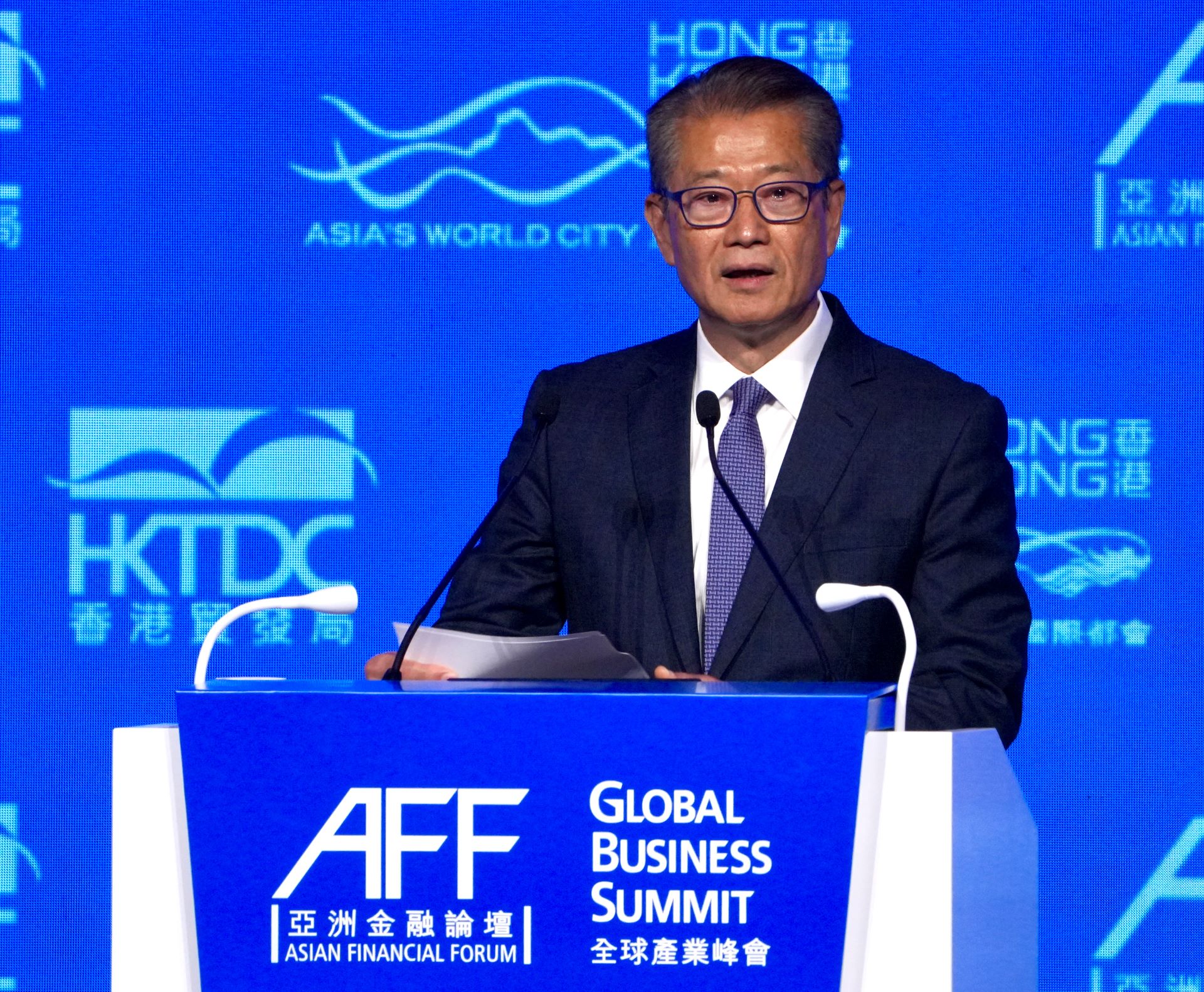

Although the Hong Kong Special Administrative Region government is expected to returned to a surplus in its operating account one year ahead of original estimates, the city must maintain cash reserves and balance current needs and long-term goals amid complicated geopolitics, Financial Secretary Paul Chan Mo-po said in his Sunday blog.

The new year lifted the curtain as a renewed bout of volatility hit global markets. A bull run in gold prices ended last month with a historic slump -- plunging more than 12 percent after extending an almost 30-percent rally to a record high of $5,600 an ounce.

ALSO READ: Gold and silver plunge as wild swings rock metals markets

Amid heightened fluctuations in external markets, Hong Kong’s financial system has remained robust and operated smoothly, with total bank deposits surpassing HK$19 trillion ($2.4 trillion), Chan said.

The benchmark Hang Seng Index began 2026 on a strong note, ending the first month of trading with a gain of about seven percent. Last month’s average daily turnover on the local bourse exceeded HK$272 billion ($34.8 billion), representing a 90-percent increase over the same period last year.

READ MORE: HSI extends rally into sixth day, surging nearly 600 points

The buoyant financial market is attributed to the SAR’s return to fiscal balance. The government announced on Friday a surplus of HK$43.9 billion for the nine months ended December 31, riding high on contributing factors, such as the average daily turnover in Hong Kong stocks having almost doubled year-on-year to HK$250 billion in 2025, while revenue from stock stamp duty exceeded earlier projections.

“The SAR government’s operating account, which manages the daily public expenditure, is now expected to return to a surplus in the current fiscal year (2025–26) -- a year earlier than previously anticipated,” Chan said.

Even as public finances show signs of improving, he warned that the authorities still face the task of exercising discipline in using public resources, with spending growth kept in line with, and ideally below, the pace of revenue expansion.

Chan cautioned that revenue would taper off between January and March as in previous years, while recurrent public expenditure will continue.

READ MORE: HK likely to post a budget surplus of HK$500 million, Deloitte says

The finance chief is due to deliver his 2026-27 budget in the Legislative Council on Feb 25.

He acknowledged that different sectors of society have their own demands, and called for greater support, while emphasizing the need to balance current needs with essential long-term investments.

There’s a need to ramp up investment in infrastructure projects and the development of the Northern Metropolis, and issuing bonds is necessary to provide funding support.

“Meanwhile, rapid technological change, particularly in areas like artificial intelligence, is reshaping the economic landscape. The market increasingly expects the government to scale up investment, hasten the development of higher value-added industries and generate more quality jobs, to accelerate growth and ensure that its dividends are more widely shared,” Chan said.

“Broadly speaking, there’s now a clear social consensus on the need to accelerate economic growth and advance development. Growing the overall economic pie would enable the government to deploy more resources to address a wide range of social needs,” he added.

Contact the writer at sophialuo@chinadailyhk.com