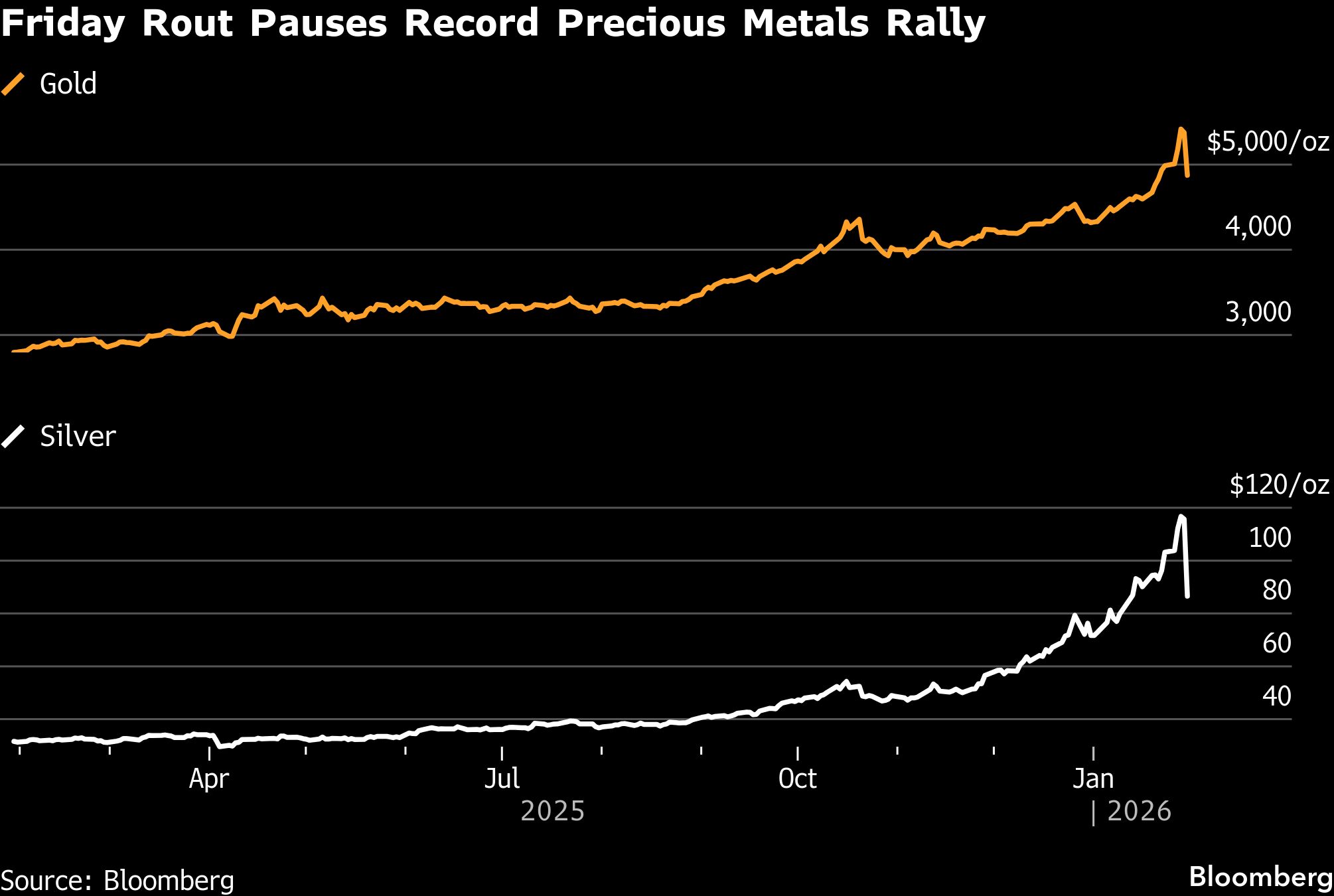

Gold suffered its biggest slide in four decades and silver posted a record intraday decline in a stark reversal of the rally that lifted prices to all-time highs.

Gold fell more than 12 percent to slump below $5,000 an ounce in its biggest intraday decline since the early 1980s. Silver plunged as much as 36 percent, a record intraday decline, as the selloff swept through the broader metals markets. Copper fell 3.4 percent in London, retreating from Thursday’s record high. The dollar jumped, boosted by a selloff of commodity currencies including Australian dollar and Swedish krona.

A wave of investor demand for precious metals over the past year has clocked record after record, shocking seasoned traders and driving exceptional price volatility. That accelerated in January, as investors piled into the time-honored havens amid concerns about currency debasement and the Federal Reserve’s independence, trade wars and geopolitical tensions.

Friday’s selloff is the biggest shock to the rally, outdoing the slump in October. It was triggered by the dollar rebounding after a report the administration of US President Donald Trump was preparing to nominate Kevin Warsh for Fed chair, a move later confirmed.

ALSO READ: Gold storms beyond $5,000 as global upheaval fans demand frenzy

“Trump announcing Warsh as his pick for next Fed Chair has been a US dollar positive and precious metals negative,” said Aakash Doshi, global head of gold and metals strategy at State Street Investment Management. “This has probably been exacerbated by month-end rebalancing as both short dollar and long precious metals has been the consensus macro trade over the past two to three weeks.”

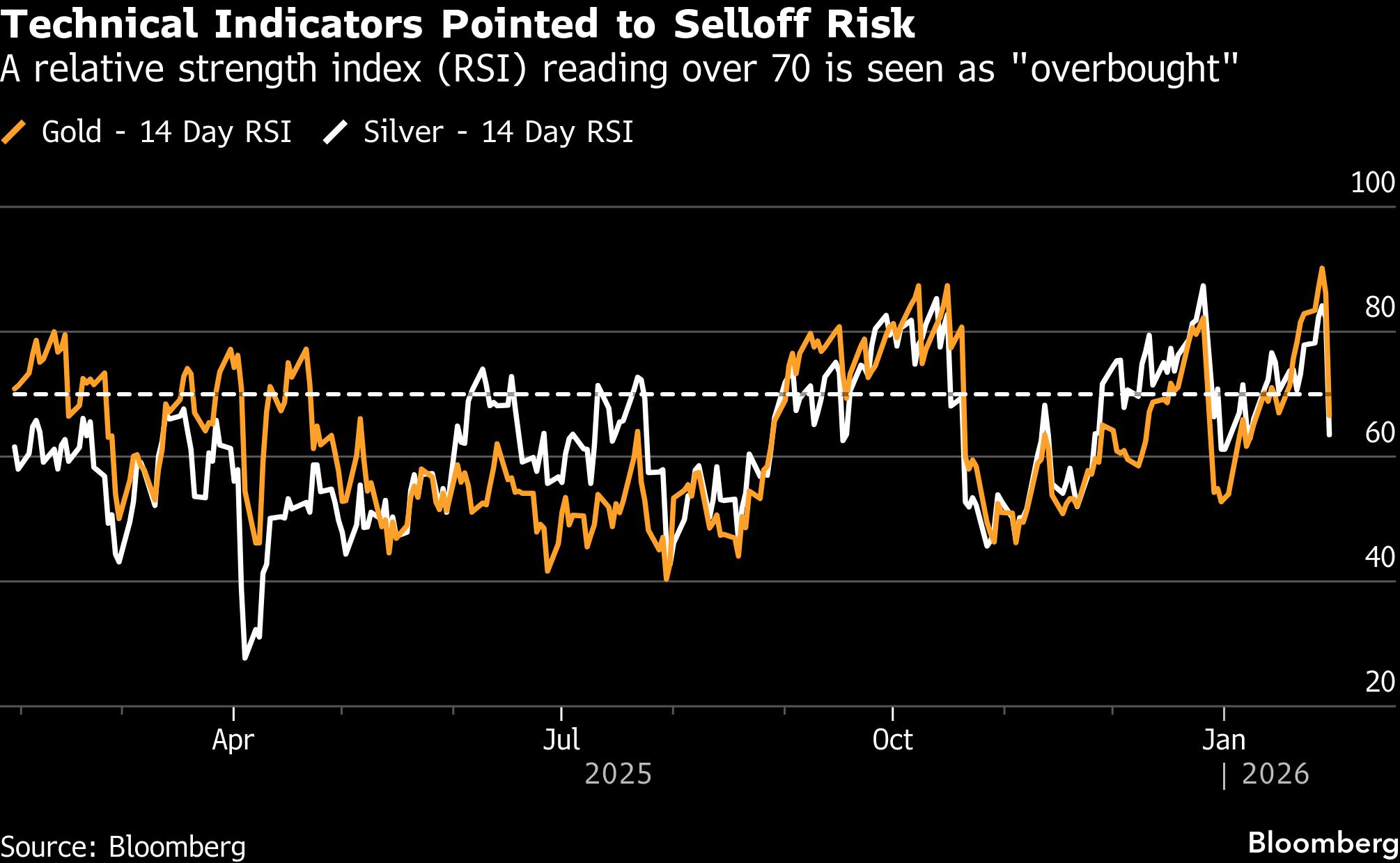

Gold’s move “validates the cautionary tale of fast-up, fast-down,” said Christopher Wong, a strategist at Oversea-Chinese Banking Corp. While reports of Warsh’s nomination were a trigger, a correction was overdue, he said. “It’s like one of those excuses markets are waiting for to unwind those parabolic moves.”

A record wave of purchases of call options, contracts which give holders the right to buy at a pre-determined price, had also “mechanically reinforcing upward price momentum”, Goldman Sachs Group Inc said in a note, as the sellers of the options hedged their exposure to rising prices by buying more.

For the SPDR Gold Shares ETF, there were large positions expiring Friday at $465 and $455, while on Comex, sizable March and April options positions were at $5,300, $5,200 and $5,100.

The metals rout also drove down shares of major mining companies including top gold producers Newmont Corp, Barrick Mining Corp and Agnico Eagle Mines Ltd, whose shares had slid more than 10 percent in New York trading.

ALSO READ: Gold surges to all-time high, rising above $4,500 per ounce

Even after Friday’s pullback, gold still registered a monthly gain of 13 percent while silver was up 19 percent for the month.

With gold and silver jumping so much already this year, some technical indicators flashed warning signs. One is the relative-strength index, which in recent weeks signaled that both metals may have become overbought and due a correction. Gold’s RSI recently hit 90, the highest it has been for the precious metal in decades.

Volatility is very extreme and both psychological resistance levels of $5,000 and $100 respectively have been broken numerous times on Friday, according to Dominik Sperzel, head of trading at Heraeus Precious Metals. “We need to prepare for the roller-coaster to continue though.”

Meanwhile, the risk of another US government shutdown was avoided after Trump and Senate Democrats reached a tentative deal. The White House is continuing to negotiate with Democrats on placing new limits on immigration raids that have provoked a national outcry.

Spot gold closed 8.9 percent lower at $4,894.23 an ounce in New York. Silver plunged 26 percent to settle at $85.20 an ounce, while platinum and palladium also tumbled. The Bloomberg Dollar Spot Index gained 0.9 percent. A higher US currency makes commodities more expensive for investors holding other currencies as they’re priced in the greenback.

Copper on the London Metal Exchange settled at $13,157.50 a ton, retreating after surging above $14,000 a ton for the first time on Thursday in its biggest intraday jump since 2008.