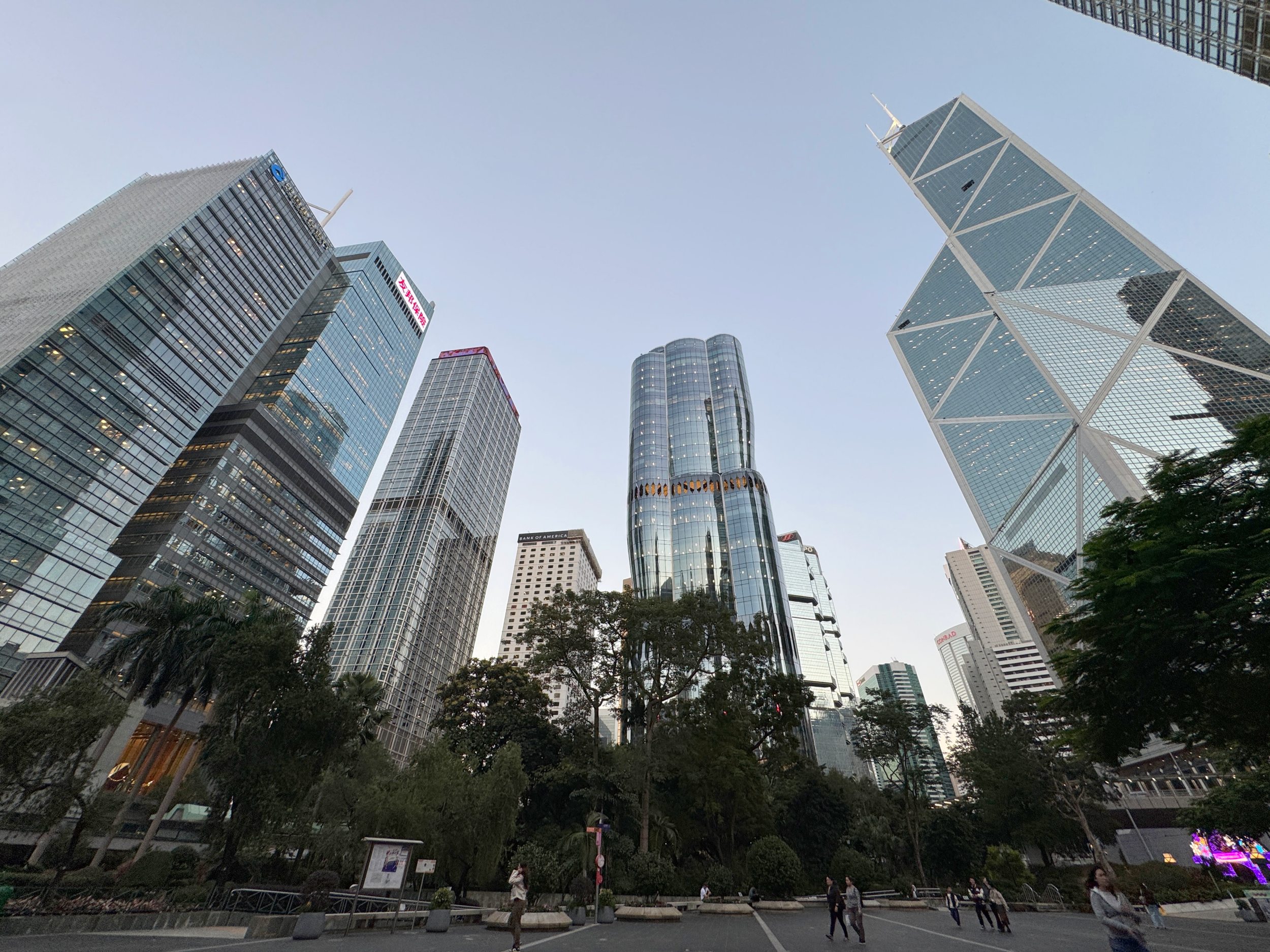

Hong Kong’s bond market is reaching new milestones with the issuance of the city’s first Central Asian sovereign bond and the debut of Hong Kong’s longest-tenure 30-year Hong Kong dollar government bond.

Experts said these developments underscore Hong Kong’s expanding significance as a key funding gateway for international issuers and its deepening role as a hub for long-term capital.

Kyrgyzstan announced the issuance of a five-year US-dollar benchmark international bond on Wednesday in the Hong Kong Special Administrative Region, marking the first sovereign dollar bond from a Central Asian country in the international capital markets.

READ MORE: Asia’s first investment-grade government sukuk ETF listed in HK

The bond was well-received, with peak orders exceeding $2.1 billion from over 130 investors. It raised $700 million — $200 million more than initially planned — with a coupon rate of 7.75 percent. The fund will support Kyrgyzstan’s national budget, specifically targeting financing for hydroelectric power and infrastructure projects.

The deal strengthens Hong Kong’s role as a global debt financing hub and reflects a growing trend of countries participating in the Belt and Road Initiative — initially launched in Central Asia — shifting offshore fundraising activities to Hong Kong and exploring diversified financing channels, said Zou Chuan, CEO of TF International, one of the financial partners facilitating the issuance.

Kyrgyzstan Deputy Minister of Finance Amanbaev Umutzhan Mominovich said: “This is our first step on the international debt capital markets. We are going to maintain our presence and become a frequent issuer for further development of our country’s debt profile and meet the needs of the Kyrgyz Republic economy.”

ALSO READ: Kyrgyzstan seeks to raise more funds via Hong Kong

During a road show in Hong Kong in December, Amanbaev said he hopes to establish connections with more international investment institutions through the SAR to address the growing domestic demand for infrastructure development.

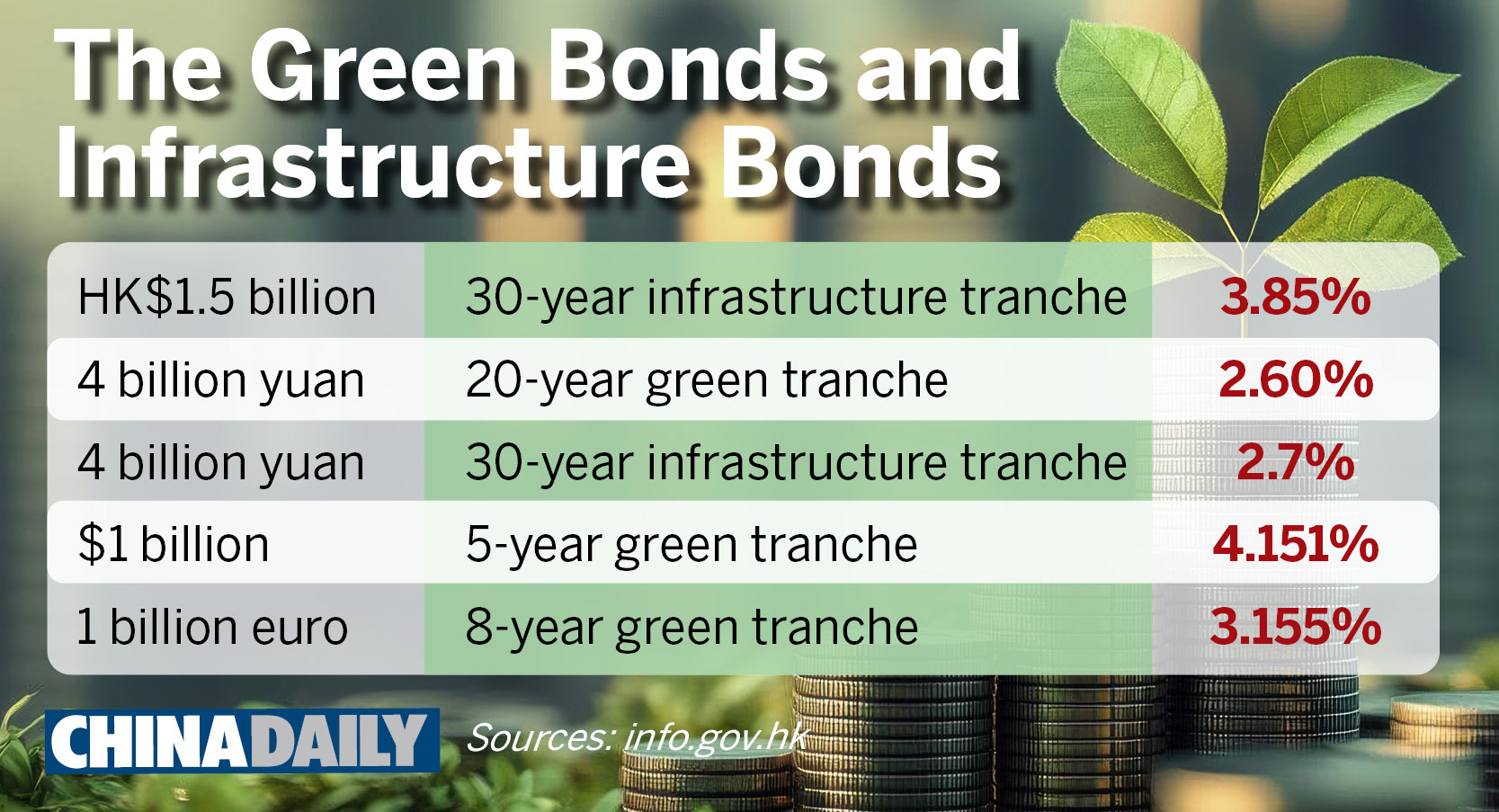

Another new bond product is the first Hong Kong dollar 30-year bond, the HKSAR government’s longest-tenure Hong Kong dollar bond to date. It is among a batch of green bonds and infrastructure bonds scheduled to list on Tuesday.

The Hong Kong Monetary Authority announced that the sales of the bonds attracted investor interest from over 30 regions across Asia, Europe, the Middle East, and the Americas, with total orders amounting to around HK$237 billion ($30.2 billion), or a subscription ratio of 3.3 to 12.5 times.

Hong Kong Financial Secretary Paul Chan Mo-po said that the issuances aim to attract and channel market capital to support green projects, promoting sustainable development in Hong Kong, and accelerate projects such as the Northern Metropolis.

“Global institutional investors responded enthusiastically to the subscription, fully reflecting their confidence in Hong Kong’s sound public finance and long-term development,” Chan added.

READ MORE: Fitch affirms Hong Kong’s ‘AA-’ credit rating, ‘stable outlook’

He said that the debut of the 30-year Hong Kong dollar government bonds helps to extend the Hong Kong dollar benchmark yield curve, further promoting the development of the local bond market.

Both the green bonds and the infrastructure bonds are being issued in alignment with the HKSAR government’s Green Bond Framework and Infrastructure Bond Framework respectively. Proceeds from the issuance will be allocated to the Capital Works Reserve Fund to finance or refinance eligible green projects and infrastructure projects in line with these frameworks.

Contact the writer at gabylin@chinadailyhk.com