Federal Reserve officials delivered a third consecutive interest-rate reduction and maintained their outlook for just one cut in 2026.

The Federal Open Market Committee voted 9-3 Wednesday to lower the benchmark federal funds rate by a quarter point to a range of 3.5 percent-3.75 percent. It also subtly altered the wording of its statement suggesting greater uncertainty about when it might cut rates again.

Speaking to reporters after the meeting, Chair Jerome Powell suggested the Fed had now done enough to bolster the economy against the threat to employment while leaving rates high enough to continue weighing on price pressures.

“This further normalization of our policy stance should help stabilize the labor market while allowing inflation to resume its downward trend toward 2 percent once the effects of tariffs have passed through,” he said.

When asked if it were a foregone conclusion that the Fed’s next move would be a cut, Powell demurred, but added that he didn’t see a rate hike as any official’s base case.

Investors reeled in their expectations for rate cuts next year, from three to two. The S&P 500 index of US stocks closed 0.7 percent higher on the day, just short of all-time highs, and the yield on 10-year US Treasury notes fell modestly to about 4.15 percent.

Wednesday’s dissents and the rate projections highlight divisions among policymakers that have emerged over whether weakness in the labor market or stubborn inflation represent the larger danger to the US economy.

In their October statement, the FOMC described what it would take into account “in considering additional adjustments” to their benchmark. In Wednesday’s statement the committee reverted to language used last December — just before a pause in rate cuts — to say “in considering the extent and timing of additional adjustments.”

The result marked the first time since 2019 that three officials voted against a policy decision, with dissents on both ends of the policy spectrum.

Two regional Fed presidents — Austan Goolsbee from Chicago and Jeff Schmid from Kansas City — voted against the decision, preferring to keep rates unchanged. Governor Stephen Miran, whom Trump appointed to the central bank in September, dissented again in favor of a larger, half-point reduction.

Fed officials also authorized fresh purchases of short-term Treasury securities to maintain an “ample” supply of bank reserves.

The decision to lower rates comes after divisions on the committee spilled into public view in recent weeks. Following the last rate cut in October, several officials warned of persistent inflation, indicating their hesitancy to support another reduction. Others remained focused on a weakening labor market, calling for at least one more cut.

Conflicting data helps explain why there hasn’t been a unanimous vote on the FOMC since June.

Unemployment moved to 4.4 percent in September, up from 4.1 percent in June. But prices — as measured by the Fed’s preferred gauge of inflation — rose 2.8 percent in the year through September, still meaningfully higher than the central bank’s 2 percent target.

The government shutdown has further complicated the policy outlook by delaying the release of key data.

Despite the divisions on the committee and economic uncertainty, investors had expected a cut on Wednesday after New York Fed President John Williams, who is viewed as close to Powell, signaled his support for a December reduction in a Nov 21 speech.

Fresh Forecasts

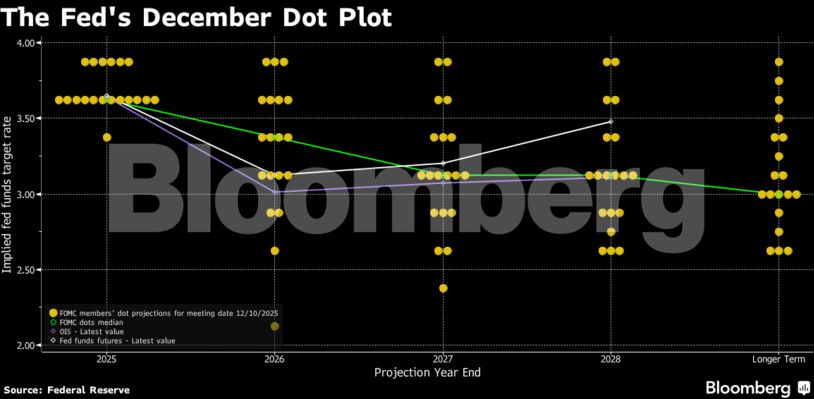

In their new economic forecasts, officials’ median projections pointed to one cut in 2026, and one in 2027. The rate outlook remained deeply divided, however. Seven officials indicated they favored holding rates steady for all of 2026, while eight signaled support for at least two.

Officials upgraded their median outlook for growth in 2026, to 2.3 percent from the 1.8 percent they projected in September. They also foresaw inflation declining to 2.4 percent next year, from the 2.6 percent they projected in September.

In his press conference, Powell said he expected the impact of tariffs to fade next year.

“Let’s assume there are no major new tariff announcements — inflation from goods should peak in the first quarter,” he said.

The policy decision also comes soon after President Donald Trump said he’s decided whom he’ll nominate to succeed Powell as Fed chair in May and indicated a decision will be announced early next year. The White House has poured criticism on the Fed for not cutting interest rates more quickly, fueling concerns that the central bank’s independence is under threat.

Fed officials approved the new Treasury purchases beginning Dec 12. The move was anticipated by many Wall Street banks as a way to support liquidity in overnight funding markets.

Since 2022 and until this month, the central bank had been reducing the size of its Treasury holdings, aiming to reach the smallest possible size without disrupting money markets.