The 50-year-old Hang Seng Index is poised to embrace change, and it couldn’t come soon enough for investors forced to put up with years of dismal underperformance.

READ MORE: Hong Kong pulls out all the stops in world IPO race

On Monday, the compiler of the gauge is expected to announce whether companies with secondary listings and unequal voting rights will be included for the first time, namely Alibaba Group Holding Ltd. Doing so would open the door to transforming the Hang Seng from a gauge overstuffed with banks and insurers to one that better reflects the technological dynamism of Chinese mainland’s economy.

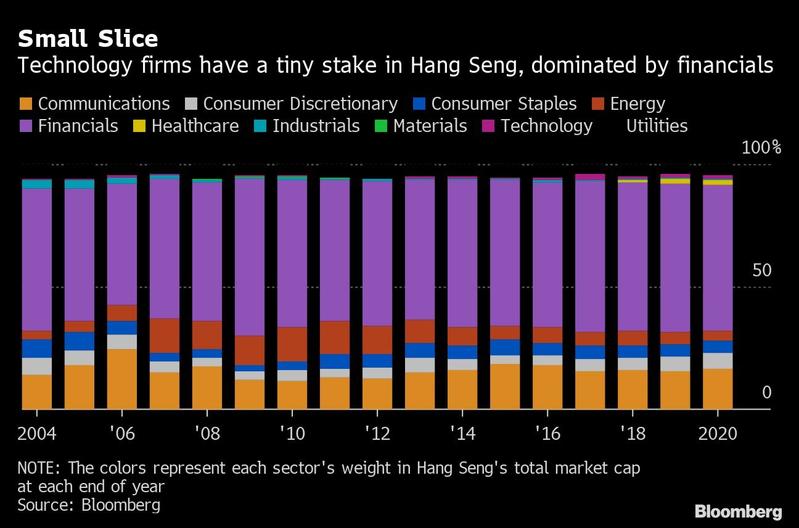

About half of the total weighting of the Hang Seng Index is in financial firms, compared with about 15% on average for benchmarks in Europe, the US, Japan and the Chinese mainland

Alibaba -- one of China’s most valuable companies -- launched a secondary listing in the Hong Kong Special Administrative Region in November. Another potential candidate for inclusion is Meituan Dianping, China’s largest food-delivery website, while JD.com Inc is considering a secondary listing of its own in the city. With almost US$30 billion of pension-fund assets and exchange-traded funds tracking the gauge as of December, such a change could spur a flood of local share sales by US-listed firms.

“The decision is going to completely change the nature of index, which has been characterized as one with low valuation and low growth rate for a long time,” said Yang Lingxiu, strategist at Citic Securities Co.

About half of the total weighting of the Hang Seng Index is in financial firms, compared with about 15 percent on average for benchmarks in Europe, the US, Japan and the Chinese mainland, according to data compiled by Bloomberg. The gauge has gained 1.7 percent a year on average in the past decade, versus 5.2 percent for the MSCI All-Country World Index. In January, the Hang Seng approached its lowest level relative to the MSCI measure since 2004.

The process of adding the likes of Alibaba may take some time, however. “In order to reduce the one-off impact on the market, the index may propose adding the weight of Alibaba gradually,” said Chi Man Wong, analyst at China Galaxy International Financial Holdings. Alibaba is the biggest company listed in Hong Kong by market cap and is the second most actively traded stock in the past 30 days, just after the Hang Seng Index’s largest component Tencent Holdings Ltd, according to data compiled by Bloomberg.

The index would need to delete two companies to add Alibaba and Meituan, as current rules require the number of firms on the gauge to be fixed at 50. Component maker AAC Technologies Holdings Inc and snack firm Want Want China Holdings Ltd are among likely candidates for deletion due to their smaller market capitalization, according to traders.

ALSO READ: HKEX chief: Alibaba’s HK listing a matter of time

The addition would raise the Hang Seng Index’s forward price-to-earnings ratio to about 12 from the current 11, making it more expensive than the Shanghai Composite Index, data show.

Ultimately, the weight of technology and consumer discretionary sectors’ could surge from the current single digits to more than 30 percent, if all US-listed Chinese mainland companies that match the Hang Seng’s requirements list in the city and are included in the index, according to Citic Securities Co.

To be sure, giving greater weight to companies with unequal voting rights could raise investor concerns.

“The key issue is that weighted voting rights create an opportunity for someone to have greater influence than their economic ownership would suggest,” said Gabriel Wilson-Otto, head of stewardship Asia Pacific at BNP Paribas Asset Management. “The underlying concern is that this heightens the potential for agency risk, and reduces avenues of recourse if the company does something that’s not in the best interests of the minority shareholders.”

Investors in some US-listed Chinese mainland firms have recently been burned by accounting scandals, raising questions about the standard of corporate governance at some companies.

The Hang Seng Index would nevertheless benefit from luring more US-listed companies, said Cliff Zhao, head of strategy with CCB International Securities Ltd.

“More funds will be attracted to follow the index, which is a good thing for Hong Kong’s stock market.”