A general view of Saudi Aramco's Abqaiq oil processing plant on September 20, 2019. (FAYEZ NURELDINE / AFP)

A general view of Saudi Aramco's Abqaiq oil processing plant on September 20, 2019. (FAYEZ NURELDINE / AFP)

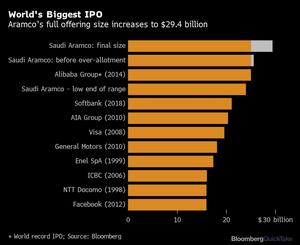

The final size of Saudi Aramco’s initial public offering jumped one month after its debut in Riyadh.

Goldman Sachs Group Inc, one of the underwriters of the world’s biggest IPO, exercised the over-allotment option and increased the offering to US$29.4 billion, according to a statement.

It said 450 million additional shares were placed at 32 riyals (US$8.53) with investors during the book-building process.

According to the terms of the offering, the bank could buy the additional shares during the stabilization period that ended Jan 9 and give support to the stock, but no such transactions were undertaken during that interval.

RELATED ARTICLES

The IPO relied heavily on individuals and high-net worth investors and funds from the Gulf, with the Saudi government institutions investing almost US$2.3 billion into the offering.

Aramco advanced 0.1 percent to 35.05 riyals as of 10:11 am in Riyadh, after retreating 0.4 percent for the week ended Jan 9. It is trading almost 10 percent higher from the IPO price.