In this file photo, a pedestrian using a smart phone walks past an electronic screen displaying the Hang Seng Index in Hong Kong, China, on Wednesday, Nov. 22, 2017.(DAVID PAUL MORRIS / BLOOMBERG)

In this file photo, a pedestrian using a smart phone walks past an electronic screen displaying the Hang Seng Index in Hong Kong, China, on Wednesday, Nov. 22, 2017.(DAVID PAUL MORRIS / BLOOMBERG)

Hong Kong’s Hang Seng Index will include dual class shares and secondary listings, allowing Chinese mainland giants such as Alibaba Group Holding Ltd into the city’s benchmark to provide a potential boost for passive investors who have for years struggled with lackluster returns.

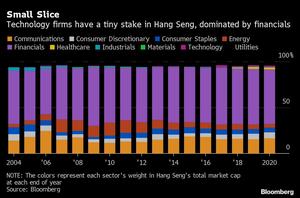

Hang Seng Indexes Co, announced the long-awaited change on Monday in Hong Kong, a step that will help move the benchmark away from a heavy dominance of financial shares

Hang Seng Indexes Co, announced the long-awaited change on Monday in Hong Kong, a step that will help move the benchmark away from a heavy dominance of financial shares. Dual class and secondary listings will be subject to a 5 percent weighting cap, surprising some investors who had been hoping for a 10 percent weighting for Alibaba, for example.

The move came after “overwhelming market support,” HSI said. Any changes will come into effect during the August 2020 index review and encompass only companies coming from Greater China.

ALSO READ: Revolution is rushing toward HK's lagging Hang Seng Index

The shift will affect about US$30 billion in pension fund assets and exchange-traded funds that track the index, and could spur a flood of local share sales by US-listed firms. Dual class shares were long blocked from listing in Hong Kong due to concerns over the unequal voting rights until Xiaomi Corp became the first in 2018. Alibaba joined the bourse last year after a US$13 billion secondary listing.

Meituan Dianping, the mainland’s largest food-delivery website, is also a potential candidate for inclusion, while JD.com Inc. is considering a secondary listing of its own in the city.

“It’s a bit surprising to me that Hang Seng caps the market weight at 5 percent,” said Kenny Wen, wealth management strategist at Everbright Sun Hung Kai Co. “But it’s understandable, since the indexer might want to take it step by step to avoid a sudden change on the Hang Seng Index, since each tech firm is relatively very big by market cap.”

Wen expects the cap to lifted eventually to 10 percent, “but it won’t happen in the next 3 to 6 months.”

Daniel Wong, a director at HSI, said at a press conference that the cap “has room to rise.”

ALSO READ: HKEX chief: Alibaba’s HK listing a matter of time

About half of the total weighting of the Hang Seng Index is in financial firms, compared with about 15 percent on average for benchmarks in Europe, the US, Japan and the mainland, according to data compiled by Bloomberg. The gauge has gained 1.7 percent a year on average in the past decade, versus 5.2 percent for the MSCI All-Country World Index. In January, the Hang Seng approached its lowest level relative to the MSCI measure since 2004.

READ MORE: Mainland IPO in stellar HK debut amid biotech craze

HSI said that any shares that carry weighted voting rights, typically those held by the founders of the company, will be considered as non-freefloat, and not eligible for the index. While for secondary listings, any shares held as overseas depositary receipts will be ineligible, further limiting the impact of Alibaba on the index.

“Aibaba has about 20 percent of total outstanding shares in Hong Kong and the remaining are in the US,” said Steven Leung, executive director at UOB Kay Hian (Hong Kong) Ltd, by phone from Hong Kong. “Even if WVR shares and US portions are not counted as free float in Hang Seng’s calculation, it still easily has a five percent weight if included into the index.”

Separately, the HSI consultation conclusion also said no additional limits will be placed on financial stocks.

Managers of passive index pension funds will now have to follow the adjustment to include weighted voting rights shares, said Michael Chan, managing director of Hong Kong-based Gain Miles MPF Consultant Ltd.

Despite institutional concerns over the corporate governance issues of dual class share companies, which gives some shareholders more weight than others, Chan said it won’t create much stir locally since retail investors are largely indifferent to how their pension money is placed.