China Resources Beverage Holdings raised HK$5.04 billion in its Hong Kong debut on Wednesday, joining a wave of large IPOs as investors cast a vote of confidence in the city’s capital market, financial analysts said.

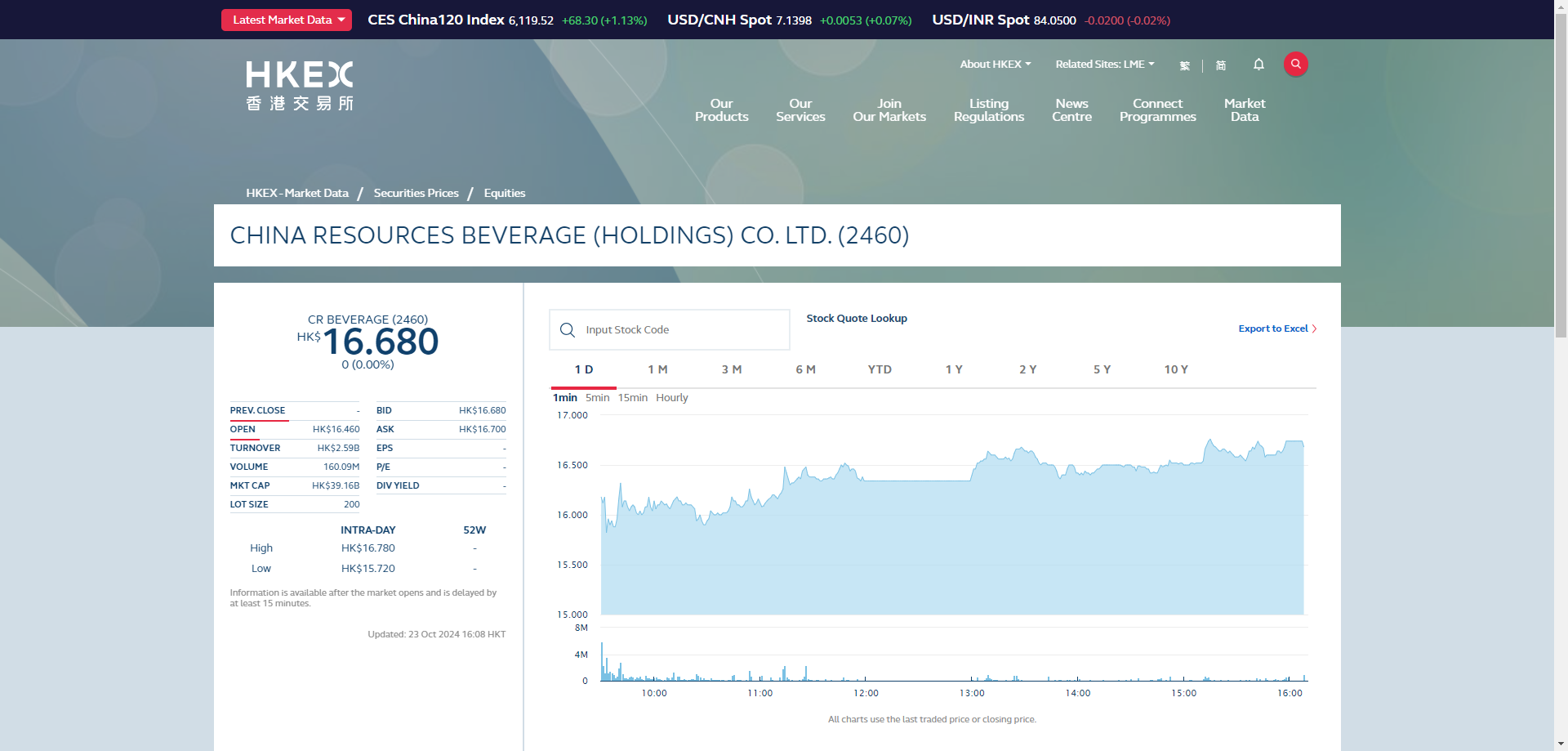

Shares of the C’estbon bottled-water maker soared 15 percent to close at HK$16.7, well above its IPO price of HK$14.50, which was set at the top of the market range. The strong debut marks the second-largest listing on the city’s bourse this year so far.

It follows exceptional investor demand, with the retail portion being oversubscribed 234 times. Retail investors were allocated 40 percent of the shares, while the international offering accounted for the remaining 60 percent.

READ MORE: Hong Kong unveils fast-track IPO process to boost listings

Given the overwhelming response, the company may exercise an over-allotment option for an additional 52.2 million shares, potentially raising total proceeds to $747 million, according to its filing, published on the Hong Kong Exchange website.

The international offering attracted a bulge of institutional investors, with cornerstone investors securing 48 percent of the shares. UBS Asset Management led the cornerstone investors with about one-third of the allocation. Others include China Tourism Group, China Travel Service Holdings, Wildlife Willow, China Post Life Insurance, and Oaktree Capital Management.

READ MORE: China Resources Power Holding to raise $500m via share placement

The company plans to allocate about one-third of the fundraising amount to strategic expansion and supply chain optimization, with the remainder expected to be used for research and development, digitalization, and potential acquisitions.

The company recorded 460.7 million yuan in profits in the first four months of this year, according to its prospectus.

According to Treasury Chief Christopher Hui Ching-yu, 100 companies had gone public in Hong Kong by the end of September, with total IPO fundraising reaching about HK$596 billion.

Chinese appliance maker Midea Group raised HK$31 billion last month, marking the Hong Kong Exchange’s largest listing in over three years, while autonomous driving firm Horizon Robotics aims to sell HK$5.4 billion shares on Thursday.

Edward Au, the southern regional managing partner of Deloitte China, noted a shift in fund managers’ attention back to the Hong Kong capital market.

“Given Hong Kong’s relatively low price-to-earning ratios on average, coupled with improving stock liquidity and the central government’s economic stimulus package, global fund managers saw an attractive entry point” to the Hong Kong stock market, Au said.

“We are seeing a gradual but steady reallocation of investment portfolios. Global fund managers show willingness to channel funds to both Hong Kong and Chinese mainland markets,” he added.

READ MORE: Horizon Robotics seeks $696m in HK IPO, would be city's largest in 2024

Au also attributed this shift to US interest rate cuts, noting that as fund costs appear to be bottoming out and markets anticipate two more rate cuts this year, “fund managers are actively reassessing their portfolio allocations”.

Cliff Ip Wang-hoi, greater China divisional president for CPA Australia, said he expects more large-scale Chinese mainland enterprises to list in Hong Kong given the supportive government policies.

Tom Chan Pak-lam, permanent honorary president of the Institute of Securities Dealers, put the recent activity in IPO businesses down to listings’ prices trading above their IPO prices.

“The key question now is whether we can sustain this momentum where new listings continue to deliver profits for investors, as this directly impacts market confidence and future IPO activities,” he said.

Contact the writer at tianyuanzhang@chinadailyhk.com