The accounting book of Hong Kong Mortgage Corp, the statutory body funded by Hong Kong Special Administrative Region government, returned to red last year as lower market interest rates and a drop in property prices kick in.

HKMC reported a net loss of HK$260 million ($33.3 million) in 2023, compared to the restated net profit of about HK$2.2 billion in 2022. Net interest income in the period has risen 11.5 percent to HK$396 million from a year ago.

As market interest rates at the end of 2023 were lower than in the previous year, this translated into reduced discount rates that increased the insurance contract liabilities for HKMC’s annuity business. Moreover, as property prices have dropped, this has had a negative impact on the HKMC’s reverse mortgage insurance business.

Amid developers launching new residential projects at discounted prices, and while interest rates are high, secondhand property owners have been compelled to reduce their selling prices.

ALSO READ: HK to harness private market forces in housing program

This led to a fall in secondhand property prices in May after the SAR government abolished all property market tightening measures. Home prices cumulatively fell 1.73 percent in the first five months of this year. Compared to the historical high level recorded in September 2021, the cumulative decline in property prices widened to 23.16 percent.

A reverse mortgage is a loan that allows eligible homeowners to borrow money against the equity in their homes and receive the proceeds as a lump sum, a fixed monthly payment, or a line of credit.

By playing the role of insurer to encourage banks in Hong Kong to provide reverse mortgage loans, a significant drop in property prices exposes HKMC to the risks of having to bear a shortfall when the proceeds from the disposal of the properties cannot cover the loan principal and interest.

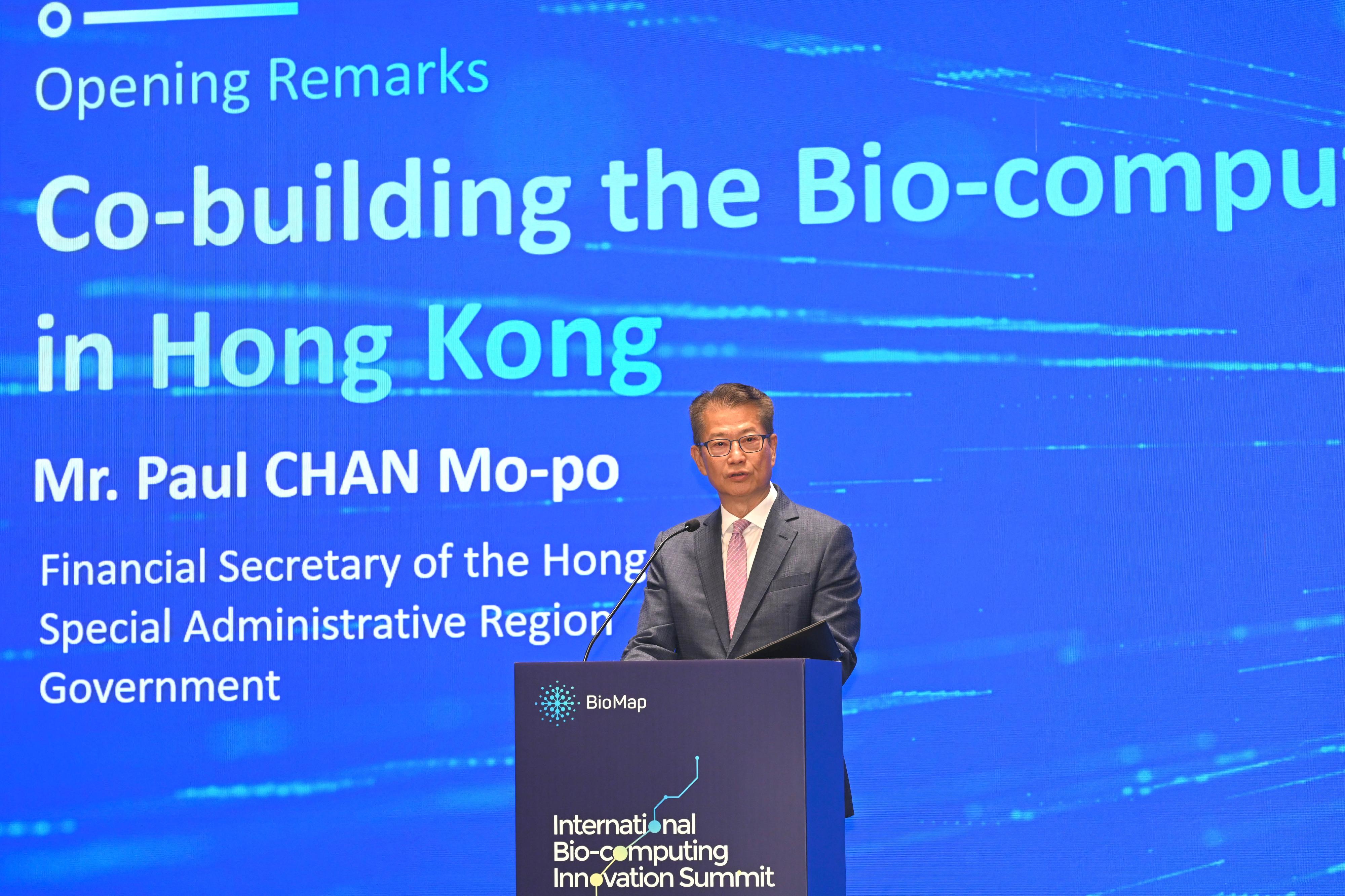

Looking ahead, Financial Secretary Paul Chan Mo-po, who is also the chairman of HKMC, said the external environment remains complex this year.

“Global economic growth will continue to be affected by the sharp monetary tightening policies implemented over the past two years, alongside international trade and capital flows, which have been distorted by geopolitical tensions,” Chan said.

READ MORE: Ray of hope for HK realty after curbs scrapped

Established in 1997, the HKMC is wholly owned by Hong Kong SAR government through the Exchange Fund. Its objectives are to maintain the stability of city’s banking sector, promote wider home ownership, and develop the local debt market and retirement planning market.