Hong Kong faces an acute urban decay problem. The number of privately-owned buildings aged 50 years or above is rising faster than those redeveloped in the past decade. There have been urban renewal financial constraints amid a property market downturn since 2021. The authorities are trying to turn the tide this year by improving their operations. Oswald Chan reports from Hong Kong.

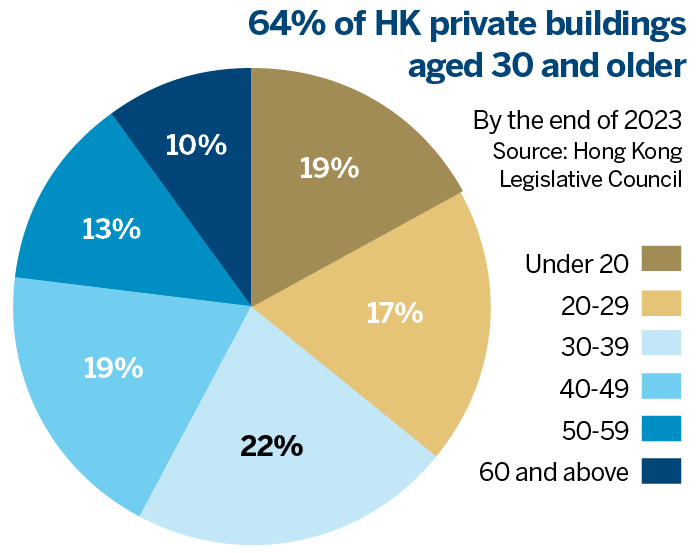

Hong Kong’s construction boom from the 1950s to the 1970s has fueled a current problem, with run-down buildings aging faster than the pace of redevelopment over the past decade.

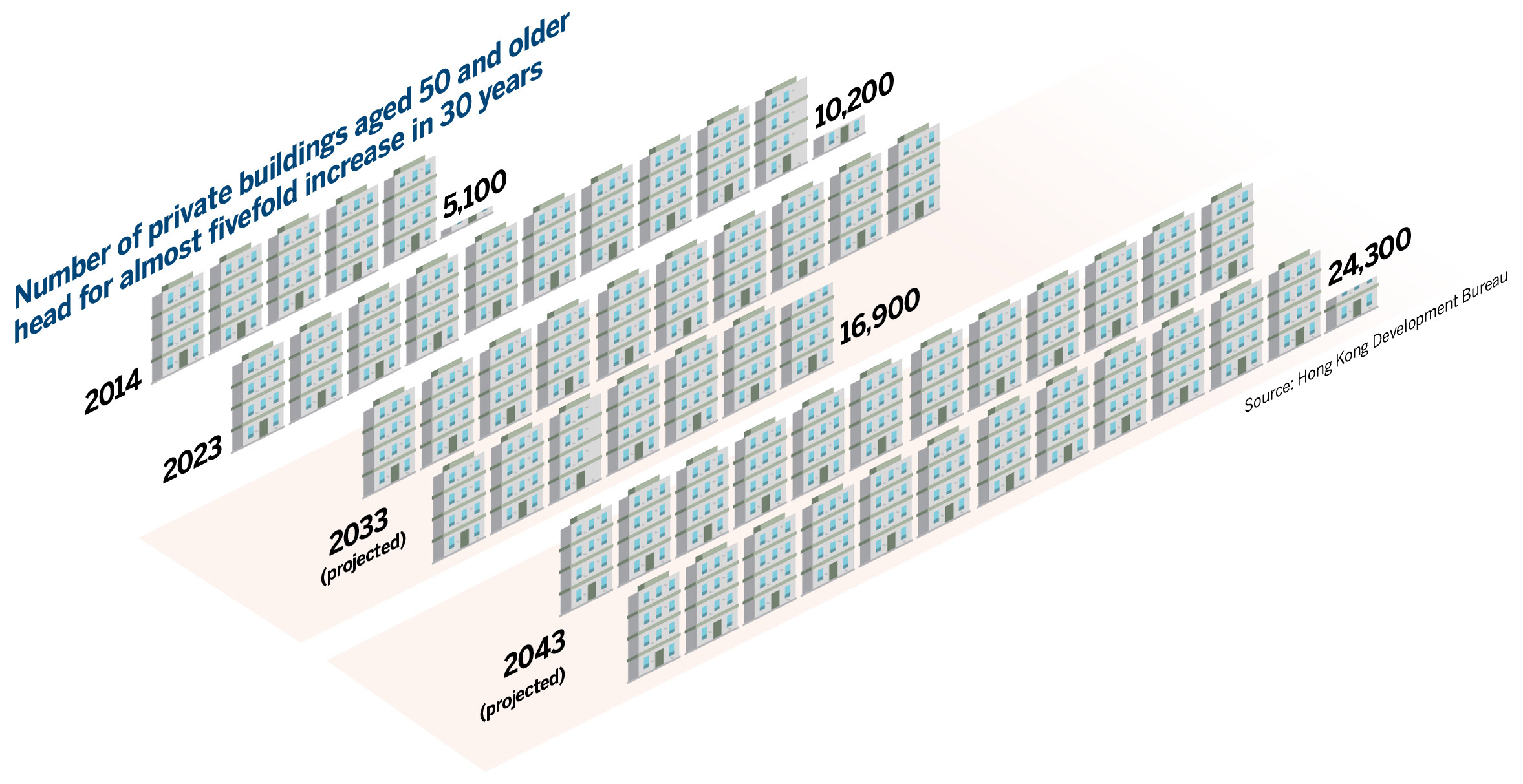

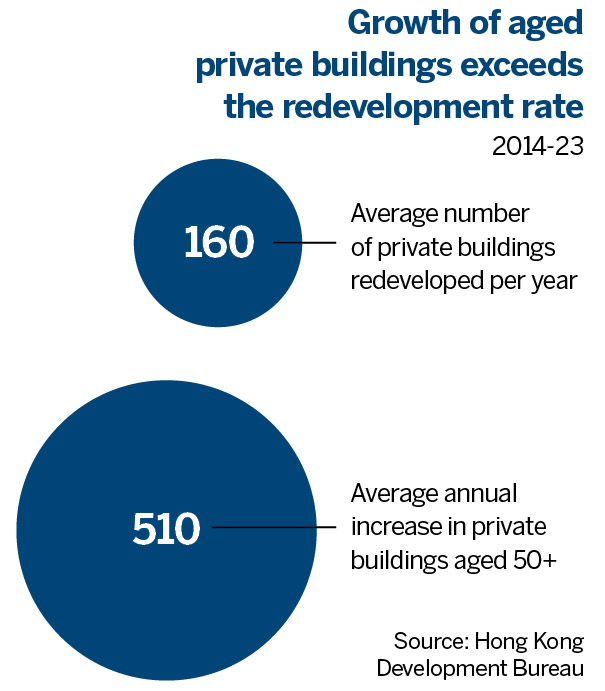

The number of private buildings aged 50 years old or above climbed by an average of 510 annually from 2014 to 2023 — far greater than the 160 buildings redeveloped each year. The pool of dilapidated buildings reached 10,200 in 2023, and is expected to hit 16,900 in 2033 and 24,300 by 2043, increasing at an average annual rate of 740.

The devastating fire at Tai Po Wang Fuk Court in November triggered alarm bells for the owners of aging buildings that proper maintenance is key to building safety and property valuation.

READ MORE: HK to tighten building maintenance regulations after Tai Po fire

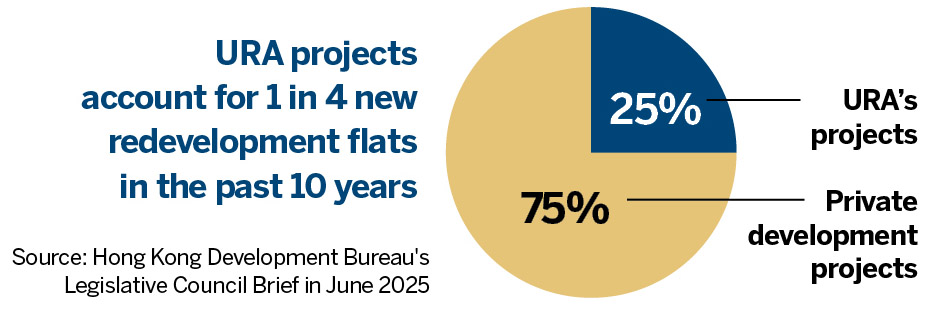

Hong Kong’s statutory Urban Renewal Authority (URA) was created in 2001 under the Urban Renewal Authority Ordinance to promote urban renewal through redevelopment, rehabilitation, revitalization and preservation. Since its establishment, the body has carried out 80 redevelopment and revitalization projects, including the redevelopment or planned redevelopment of 1,781 dilapidated buildings, improvement or planned improvement of 334,600 square meters of urban area and the construction of 25 percent of new flats built from all redevelopment projects across the special administrative region over the last decade.

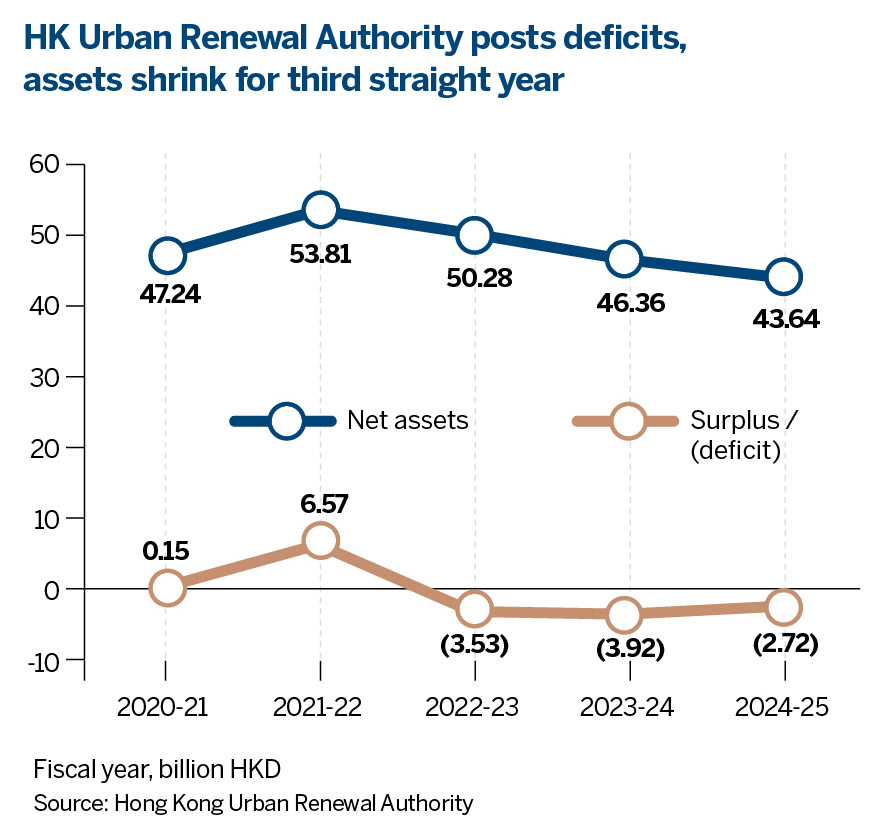

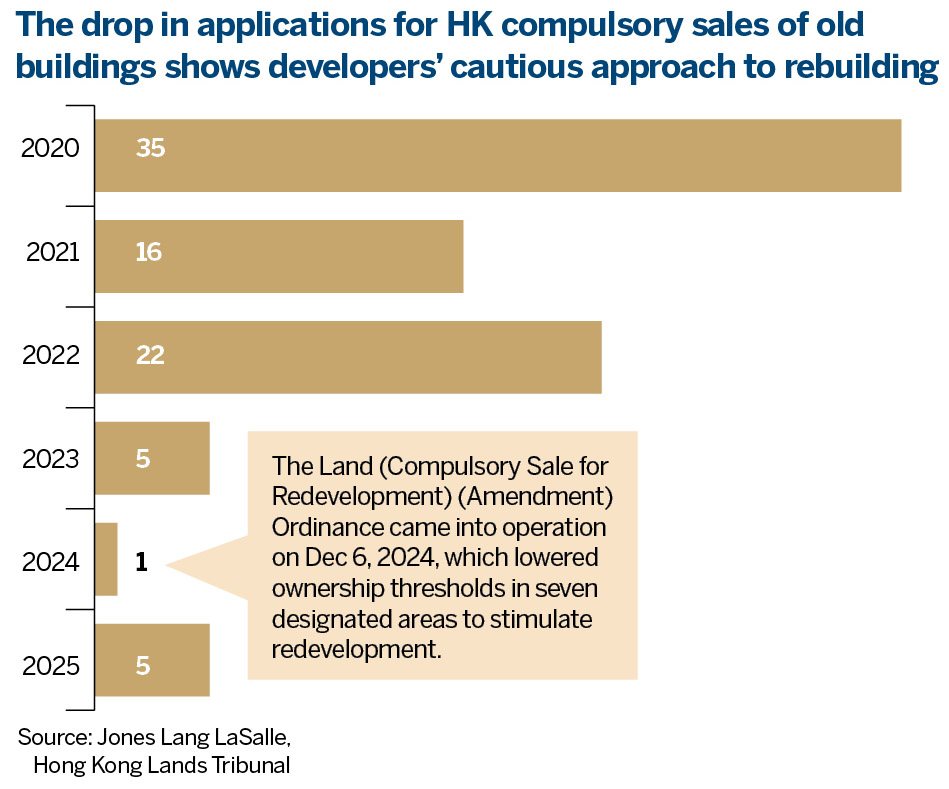

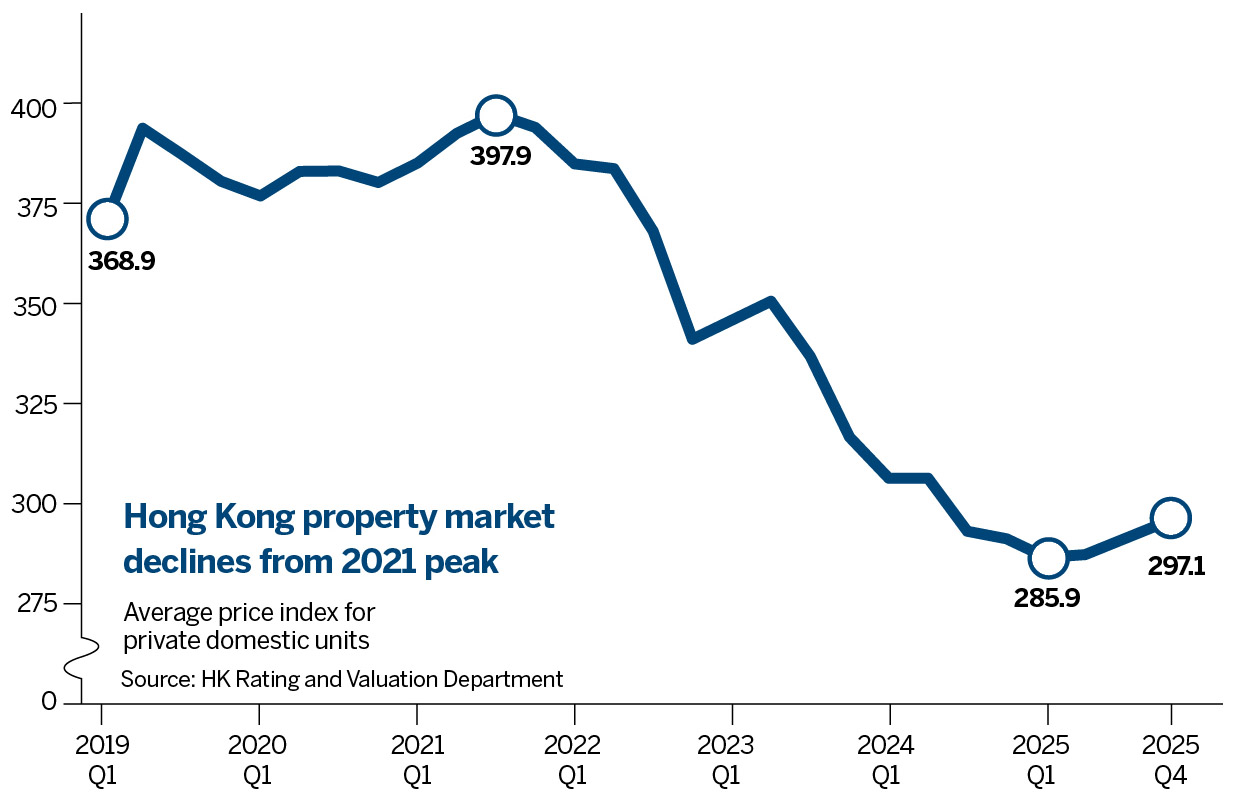

Urban renewal in Hong Kong is deeply linked to the city’s residential property market cycle. Since the market’s downward correction in 2021, the bidding appetite of developers has dwindled, significantly reducing a major source of the URA’s income which comes from upfront payments for successful tenders. The URA has incurred three consecutive years of net deficit since the 2022 financial year after posting eight consecutive yearsline of net surpluses from 2014 to 2021. Net deficits of HK$3.5 billion ($448 million), HK$3.9 billion and HK$2.7 billion were recorded in 2022, 2023 and 2024, respectively.

The URA acquired scores of properties for redevelopment at peak values during the bullish property run. Depreciating land values have further weakened its financial coffers as the organization has made additional provisions for project losses with redevelopment projects becoming less financially viable.

READ MORE: Land redevelopment bill to update compulsory sale regime

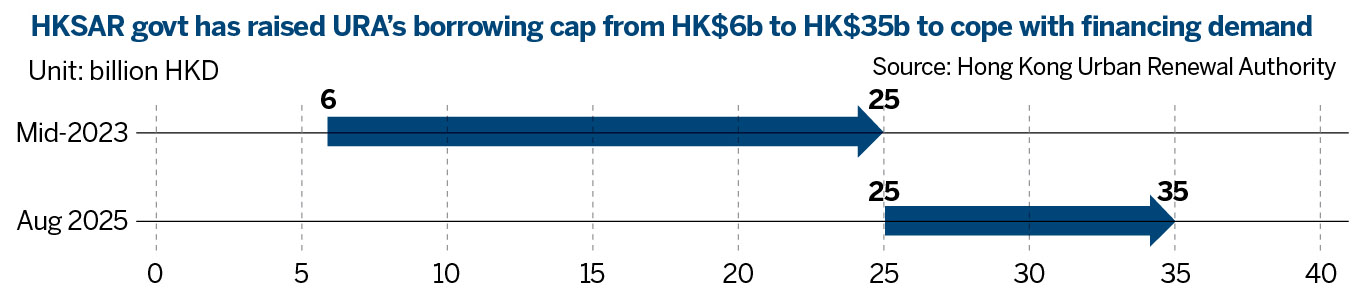

The URA estimates it will have to spend around HK$46 billion to meet redevelopment costs between 2025 and 2030, while cash inflows from upfront payments by joint-venture developers and rental income are highly susceptible to the real-estate sector’s performance.

To ensure that redevelopment projects can be sustained in the long term, the URA is recalibrating its operations with the HKSAR government, with specific proposals due this year.

Reform compensation rules

An integrated approach concerning aspects of acquisition and compensation policy, rehabilitation, strategy and redevelopment, as well as organizational structure makeover, is needed to hasten the pace and sustainability of redevelopment, say property experts, economists and think tank researchers.

Kicking off the process will involve reviewing the URA’s acquisition and compensation policy, and adopting a rehabilitation strategy.

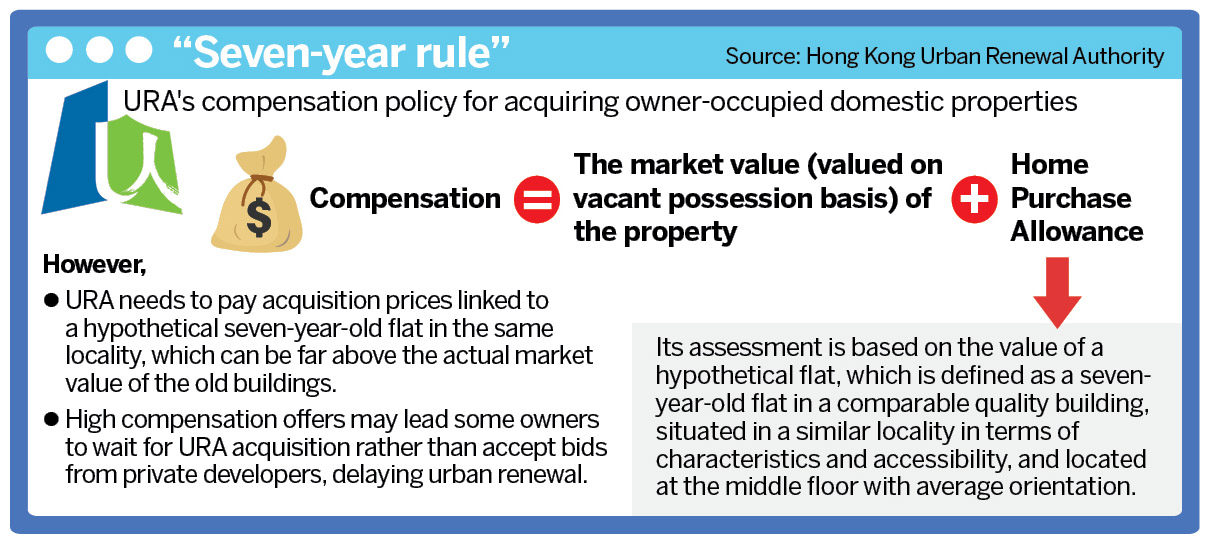

Under the existing Flat-for-Flat Scheme, established in 2011, eligible domestic building owners and tenants affected by redevelopment projects must first accept a cash compensation amount calculated under the seven‑year rule (the hypothetical seven‑year‑old flat value in the same locality), with this amount used to buy in-situ flats at redevelopment sites or off-site flat-for-flat units provided by the URA.

Many buildings being redeveloped are at least half a decade old, and compensating apartment owners based on a seven-year-old value is typically higher than the true market value of old units, making the policy generous compared with normal market transactions or compensation tied to the actual age of affected buildings. Many owners, therefore, hold on to their units for the best compensation deal and are not proactive in conducting renovations.

“The URA should come up with a new multioption compensation framework in place of the generous seven-year rule compensation principle, and it should be decoupled from the local residential property market cycle,” says Calvin Au Hou-che, a senior researcher at the Civic Exchange.

Betty Wang Xiao, an assistant professor at HKU Business School, says that even if affected owners are willing to accept lower compensation (at prices based on a building’s age), there is yet no formal mechanism for the URA to offer or negotiate compensation below the seven-year benchmark.

“Any change would require policies to be revised,” she says. “The URA could offer tiered compensation or a one-off cash settlement. South Korea has shown how to design a one-off monetary compensation mechanism. In South Korea, relocation subsidies amount to 30 percent of an appraised residential value, plus ex-gratia allowances and wage compensation.”

As for rehabilitating buildings, Ryan Ip Man-ki, vice-president of Our Hong Kong Foundation and executive director of its Public Policy Institute, says the Wang Fuk Court blaze demands that the URA play a pivotal role in helping homeowners to maintain their buildings and carry out repair work to a high standard.

In this respect, Wang calls for bigger voluntary participation. “Wider grassroots involvement is vital in voluntary or self-initiated building rehabilitation by speeding up applications for rehabilitation permits or offering tax incentives for owners who actively participate in building rehabilitation,” she says.

Since 2018, the URA has administered various government-funded building rehabilitation programs costing some HK$19 billion.

Boost private investment

More importantly, it is necessary to spur private developer participation in redevelopment. Last year’s Policy Address proposed a number of measures, such as reserving three sites in the Northern Metropolis new development area for the URA to build apartments under the flat-for-flat replacement program; the cross-district transfer of plot ratios, raising the plot ratio of private redevelopment projects and handing out land premium vouchers on a pilot case basis; releasing industrial land in urban areas; and relaxing the gross floor area exemption arrangement for carparks in private developments.

Eric Tsang Chin-pang, acting head of valuation and advisory services at Colliers International (Hong Kong), says he believes such initiatives could increase flexibility and strengthen cash flow for developers. Even so, some statutory procedures can still slow down the redevelopment process, including land premium payments, submissions to the Buildings Department and planning applications made to the Town Planning Board, he says.

“These obligations impose a financial burden on developers and may hinder redevelopment projects,” says Tsang. Hence, the SAR government should consider innovative economic incentives and building relaxation measures to hasten the process, he adds.

The URA’s current business model is to acquire properties first for redevelopment before inviting developers to tender for the site, relieving it of responsibility for construction costs. Experts have proposed a self-development model in addition to the mainstream arrangement of putting redevelopment sites to tender.

In June, the SAR authorities gave the Hung Hom Bailey Street site and a site in Tseung Kwan O to the URA at a nominal land premium of HK$1,000 for 50 years. Both sites are expected to generate cash inflows for the URA when they are put up for tender.

Ip says if the URA were to opt for a self-development model, the advantage is that it could proceed regardless of market sentiment. “This would allow greater control and continuity but it would require the URA to establish in-house design, construction and sales teams, substantially increasing both operating costs and financial exposure,” he says.

“Self-development could save time on the land acquisition process that may cut the required development time of the entire redevelopment process by half, say, from 10 years to five to six years,” says Tsang. The government could also consider a more flexible land premium payment arrangement, such as by installments, for urban redevelopment projects. “This would have a significant impact on developers’ cash flows when they do not have to strain their financing capabilities in making initial capital investment in land.”

More incentives needed

To spur greater interest from private developers in urban redevelopment projects, the government could consider implementing measures to strengthen infrastructure and supporting facilities, such as building schools and shopping centers, as well as exploring ways to reduce social responsibility requirements in government construction tenders, Tsang tells China Daily.

Wang urges the government to consider putting a cap on the hold-out period of redevelopment projects, or levying a vacancy tax or similar measures if a property is empty and unused for too long.

Relaxing building rules could also help, such as removing the mandatory requirement to construct underground carparks in private projects, potentially hastening construction periods, Tsang says.

“Building underground parking spaces takes a long time and incurs high costs for developers, dampening their interest in redevelopment projects. New policies could shorten the construction period and save costs, thus hastening the redevelopment process,” he says.

Au wants the government to review the building code to put heavy emphasis on building safety. “If the code could be relaxed somewhat, it could cut construction costs and quicken the redevelopment process,” he says.

Long-term renewal plan

Even if the compensation policy is revamped and private developers’ interest in redevelopment projects is raised, Au says the government has to articulate a long-term vision for urban redevelopment to make redevelopment projects more predictable.

“Urban development is not just about piecemeal building rehabilitation. Rather, it is about how to adapt to a people-centric approach to enhance environmental livability, green living, community vitality and urban resiliency by preserving culture and heritage, with emphasis on master planning and the predictability of redevelopment schedules,” he says.

ALSO READ: HK sets 10-year housing target at 420,000 units

To achieve this vision, he thinks creating an intergovernmental agency tasked with overseeing urban redevelopment is essential. The Home and Youth Affairs Bureau could communicate more with owners’ corporations in each district to gauge homeowners’ needs regarding redevelopment. The URA, the Development Bureau and the proposed intergovernmental agency could then coordinate on redevelopment policies.

The URA also has its role to play, according to Au. “It can coordinate in the land assembly process by centralizing information on land ownership in urban redevelopment sites and the Northern Metropolis area so developers transfer unutilized plot ratios from redevelopment projects to new development sites in the Northern Metropolis. Land ownership information needs to be constantly updated,” he says.

The URA should also be more proactive in collaborating with the private sector, he adds.

Next Actions

- Review the seven-year rule to tie compensation more closely to actual building age.

- Encourage more grassroots participation in voluntary or self-initiated building rehabilitation.

- Inspire more private developer participation in urban redevelopment projects.

- Create an intergovernmental agency tasked with overseeing urban redevelopment.

- Cultivate a long-term and sustainable people-centric urban renewal vision.

Contact the writer at Oswald@chinadailyhk.com