Rarely have equity capital markets (ECM) bankers had such a hard time predicting how business will be in the months to come.

Last year’s forecasts are now out the window as the coronavirus pandemic upends business plans and deals. With the effects of the outbreak rippling through markets and the broader economy, bankers in Asia are bracing for a sharp slowdown in initial public offerings in the region.

2020 could be one of the worst years in the past decade from a capital-markets perspective; it could actually be the best ever, it’s just too early to tell. Rarely in any year would you have such dispersion of potential outcomes.

Aaron Arth, Head of the financing group for Goldman Sachs Group Inc in Asia ex-Japan

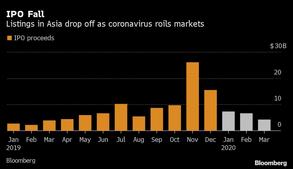

A busy January - before the virus spread across Asia and beyond - means the IPO haul in the first quarter actually wasn’t bad. At US$18.26 billion, it was the most since 2011, according to data compiled by Bloomberg. However, the numbers have nosedived since the start of the year, as many of the world’s equity indexes have collapsed into bear markets.

ALSO READ: Asia’s IPO market hasn’t been this hot since 2007

“2020 could be one of the worst years in the past decade from a capital-markets perspective; it could actually be the best ever, it’s just too early to tell,” said Aaron Arth, head of the financing group for Goldman Sachs Group Inc in Asia ex-Japan. “Rarely in any year would you have such dispersion of potential outcomes.”

It all hinges on when the coronavirus outbreak is brought to an end, which will prompt companies that had put off share sales to come to the market in droves. The virus has caused a slew of listings around the world to be temporarily shelved, from Indonesian carrier Lion Air to Chinese on-demand cleaning startup 58 Home. But expectations of a rebound in IPOs early in the second quarter are slim.

“The new-issue market in the second quarter is likely to see a slow start,” said Alex Abagian, co-head of Asia Pacific equity capital markets at Morgan Stanley. “Let’s see if there’s a V-shaped recovery on the back of unlimited stimulus, and hopefully that will stimulate ECM IPO volumes again.”

Capital raising

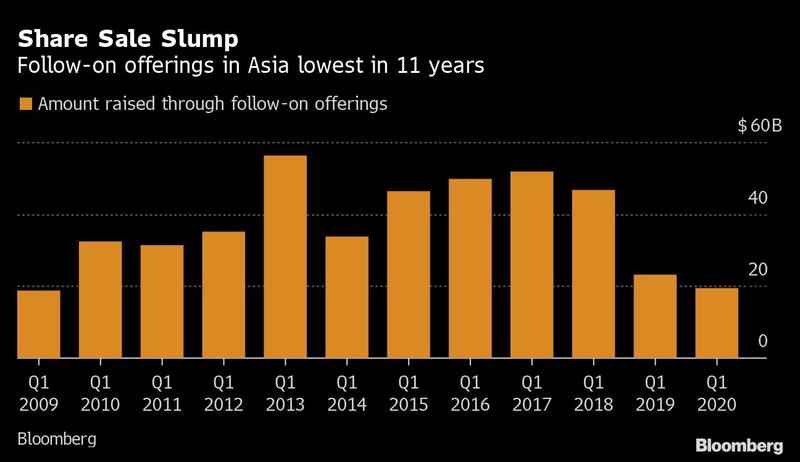

The tough IPO environment is making bankers focus more on follow-on offerings from companies whose balance sheets got battered by the pandemic and are in need of capital. Several of them, from Australian maker of hearing devices Cochlear Ltd to Singapore Airlines Ltd, have already moved to secure capital to get them through the market turmoil.

“It’s the year of staying nimble,” said Niccolo Manno, head of Asia Pacific ECM Syndicate at JPMorgan Chase & Co. “If you have a couple of days where the market feels better, I wouldn’t be surprised to see a couple of these companies tap the market to get a safety buffer.”

READ MORE: Hong Kong bourse bangs virtual gong on IPO in time of virus

But there haven’t been many such windows in the past few weeks. Share sales by listed companies and their shareholders had their worst start to a year since 2009, totaling just US$19.55 billion, data compiled by Bloomberg show. Issuers refrained from follow-on offerings as markets suffered some of their worst routs in decades. The MSCI Asia Pacific Index has slumped almost 22 percent since the start of the year, with declines accelerating again this week after a bounce last week.

One fund raising tool that is expected to see an increase in popularity is convertible bonds, as they become attractive to issuers when volatility is high and interest rates low. Given the slump in share prices, the chance to convert into equity at a premium also comes highly valued. They had a slow start to the year, though: Asian firms raised only US$11 billion in such debt in the first quarter, a 44 percent drop from the previous three months, Bloomberg-compiled data show.

Convertibles could also be used by companies with strong balance sheets as a source of capital to buy back shares that have dropped in price, Morgan Stanley’s Abagian said.

“That’s a dialogue we’re having right now with corporates across sectors.”