A screen displays stock figures outside the Exchange Square complex, which houses the Hong Kong stock exchange, in Hong Kong, on Sept 16, 2019. (PAUL YEUNG / BLOOMBERG)

A screen displays stock figures outside the Exchange Square complex, which houses the Hong Kong stock exchange, in Hong Kong, on Sept 16, 2019. (PAUL YEUNG / BLOOMBERG)

A year anticipated to be full of headwinds for Hong Kong Special Administrative Region’s stock exchange turned euphoric instead. The challenge is now to add to the momentum.

Hong Kong Exchanges & Clearing Ltd on Wednesday reported that profit rose 23 percent to a record HK$11.5 billion (US$1.48 billion) in 2020.

Hong Kong Exchanges & Clearing Ltd on Wednesday reported that profit rose 23 percent to a record HK$11.5 billion (US$1.48 billion) in 2020

Incoming Chief Executive Officer Nicolas Aguzin is preparing to take the helm after a year when trading jumped 60 percent, the bourse saw the biggest initial public offering flood in a decade and inflows of cash through links to Shanghai and Shenzhen doubled.

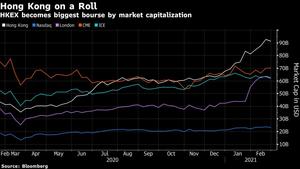

The boom has continued in 2021 and investors have cheered. The stock is up 150 percent in the past 11 months. The bourse is now the world’s biggest in terms of market value, far bigger than its London rival and four times as big as Nasdaq Inc, for example.

ALSO READ: HKEX interim chief: Bullish IPO market seen in Year of the Ox

The exchange’s shares fell on Wednesday amid reports the city will raise the stamp duty on stock trading for the first time since 1993, potentially cutting trading volumes. The shares were down 5.4 percent as of noon.

Aguzin, who’s slated to take over in May but still needs regulatory approval, faces pressure to build on the legacy of his predecessor Charles Li.

The appointment of a veteran investment banker rekindled some anticipation that the bourse would again try its hand at acquisitions. Plans to internationalize have largely been put on hold since Li famously embarked on a failed bid to buy the London Stock Exchange in 2019.

The appointment of a veteran investment banker rekindled some anticipation that the bourse would again try its hand at acquisitions. Plans to internationalize have largely been put on hold since Li famously embarked on a failed bid to buy the London Stock Exchange in 2019.

“There’s a broad array of organic and inorganic growth options in front of us,” said Fred Hu, a board member and founder of Primavera Capital Ltd. “And Aguzin is well positioned to take HKEX into the future, to further deepen the connectivity with China but also connectivity with the rest of the world.”

ALSO READ: HK financial system 'resilient' as city moves up in world ranking

Analysts for now are bullish the exchange can continue to ride the current boom of more mega-IPOs. It could also get a boost from a proposal by Hang Seng to expand the city’s benchmark index from the current 50.

That could propel the share price above HK$600, according to Steven Leung, executive director at UOB Kay Hian (Hong Kong). China International Capital Corp has a target price of HK$634.

“IPOs and the daily turnover level matters more to the HKEX share price than the new CEO’s strategy, which is more mid- to long-term,” said Leung.

Nonetheless, the exchange should explain further the decision to name a non-Chinese speaker as CEO and why it was announced before getting the regulatory approval, he said.

READ MORE: Mainland pledges all support for HKSAR as finance hub