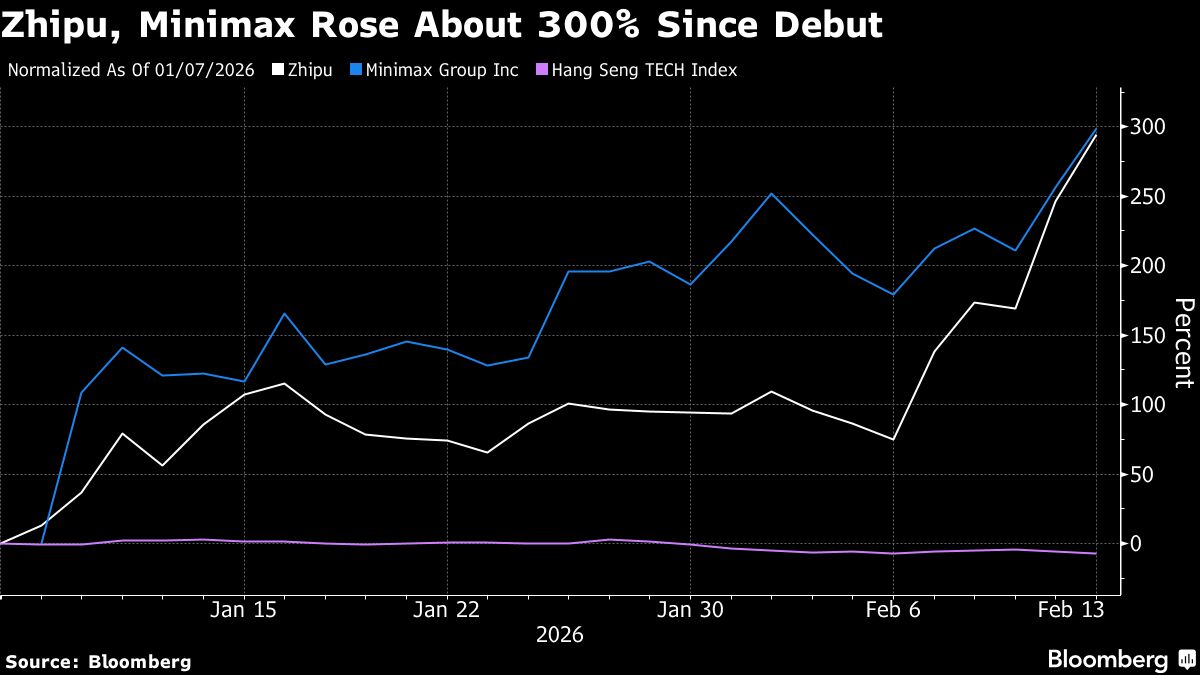

Shares of Chinese AI model developer Zhipu have more than doubled this week, underscoring investor appetite for the country’s emerging generative-AI firms even as established players elsewhere face a valuation reset.

The Hong Kong-listed stock surged as much as 22 percent on Friday to a record HK$492, taking gains this week to around 120 percent.

Peer Minimax Group Inc also advanced around 40 percent over the same period, while the broader Hang Seng Tech Index remained little changed.

Momentum has been fueled by a wave of Chinese firms unveiling major AI model upgrades ahead of the Lunar New Year holiday, a crucial window for user adoption, while Wall Street analysts stay upbeat about their technological edge.

Investors are also positioning for an expected release from DeepSeek during the holiday, after last year’s launch triggered a global frenzy over China’s fast-rising AI ecosystem.

RELATED ARTICLES

- AI large-model company Zhipu gains more than 13% in HK debut

- MiniMax jumps 91% in Hong Kong debut after $619m IPO

- HK's IPO market starts year on strong note

- Strong pipeline, policy flexibility and attractive valuation to fuel HK IPO

Zhipu unveiled the latest iteration of its large language model, GLM-5, surpassing a rival from Moonshot AI released just weeks earlier to claim the top spot among open-source models on benchmarking site Artificial Analysis.

The company, formally known as Knowledge Atlas Technology JSC Ltd, also hiked the price of its GLM Coding Plan — similar to Anthropic PBC’s Claude Code, which is unavailable in China — by 30 percent to capitalize on surging demand.

Investor sentiment may have also been boosted by Zhipu’s hiring of advisory institutions for a Shanghai Star Market listing.

“There is a lot of retail interest as they are among the first Chinese emerging AI model developers listed,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “Still, they are at early stage of development with significant uncertainty around adoption and monetization.”

JPMorgan Chase & Co named Zhipu and Minimax as its top picks “to capture the next wave of global AI value creation,” citing their distinction as independent large-language-model developers with accelerating global footprints.

Yet signs suggest the rally may be running too fast. Zhipu shares now trade above JPMorgan’s year-end price target of HK$400. Their outperformance versus China’s tech heavyweights may also reflect thinner trading volumes, amplifying price swings.