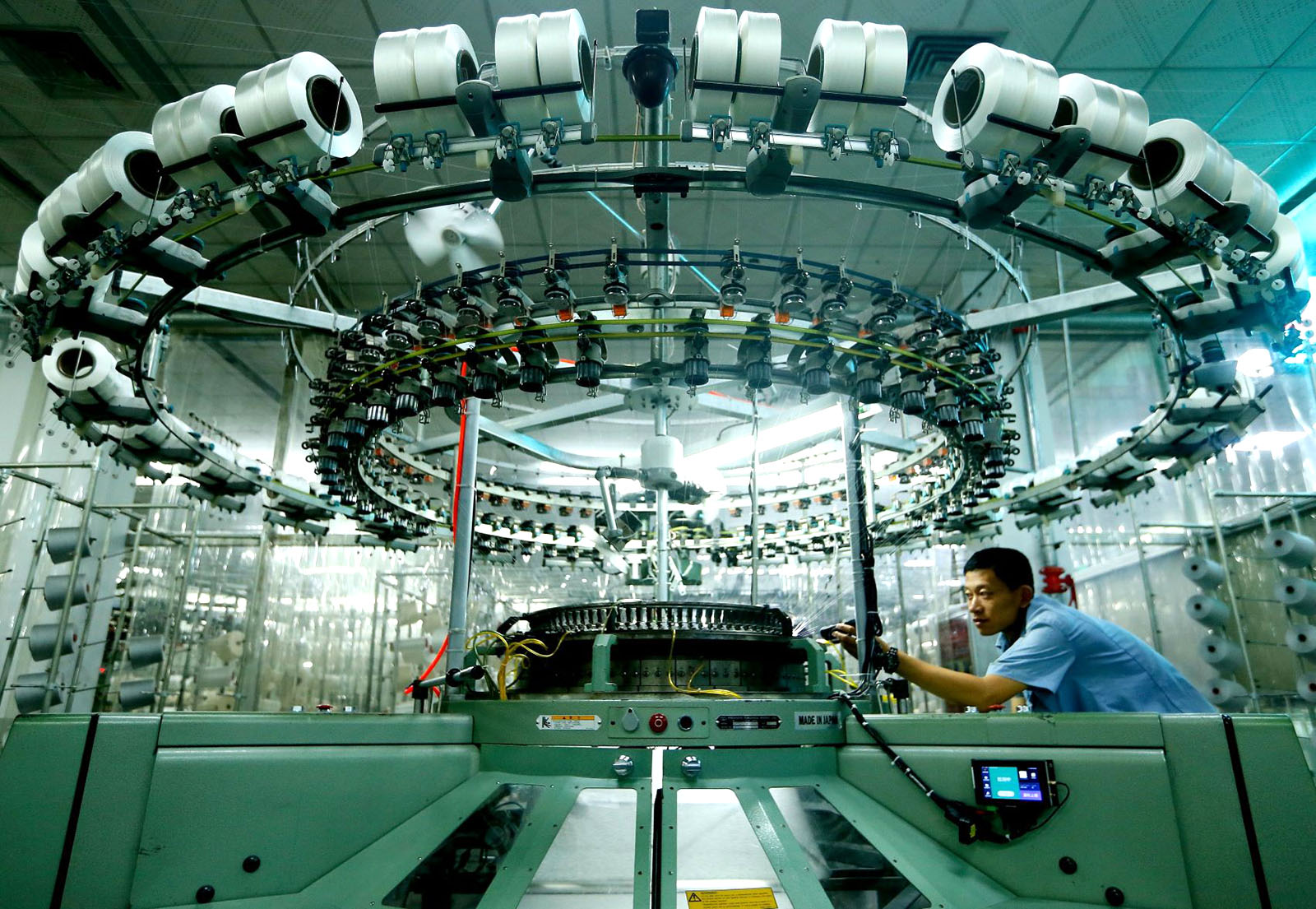

To assist struggling businesses, Made-in-China.com has established a 150 million yuan special development fund for the light industry sector. The fund focuses on supporting industries such as consumer electronics, clothing and textiles, toys, and office supplies.

The special development fund will be used to extend the promotional service period for new platform entrants. Online promotion efforts in the light industry sector will also be boosted to provide more opportunities for foreign trade enterprises to accumulate visitor volume and expand business opportunities.

The platform will organize online activities for high-growth markets such as the Middle East, South America, and East Asia, conduct offline exhibitions and events, and leverage social media to facilitate supplier-buyer connections.

Cao believes that businesses still have an optimistic outlook on the development of new markets. "The potential demand in international markets is enormous, and as long as the demand exists, Chinese enterprises will play a crucial role in the global supply chain."

Zhang Xiaomin and Zhu Youfang contributed to this story.

Contact the writer at cangwei@chinadaily.com.cn