An investor looks at stock information at a brokerage in Shanghai on March 16. Morgan Stanley Capital International plans to include China A shares in its Emerging Markets Index and All Country World Index starting next year. (AFP)

An investor looks at stock information at a brokerage in Shanghai on March 16. Morgan Stanley Capital International plans to include China A shares in its Emerging Markets Index and All Country World Index starting next year. (AFP)

China’s equity market is firmly in the spotlight after an almost unprecedented rally that helped lift global stocks to a one-month high.

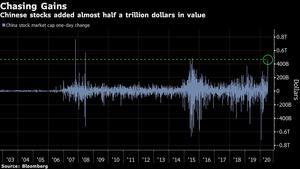

Monday’s surge alone added more than US$460 billion to Chinese stock values, behind just one day in July 2015 as the biggest increase in shareholder wealth since the global financial crisis

The speed of the past week’s gains in China is in many ways unseen since the stock bubble that burst five years ago. Monday’s surge alone added more than US$460 billion to Chinese stock values, behind just one day in July 2015 as the biggest increase in shareholder wealth since the global financial crisis.

ALSO READ: HK stocks enter bull market after US$1.1 trillion rebound

The advance continued on Tuesday, though at a slower pace. The CSI 300 Index rose 0.6 percent at the close to extend its five-year high, with trading volume more than three times the three-month full-day average. The offshore yuan strengthened past 7 per dollar for the first time since March.

China’s state media struck a more measured tone on Tuesday, after earlier publishing commentaries that highlighted the case for buying shares. Two newspapers urged investors to be rational: the Securities Times -- one of China’s most widely circulated financial publications -- said investors should be mindful of potential risks and not use the market as way to make a fortune overnight.

ALSO READ: A-share market extends robust rally

“The market will likely consolidate after strong rallies, especially as big caps have outperformed smaller peers by a big margin in the past week,” said Shen Zhengyang, an analyst with Northeast Securities Co. “Regulators wouldn’t want to see rapid gains in the market either. But there remain plenty of opportunities, and investors will continue to rotate into some laggards so the uptrend is still intact.”

Wang Hongyuan, the co-chairman of First Seafront Fund Management Co who predicted the stock bubble bursting in 2015, warned investors to stay cautious.

This year’s low interest rates and the first losses ever for some popular wealth-management products are driving retail investors to stocks. But some analysts, as well as mainland media, say the country’s economic recovery and the government’s handling of the coronavirus outbreak have helped underpin the rally.

READ MORE: 20 years on, HKEX surges over 40 times in market cap

Mainland traders are counting on the momentum to continue, increasing the amount of leverage in the equity market to almost 1.2 trillion yuan (US$171 billion), the highest since late 2015.

The risk-on sentiment sent Chinese government debt plunging, with the yield on notes due in a decade rising over 3 percent for the first time since January on Monday. The yield on China’s 10-year government bonds was last at 3.02 percent.

A measure of consumer staples rose 3.1 percent as the best performer among the CSI 300 Index’s 10 industry groups Tuesday. Kweichow Moutai Co, China’s biggest stock by market capitalization, climbed 5.5 percent.

READ MORE: Mainland shares to outperform Asian peers this year