Alibaba Group Holding debuts on the Hong Kong Exchanges and Clearing Market on Nov 26, 2019. (PHOTO / VCG))

Alibaba Group Holding debuts on the Hong Kong Exchanges and Clearing Market on Nov 26, 2019. (PHOTO / VCG))

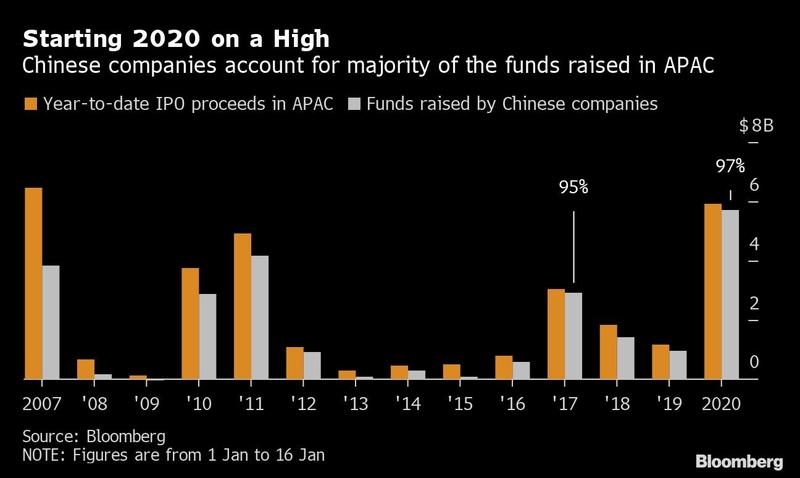

Companies are raising money in Asian Pacific equity markets at the fastest pace since the global financial crisis.

Just 15 days into the new year, initial share sales have reached US$5.9 billion, the most since 2007 for the period, according to data compiled by Bloomberg. Chinese companies are leading the fundraising, accounting for 97% of the proceeds raised, the data show.

The Chinese dominance is no surprise with Beijing-Shanghai High Speed Railway Co clinching the biggest deal in Asia this year, raising US$4.3 billion on the mainland

ALSO READ: Top 10 global IPO lists in 2019

The Chinese dominance is no surprise with Beijing-Shanghai High Speed Railway Co clinching the biggest deal in Asia this year, raising US$4.3 billion on the mainland.

Alibaba Group Holding Ltd’s second listing in Hong Kong last year has set the stage for other Chinese mainland companies that are considering doing the same, which bodes well for the APAC IPO volume this year. The ecommerce giant’s Hong Kong shares have surged about 25% since its listing in November.

At the end of last year, the Hong Kong bourse saw a spike in inquires by Chinese mainland companies listed elsewhere. Trip.com Group Ltd and Netease Inc, both of which are trading on the Nasdaq, are said to be in preliminary discussions with the exchange for a potential second listing in Hong Kong. A secondary listing is seen as a hedge by Chinese companies listed in the US, as Trump administration officials are looking at various ways to curb their access to American funding.

READ MORE: World's biggest IPO got bigger: Aramco IPO at US$29.4b

There are 196 Chinese companies listed on major US exchanges with a combined market value of US$1.2 trillion, according to Bloomberg-compiled Data. Among these firms, BeiGene Ltd and Alibaba are the only two with a second listing in Hong Kong.