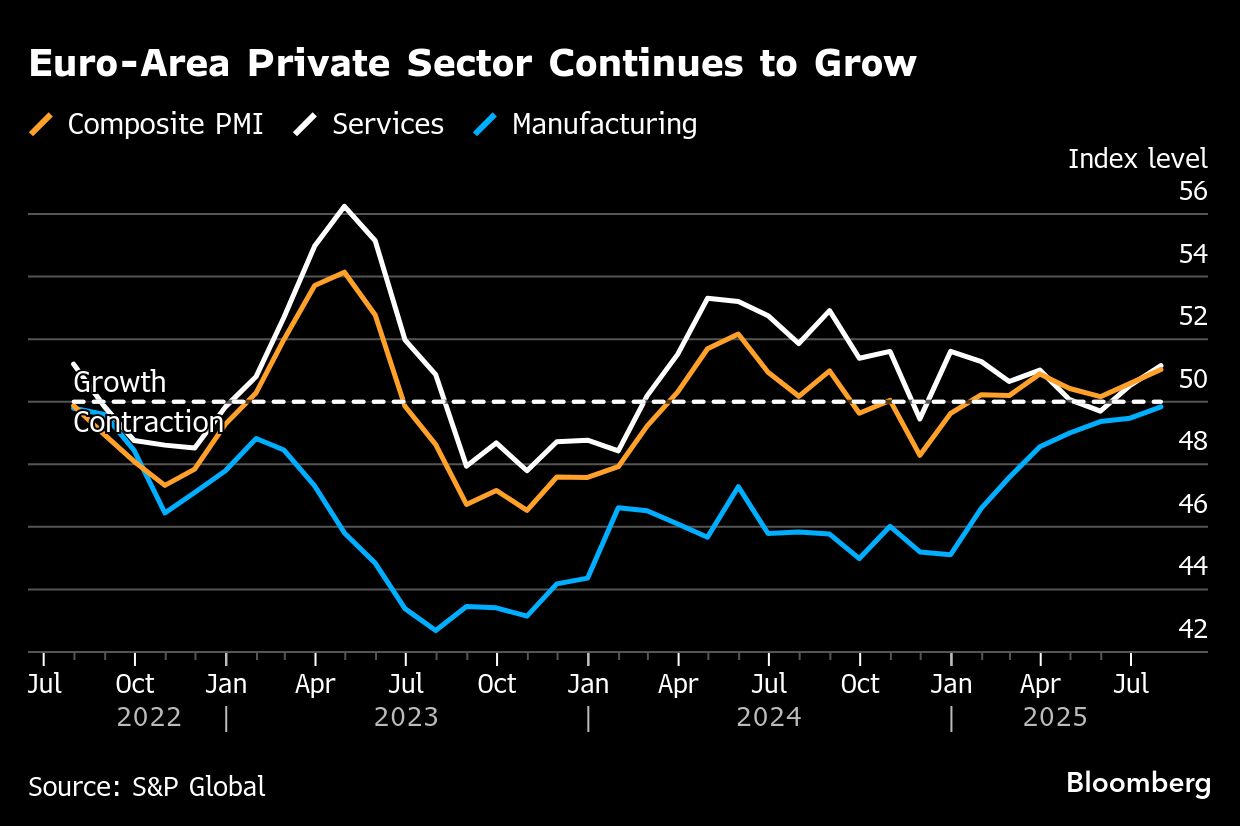

The euro area’s private sector grew at the quickest pace since last August as a three-year manufacturing downturn nears an end and the services sector gathers momentum, even as a trade showdown with the US looms.

The Composite Purchasing Managers’ Index compiled by S&P Global rose to 51 in July from 50.6 in June, further above the 50 threshold separating expansion from contraction. Analysts had predicted a reading of 50.7.

While manufacturing continued its recovery in line with expectations, recording its highest reading since July 2022 to close in on an exit from contractionary territory, services saw a surprisingly strong increase to 51.2.

“The euro-zone economy appears to be gradually regaining momentum,” Cyrus de la Rubia, an economist at Hamburg Commercial Bank, said Thursday in a statement. German factories are playing a “key role” but for manufacturing in Europe to return to solid growth, “French industry must also regain its footing.”

ALSO READ: EU proposes more flexible emission rules for carmakers

The numbers come just hours before the European Central Bank sets borrowing costs for the 20-nation euro zone. Economists and investors expect it to stand pat after a year-long barrage of cuts. They anticipate at least one more quarter-point reduction this year, however, bringing the deposit rate to 1.75 percent.

While some policymakers are concerned about headwinds to economic growth ranging from tariffs to wars, others highlight Europe’s resilience in the face of President Donald Trump’s tariffs.

Indeed, gross domestic product advanced by a surprisingly strong 0.6 percent between January and March, though is yet to display the full impact of the trade friction. The European Union has just over a week to reach a deal with the US to avoid Trump’s latest threat of a 30 percent levy on goods. Diplomats briefed on the negotiations are hopeful that progress is being made toward a rate of 15 percent.

READ MORE: Big pharma fears best-selling drugs in crosshairs of US-EU tariff spat

“The PMI survey suggests euro-area GDP growth is muted as the uncertainty created by changes in US trade policy hits the economy, but activity is far from crashing. The stability will probably lead the ECB to leave interest rates unchanged later today, but we expect further easing — and damage to the economy — later in the year as tariffs rise,” said David Powell, senior economist.

The baseline scenario in the ECB’s June projections assumed tariffs would stay at 10 percent, with no retaliation by the EU. In such a case they expected growth to accelerate in the coming years, reaching 1.3 percent in 2027. Inflation was seen at the 2 percent goal in 2027 after falling short of that target next year.

READ MORE: EU proposes greater flexibility for automakers in CO2 compliance

A severe scenario anticipated a 20 percent tariff rate on all European goods and retaliation by the EU, leading to significantly lower growth and a prolonged inflation undershoot.

For now, de la Rubia noted “good news” for the ECB as disinflation continued in the closely watched service sector.

“Prices for goods did not fall further in July,” he said. “But the stronger euro and US tariffs are likely to exert downward rather than upward pressure on inflation in the coming months.”

PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

PMIs from Australia, Japan, India and the UK remained above 50. Later Thursday, the US composite reading is also expected to signal growth.