As markets in New York, Sydney and London tumble in ways rarely seen before in history, trying to time a good entry point for stocks may seem like a futile exercise right now.

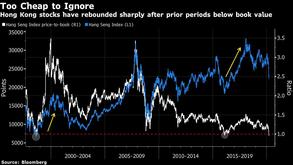

But in Hong Kong, some investors are braving the unprecedented to do just that. Weeks of global market volatility have lashed the Hang Seng Index so much that it’s trading below book value for only the third time in almost as many decades. In 2016 and 1998, that very multiple signaled the start of rallies that rewarded traders with returns of as much as 175 percent within two years. The gauge’s 2.6 percent loss Thursday means traders are pricing firms’ assets at 94 percent of their stated worth, just above a record low.

Weeks of global market volatility have lashed the Hang Seng Index so much that it’s trading below book value for only the third time in almost as many decades

ALSO READ: Hong Kong stocks close 2.61% down

Even as investors continue to liquidate virtually everything in a rush to raise cash, the valuation case in Hong Kong has become too strong to ignore for Baring Asset Management (Asia) Ltd and East Capital Group. They’ve been buying Hong Kong stocks in the past weeks, highlighting the price-to-book metric as well as an attractive dividend yield. Like many of the word’s benchmarks, the Hang Seng measure entered a bear market this month as efforts to stem the coronavirus outbreak threaten to derail global economic growth.

“The worst has probably passed or we are very close to it,” said Khiem Do, head of greater China investments at Barings, who has been working in the asset management industry since 1977. “When the Hang Seng Index falls to one times book or below, usually that has signaled a good entry point in the medium term.” Barings managed about US$340 billion at the end of 2019.

Hong Kong is the only of the world’s 10 biggest stock markets with a benchmark that’s trading below book value. Such levels have enticed record buying from Chinese mainland investors despite the Hang Seng’s 17 percent slump for March. They’ve purchased a net HK$107 billion (US$13.8 billion) of Hong Kong equities so far this month through trading links with the mainland, according to data compiled by Bloomberg.

READ MORE: HK next up in world's growing list of stock bear markets

Sweden-based East Capital, which manages 5.2 billion euros (US$5.7 billion), recently bought Hong-Kong listed mainland companies in the e-commerce and clean energy industries and plans to acquire more, said Francois Perrin, portfolio manager and head of Asia for the firm. “Market dislocation is real these days and is best captured by the current extreme volatility,” he said. “In that environment, fear and panic prevail over fundamentals.”

Concern about the rapidly rising number of new coronavirus cases outside of China and parts of the world going into lockdown has kept many from joining the buying in Hong Kong.

“We kept lowering our long positions in the past few weeks and added more short positions to hedge our remaining long positions,” said Yang Yan, fund manager at Atlantis Investment Management Ltd, which oversees about US$1 billion. Citing the difficulty to forecast 2020 earnings, she said, “It doesn’t make much sense to do too much in the short term as it is too early to make a judgment.”

Caroline Maurer, head of Greater China equities at BNP Paribas Asset Management, was considering buying some Hong Kong- and mainland-listed Chinese technology and health care companies in late February. But she now thinks an IT recovery will be delayed at least two or three months. So the firm, which managed 440 billion euros at the end of 2019, isn’t yet in a rush to put money into the sector. However, if pockets of health care get cheaper still, “we will buy.”