In this file photo, people attend Alibaba's stock trading debut at the headquarters of the Hong Kong Exchanges and Clearing in Hong Kong on Nov 26, 2019. (YE AUNG THU / AFP)

In this file photo, people attend Alibaba's stock trading debut at the headquarters of the Hong Kong Exchanges and Clearing in Hong Kong on Nov 26, 2019. (YE AUNG THU / AFP)

There’s a relatively low-risk way to gain from Alibaba Group Holding Ltd’s stock should a rush of passive funds push up its valuation in Hong Kong.

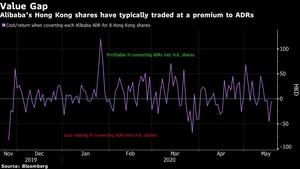

Arbitraging the shares -- or purchasing Alibaba in one market to sell it in another for a higher price -- allows traders to exploit even the smallest difference between US and Hong Kong listings. While the city’s pegged currency means the strategy will never be hugely profitable, shares traded here are expected to become more attractive to investors than the American depositary receipts (ADRs).

Hong Kong will become the core market for Alibaba trading in the future. More people will convert their US-listed Alibaba shares into Hong Kong-listed ones, not just because of potential index-related flows but because overall ADR (American depository receipt) performance is increasingly clouded by accounting concerns

Nelson Yan, head of offshore capital markets investment product at Creditease Wealth Management (Hong Kong) Ltd

Hang Seng Indexes Co’s decision to include dual class shares and secondary listings in its benchmarks opens the door for Alibaba -- the world’s seventh most-valuable company -- to join. That alone would boost index-tracking purchases of the Hong Kong stock. Those in the market also see some active money shifting toward the Asian listing, given the more favorable time zone for the region’s investors and the potential for access to trading links with the Chinese mainland.

ALSO READ: Hang Seng revamps benchmark index to open door for Alibaba

Deepening scrutiny of mainland companies in the US is another factor cited. On Wednesday the Senate approved legislation that could lead to Chinese companies such as Alibaba and Baidu Inc. being barred from trading on US stock exchanges amid increasingly tense relations between the world’s two largest economies.

“Hong Kong will become the core market for Alibaba trading in the future,” said Nelson Yan, head of offshore capital markets investment product at Creditease Wealth Management (Hong Kong) Ltd. “More people will convert their US-listed Alibaba shares into Hong Kong-listed ones, not just because of potential index-related flows but because overall ADR performance is increasingly clouded by accounting concerns.”

To be sure, the return from converting equity has been fairly volatile. Investors who hold US equity could have obtained a paper gain of as much as HK$119 (US$15.35) per converted ADR in late January if immediately selling the Hong Kong shares. On Tuesday, doing the same would have yielded a loss of HK$5 per ADR.

ALSO READ: Revolution is rushing toward HK's lagging Hang Seng Index

To convert, ADR holders must turn in the equity to the depositary bank -- in this case Citibank NA-- through their brokers. Once fees are settled, the depositary bank distributes eight Hong Kong shares for each ADR received, according to the Alibaba prospectus. Holders need to pay as much as US$0.05 for converting each ADR.

“More people will want to shift shares back to Hong Kong if the city’s shares are a little bit higher than the ADRs. Lots of people have done so since the November listing and I expect this trend to continue,” said Chi Man Wong, analyst at China Galaxy International Financial Holdings Ltd. The Hong Kong stock is 20 percent above November’s offering price.

The depositary bank’s total share holdings has decreased by 940 million since Alibaba’s Hong Kong listing, according to exchange data, which Wong said indicates conversion demand. The bank still holds about 3.3 billion shares for its clients, or 15 percent of total outstanding equity in the company, exchange data as of Tuesday show.

READ MORE: Hong Kong pulls out all the stops in world IPO race

Investors converting into Hong Kong shares could help Alibaba establish a greater weighting in the Hang Seng Index if it gets included. The amount will be calculated only on shares registered in Hong Kong. At current levels, Alibaba would have a 3.4 percent weighting, less than the 5 percent ceiling for secondary listings announced earlier this week, according to Wong. That would put its weighting below Tencent Holdings Inc.

Currently, about 22 percent of Alibaba’s equity is registered in Hong Kong, while the rest are in the US, according to according Hong Kong stock exchange data.

READ MORE: Mainland IPO in stellar HK debut amid biotech craze

“If you want to boost Alibaba’s potential weight in the index, you need to increase the portion of registered shares in Hong Kong,” Wong said. “For now, converting ADRs is the only way to achieve that.”