Hong Kong’s unique economic advantages and ecosystem have made it a premier destination for international startups, which see the city as indispensable for growth in the Asia-Pacific region. Jessica Chen reports from Hong Kong.

When Giovanni Casinelli and co-founder Andrea Baronchelli launched Aspire — a business-to-business multicurrency financial platform — in Singapore in 2018, they envisioned a multi-region footprint in a modest four-desk office.

Casinelli, a computer science graduate of Politecnico di Milano — Italy’s largest science-technology university — soon realized that Hong Kong would be their first step beyond the Lion City for his startup.

Aspire’s journey to the Hong Kong Special Administrative Region could be traced back to November last year when the HKSAR found itself in the crosshairs of geopolitical conflicts. But Casinelli had a vision for his business to gain a strong foothold in the city’s booming financial technology sphere. He found his manager in Hong Kong, Ian Lee, a local veteran professional with a solid background of work experience at global tech giants, Oracle and SAP.

READ MORE: Chan reaches out to Spanish entrepreneurs

Three months after Casinelli — an Italian-born IT genius — ventured into Hong Kong, the Western media started another round of their doomsayer chants, fermenting a pessimistic sentiment about the city’s future. Casinelli, Lee and their team stood their ground, eager to fast-track their business in Asia, especially in Hong Kong, and make their strategic stronghold expand in the region. In the past five years, Aspire, described as an all-in-one financial platform for modern businesses, has seen the number of its corporate customers grow from zero to 20,000. In May, the company secured a money service operator’s license from Hong Kong’s Customs and Excise Department.

An ideal springboard

Although Hong Kong’s small and medium-sized enterprises managed to ride out global financial crises in the past, they are now struggling like never before amid sluggish economic growth, posing challenges for their agility and vitality.

However, Casinelli remains uncompromising. “A good market is still a good market,” he says. He is certain that Hong Kong is the perfect strategic place for his fintech startup to win markets across Asia. “Hong Kong is an integral part of our growth strategy for the Asia-Pacific region as it’s our first venture outside of Southeast Asia.”

The global geopolitical problems are real, but the state of the market is what really matters to ambitious firms like Aspire.

According to Hong Kong’s Trade and Industry Department, there were 360,000 SMEs in the city as of March, employing 1.2 million people. Most of the SMEs were engaged in the import-export and wholesale industries, with professional and business services coming second.

A 2023 DBS survey showed that Hong Kong is witnessing a revival of business digitalization, with 93 percent of SMEs recognizing the digital trend as critical for their growth. At the same time, Hong Kong is experiencing an entrepreneurial boom, with the number of startups having more than tripled in the past decade.

“Hong Kong stands as a thriving ecosystem for startups and fintech worldwide, offering a conducive environment for growth and innovation,” says Leung Hong-king, global head of financial services, fintech and sustainability at InvestHK — an HKSAR government agency geared to supporting investment and business expansion.

Hong Kong’s market-driven startup ecology is appreciated by entrepreneurs who have ventured into the city of opportunity. Harry Chen, a Canadian entrepreneur, says he finds Hong Kong to be the “best choice” in tapping into the wider prenatal and neonatal healthcare market in the Guangdong-Hong Kong-Macao Greater Bay Area.

Chen, a graduate of the University of California, Berkeley, sees the HKSAR’s deepening integration into the GBA as too promising for a bio-health startup to underestimate. “Hong Kong is a strategic location because of its access to a large population, and it’s just one step away from manufacturers in the Pearl River Delta,” says Chen, who is a partner and chief financial officer of E3A Healthcare — a biotech startup founded in Singapore in 2019.

The firm started from scratch, initiated by a team of researchers from the National University of Singapore, and set up a holding company in Hong Kong the same year despite the social unrest in the city. For E3A Healthcare, getting a foothold in Hong Kong to access the market in the populous GBA is strategically vital, and its confidence in Hong Kong remains strong.

“Singapore’s market is relatively limited,” says Chen. The HKSAR’s strategic status in China and Southeast Asia is more important because of its ready-made market access to densely populated regions, he adds.

E3A Healthcare raised its first venture capital in Hong Kong through financial advisors, following a common pattern of how international players find their way to Hong Kong. The city’s universities and Hong Kong Science Park, as well as San Tin Technopole, which unites the sister cities of Hong Kong and Shenzhen, are all on the startup ecosystem. StartmeupHK — an agent operating under InvestHK — also holds conventions, salons and forums to support the startup community.

The City University of Hong Kong’s HK Tech 300, for example, provides training and growth opportunities for young entrepreneurs and translates the university’s research and intellectual property into practical applications. Having won an award in the HK Tech 300 Southeast Asia Startup Competition in June, E3A Healthcare planned to make a further foray into Hong Kong. The biomedical player has now mapped out a clear path to an initial public offering in the city or on Nasdaq within the next three years.

“Given the existing infrastructure and the dynamic path of chapters 18A and 18C at Hong Kong Exchanges and Clearing, E3A Healthcare would find it comparatively easier to go through the whole process,” says Chen.

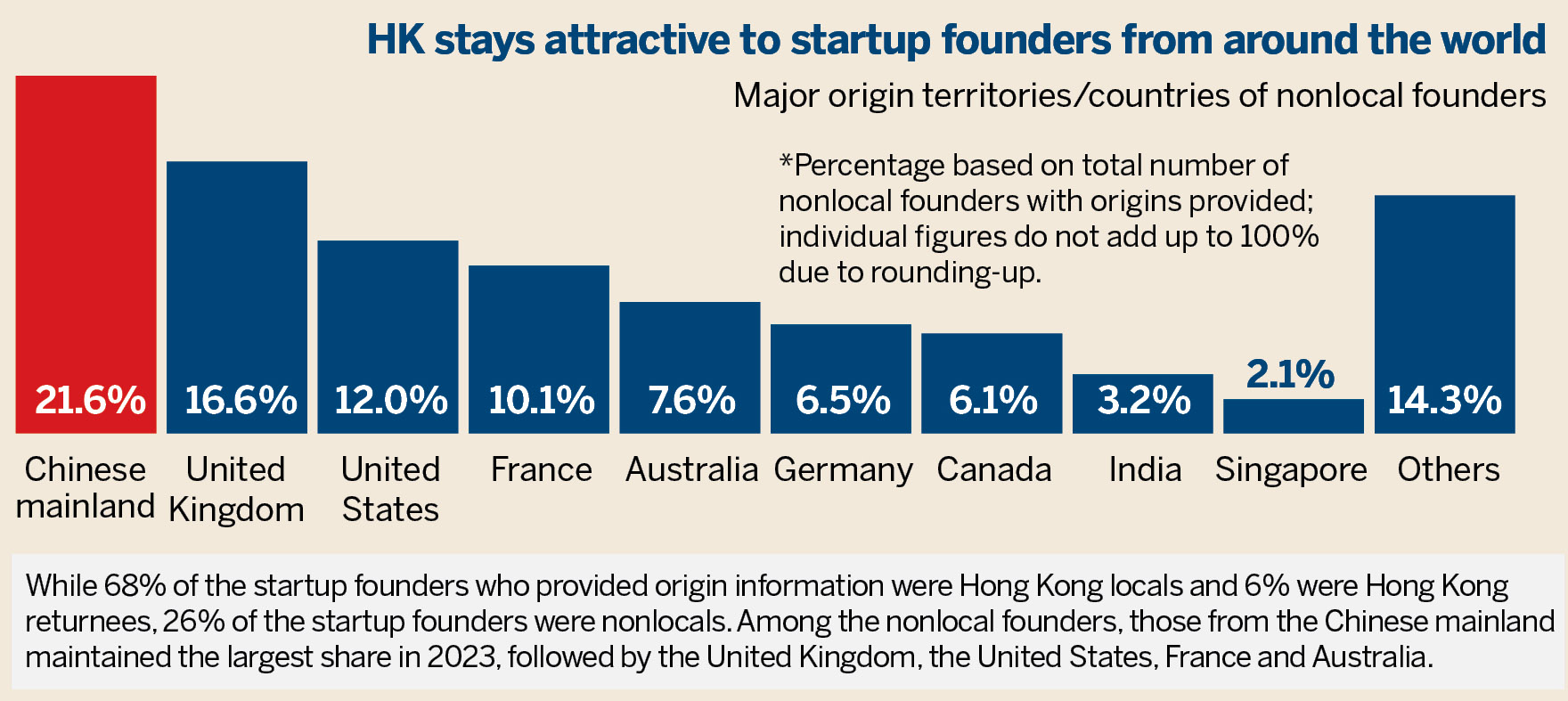

A survey conducted by InvestHK in 2023 showed that the number of startups in the city had surged over 30 percent since 2019. Despite external and internal challenges, their number has continued to grow, reaching a record high of 4,257 last year. Among the startups, about 26 percent of their founders were nonlocals, mostly from the Chinese mainland, the United Kingdom and the United States. The statistics show that Hong Kong is an international arena for entrepreneurs from across the globe.

Favorable ecosystem

Eli David Rokah, who founded global innovation research platform StartupBlink, notes that Hong Kong’s startup ecosystem is fueled by a diverse range of industries, particularly fintech, in which the HKSAR ranks 18th globally according to StartupBlink, along with the technology, e-commerce, biotech and other sectors. “Hong Kong’s advantageous position as an international financial center attracts global investors and provides startups with access to a vast network of potential customers and partners,” he says.

Over the years, InvestHK has actively promoted Hong Kong as a premier startup destination and has offered comprehensive support services to local and international startups, such as guidance on market entry, networking opportunities, and building up connections with key stakeholders in the startup ecosystem.

A survey conducted by StartmeupHK showed that favorable factors like the HKSAR’s simple tax system and low tax rate, accessibility to international and regional markets, access to funding and free flow of information, as well as business opportunities on the mainland, help make the city a hub of opportunity.

The strong entrepreneurial culture and the workforce’s high productivity also encourage startups to use Hong Kong as a base for their operations to venture into the GBA and the rest of Asia, Sun Dong, Hong Kong’s secretary for innovation, technology and industry, said at the awards ceremony of the HK Tech 300 competition.

Aspire and E3A Healthcare share a common pattern of launching a startup in Singapore and seeking to thrive in Hong Kong. Although both cities have often been compared with each other, and are reportedly pitted against each other, what has happened in the business world suggests otherwise. It’s not about Hong Kong versus Singapore — it’s about the flow of money.

In October 2023, the HKSAR government launched the Research, Academic and Industry Sectors One Plus Scheme, providing HK$10 billion ($1.28 billion) to strengthen collaboration among the government, industry, academia and the research sectors. Apart from this initiative, startups can also benefit from other funding sources, such as the HK$2 billion Innovation and Technology Venture Fund, Hong Kong Science Park’s Venture Fund and the Cyberport Macro Fund, which provide resources for companies to scale up.

“I have applied for every grant available regardless of the amount, allowing our company to start with low running costs because most of them were covered by reimbursements,” says Kyle Wong, CEO and co-founder of PanopticAI.

Chen says the Research Talent Hub funding under the Innovation and Technology Fund is “the most direct and impactful support from the government”. The funding provides eligible startups with a monthly grant of up to HK$180,000 for three years to hire research talent.

ALSO READ: Startups rise on capital ideas

Besides government funds, Hong Kong’s tax system and IPOs have long been driving the city in its bid to become a hub for startups and entrepreneurs. Hong Kong’s territorial tax system taxes corporations 8.25 percent on the first HK$2 million of profits earned in the city and 16.5 percent on the rest. It does not levy a value-added tax or a goods and services tax. “This simplicity helps businesses with financial planning and budgeting,” says Giovanni Angelini, founder of Hong Kong-based Angelini Hospitality.

By comparison, Singapore’s tax system features a corporate tax rate capped at 17 percent, with numerous incentives and exemptions that effectively lower the tax burden for many companies. In addition, the city state increased its goods and services tax rate from 8 percent to 9 percent in January.

Like Casinelli, Angelini is unwavering in his belief that Hong Kong remains the most ideal place for starting a company.

“It outwits its competitors with its less stringent compliance requirements, creating a more attractive environment for businesses that prioritize operational efficiency.”

Zhang Tianyuan contributed to this story.

Contact the writer at jessicachen@chinadailyhk.com