Hong Kong exports and imports products it neither manufactures, nor consumes. Trade accounted for 384 percent of its 2022 GDP. In the global supply-chain rebalancing, the SAR can strengthen physical and digital integration with the mainland, and reach out to new markets. Oswald Chan reports from Hong Kong.

(INFOGRAPHICS: DONG KAI, MOK KWOK-CHEONG)

(INFOGRAPHICS: DONG KAI, MOK KWOK-CHEONG)

The global economy worked efficiently from the 1960s through to 2020 before emergency restrictions on the movement of people to contain COVID interrupted shipping and raw material flows, disrupting global manufacturing and trading networks. The war in Ukraine shrunk global wheat supply and fertilizer inputs. Sanctions on Russia choked off oil for winter heating to Western Europe.

Manufacturing and trading challenges are no longer about lean, low-cost production and linear supply-chain logistics. The crises now range from basic food self-sufficiency to de-risking medicine, and raw materials that are critical for essential services. The consumer focus is being displaced by fundamental security concerns. The reset is about reshoring, onshoring, and nearshoring critical supply and capacity.

China Plus One

The escalating United States-China strategic standoff has multinationals scrambling to disperse manufacturing from China to peripheral countries like Vietnam, Thailand, Indonesia, Malaysia, the Philippines, and Bangladesh. They are spreading risk in what has been labeled the “China Plus One” strategy.

China has comprehensive component subsupplier feeder chains built into its manufacturing hubs, which cannot easily be replicated elsewhere due to lack of scale. Sheer scale makes the Chinese manufacturing model globally efficient and unmatched. It links massive manufacturing capacity and access to the world’s largest single consumer market.

As Legislative Council Member (Transport) Frankie Yick Chi-ming puts it: “China has developed a comprehensive supply chain of different components for different industries. The low technology level, labor skills, and small domestic markets of Asian countries cannot transfer the entire supply chain out of China.”

Superior value-adding

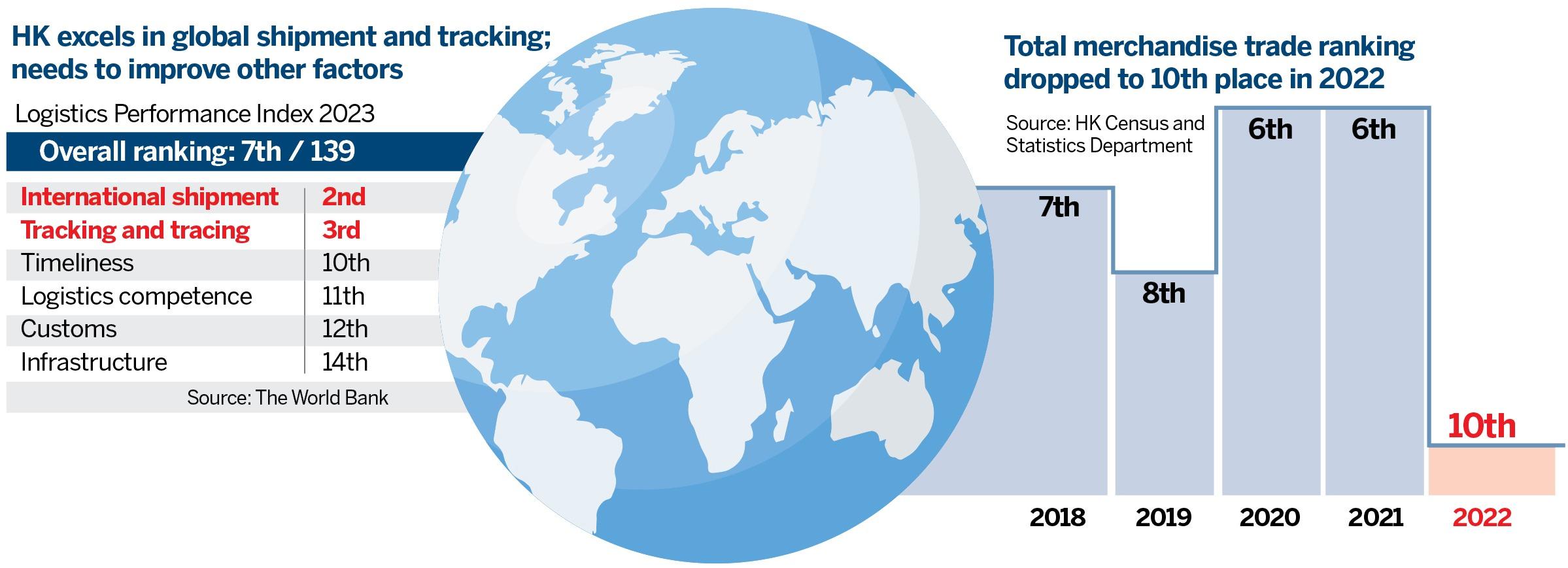

As a premier global offshore trading hub, Hong Kong exports most of the goods it does not produce, and imports most of the goods it does not consume. It value-adds sophisticated trade financing, insurance, air plus sea logistics, and storage facilities. The World Trade Organization ranks Hong Kong the 10th-largest trading center in 2022, accounting for 2.5 percent of world trade.

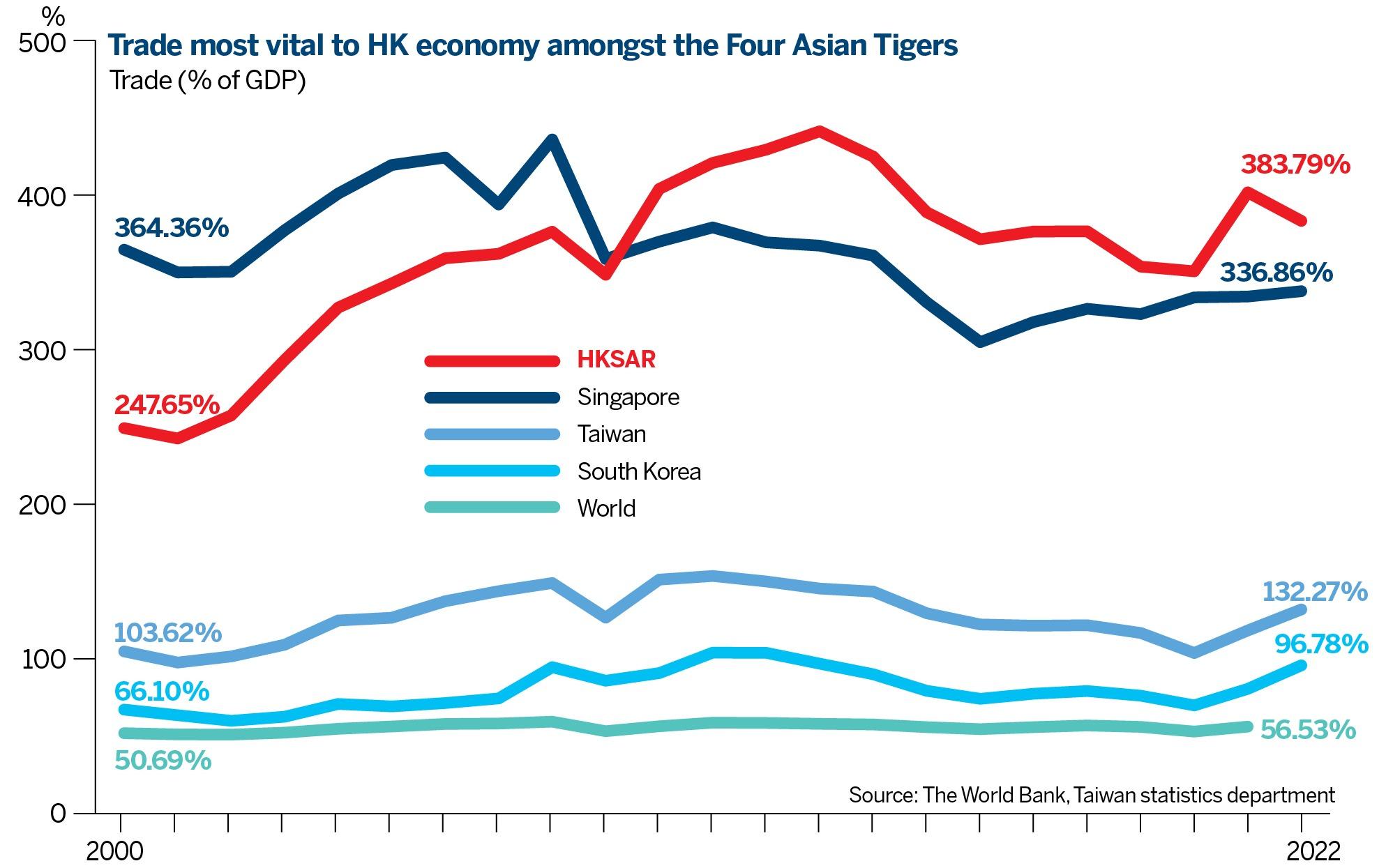

World Bank data show trade represented 384 percent of Hong Kong’s gross domestic product in 2022, higher than Singapore’s 337 percent in the same year. Expressed as a percentage, the ratio is an indicator of the relative importance of international trade in any economy by dividing the aggregate value of imports and exports over a period by the gross domestic product for the same period. The ratio of 384 percent of GDP indicates that international trade plays a more important role in the Hong Kong economy.

“Supply chain reconfiguration will affect Hong Kong as corporations reduce business risks through trimming operations on the mainland for other alternatives,” asserts Louis Chan Wing-kin, deputy director of research at Hong Kong Trade Development Council.

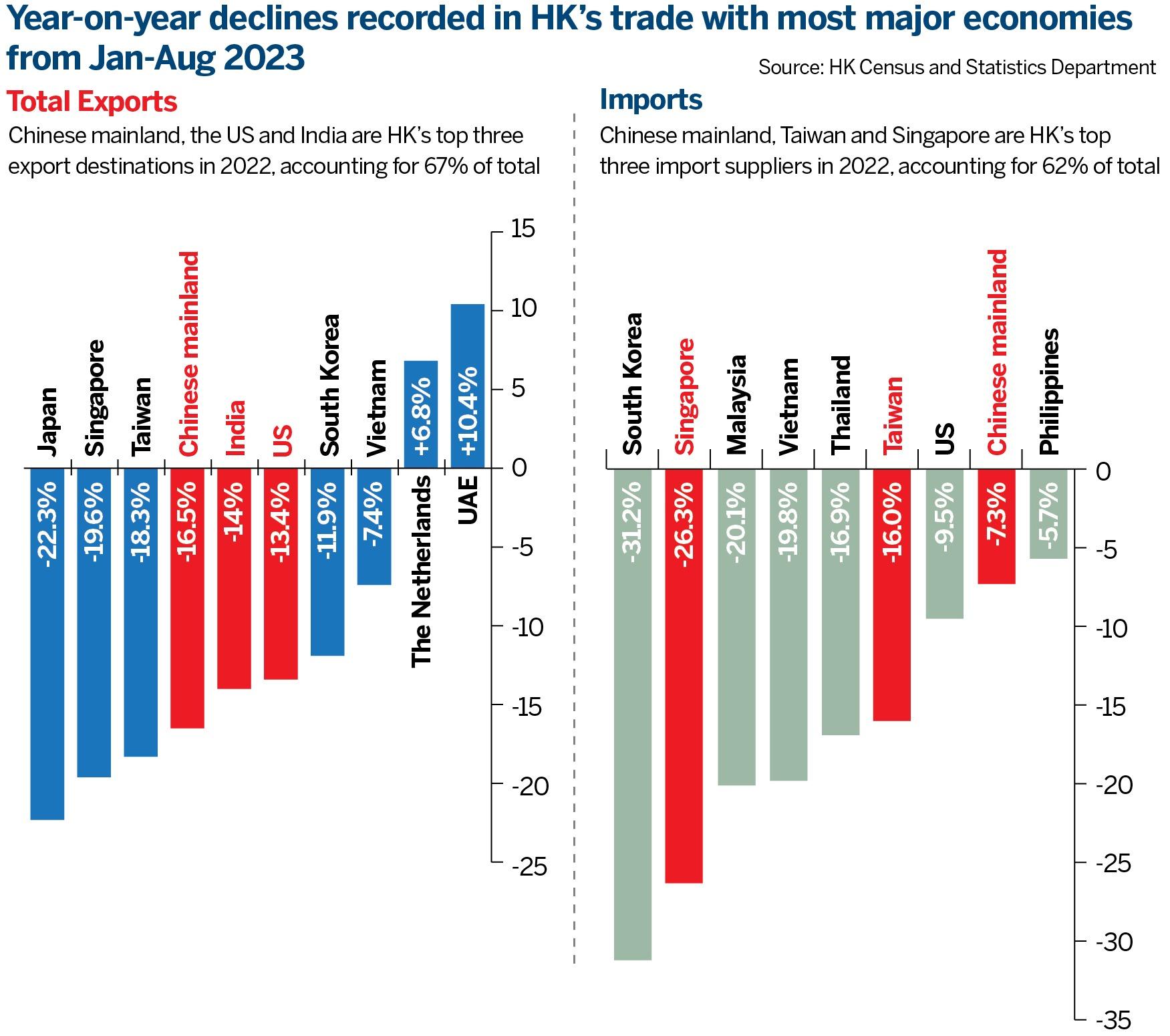

Cheung Wai-man, professor of the Chinese University of Hong Kong’s Business School’s Department of Decisions, Operations and Technology, and director of CUHK’s Asian Institute of Supply Chains and Logistics, agrees. “The successive drop of Hong Kong’s exports reflects both the subdued consumer market in the US and Europe; as well as the global supply chain reconfiguration.”

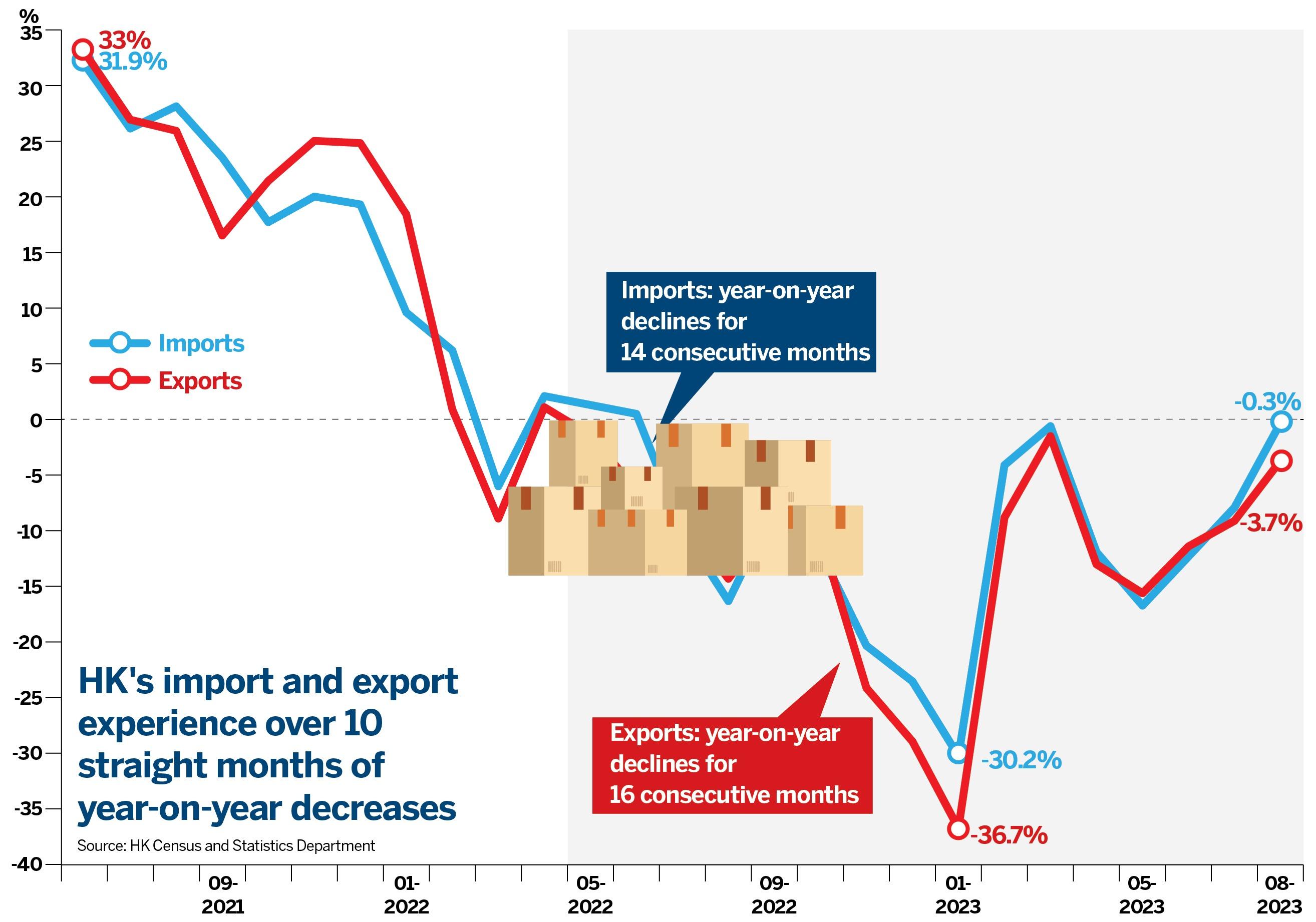

As of August, the value of Hong Kong’s total goods exports has suffered a successive 16-month decline since May 2022. Export goods value plunged 36.7 percent in January, the greatest fall in 70 years. In the first eight months of 2023, the value of total goods exports decreased by 13.2 percent.

The story of imports is similar. The value of total goods imports endured successive 14-month contractions since July 2022, with the value of total goods imports down 11 percent in the first eight months of 2023.

Think tank Oxford Economics expects world goods trade will grow around 2 percent per year during 2019 to 2024, similar to the world gross domestic product expansion. For most of the post-war period goods trade grew faster than world economic growth. Moody’s Analytics expects the deglobalization of international trade will dampen growth of Asia’s export-focused economies.

Reaching new heights

The country’s 14th Five-Year Plan (2021-25) and the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area envisage Hong Kong developing into a full-fledged maritime and aviation center, as a high value-adding trade and logistics hub.

The trade and logistics sector is one of Hong Kong’s four key economic pillars, accounting for one-fifth (around HK$651 billion) ($83.46 billion) of GDP and over 610,000 jobs. The logistics sector alone contributes 6.2 percent (around HK$170 billion) to GDP and around 184,000 jobs, according to government data.

Transport constituency lawmaker Yick says the Transportation and Logistics Bureau currently led by permanent secretary-level administrative officials may not be the answer. Yick urges a statutory organization, like the Airport Authority Hong Kong and Hong Kong Maritime and Port Board in the aviation and maritime industries respectively, to formulate and execute strategies for the trade and logistics industry.

“If there is no statutory body, the administration can set up a logistics department under the Transport and Logistics Bureau to oversee all matters related to the logistics industry, like the Transport Department oversees matters for the transportation industry,” the lawmaker argues.

Having adequate logistics land is important for industry development, says Cheung. “The land area should not be too scattered for economies of scale. Storage facilities for long-period leases will encourage logistics operators to commit investments in smart logistics solutions.”

Digital platforms

Digital transformation across entire industries needs component stakeholders to be data driven. That is not the case, apart from the multinationals. Small- and medium-sized local players need to invest in data management expertise and systems. The government, industry, and academia can establish standardized software to transform them with external expertise and subsidies.

Yick emphasizes: “Hong Kong is lagging behind regional competitors, because the government has not proactively initiated the smart port project until 2022; and port operators are unwilling to share sensitive business data essential to build a platform integrating data from owners, intermediaries, ship companies and the airport.”

The government will set up a data-sharing platform for phased trials from 2023 to promote data management in the maritime and port industries, for wider use by 2025. HKTDC’s Chan notes that SME third-party logistics service providers in the city lack data availability for business decisions and forecasting. They need funding for digital investments and data management expertise.

Universal data compatibility

If smart logistics technology in Hong Kong can be synchronized with the Chinese mainland and Association of Southeast Asian Nations (ASEAN) members, then logistics value can be enhanced. “When smart logistics solutions can be universally applicable, Hong Kong SMEs will be more willing to invest as there will be critical mass to lower their cost to adopt logistics technology,” Chan says.

In October 2020, the government launched a HK$300 million pilot subsidy scheme for third-party logistics service providers to adopt smart logistics solutions. As of end-March, 200 projects involving HK$118 million have been approved to benefit over 170 enterprises. Since January 2023, the government has increased the subsidy ratio for each application to lower the cash flow requirements, for more participation.

“Nowadays, logistics companies in Hong Kong buy technology services not in a hardware product format but in a service subscription format. The government should be more flexible to offer financial subsidies for SME logistics operators,” suggests Cheung.

Along with hard transportation networks, soft infrastructure connectivity is also important. Cheung says Hong Kong SAR and the central government should figure out how to incentivize alignment for Hong Kong, Macao and Guangdong province to implement a digital cross-border platform that combines the trace-and-track of the logistics process and trade finance settlement.

“Such a platform will provide the high value-added services of visibility of the supply-chain process through the track-and-trace technology, and connect the trade finance platforms. This will bolster Hong Kong’s trade and logistics hub position because the city excels as a data center hub and trade finance settlement center,” notes Cheung.

Finding new markets

CUHK’s Cheung sees a larger perspective: “As Hong Kong logistics players should find business opportunities from cross-border e-commerce and new markets of Southeast Asia, Middle East and Africa, Hong Kong should train talent well-versed in these markets.”

The CUHK professor says, “The university will do more to attract students from Southeast Asian countries to enroll in school programs that can build deep knowledge of trade development in Asia, the United States and Europe.”

HKTDC’s economist Chan emphasizes it is important for Hong Kong to participate in multilateral trade blocs such as the Regional Comprehensive Economic Partnership, which covers one-third of the world’s population (2.2 billion people) and accounts for nearly 28 percent of global trade. Hong Kong has cemented Closer Economic Partnership Arrangement with the Chinese mainland, and signed free trade agreements with ASEAN countries, Australia, and New Zealand.

“It is not a zero-sum game. As the world economy rebalances, Hong Kong may tilt more to Asian and Middle East markets. The city’s trade flows will reflect this trend,” says Chan. The HKTDC economist points out that innovation and technology components and services will be the main sources of value-adding for Hong Kong goods exports in the future. “The I&T development in the Guangdong-Hong Kong-Macao Greater Bay Area will be critical for the city’s export sector.”

Given the city’s role as a global trade facilitator moving up the value-chain of products and services, serving the Chinese mainland, ASEAN, Middle East and Western markets, the technology talent pool should go beyond limited skill sets of information technology and programming. It needs to design systems that seamlessly process international trade, allowing for the regulations that apply across different borders. It needs to factor in the peculiarities of different markets and understand them.

Reaching out to provinces

As the developed cities in the Chinese mainland upgrade their logistics efficiencies, Hong Kong has to reach out to the central provinces that need such facilitation. How can the extended distances and less sophisticated provinces be catered to efficiently by Hong Kong as their hub?

Lawmaker Yick raises a strategic challenge: “The issue is how to enlarge the catchment area for Hong Kong’s logistics service operators, to channel more manufactured goods from the inland provinces to Hong Kong for overseas shipment.”

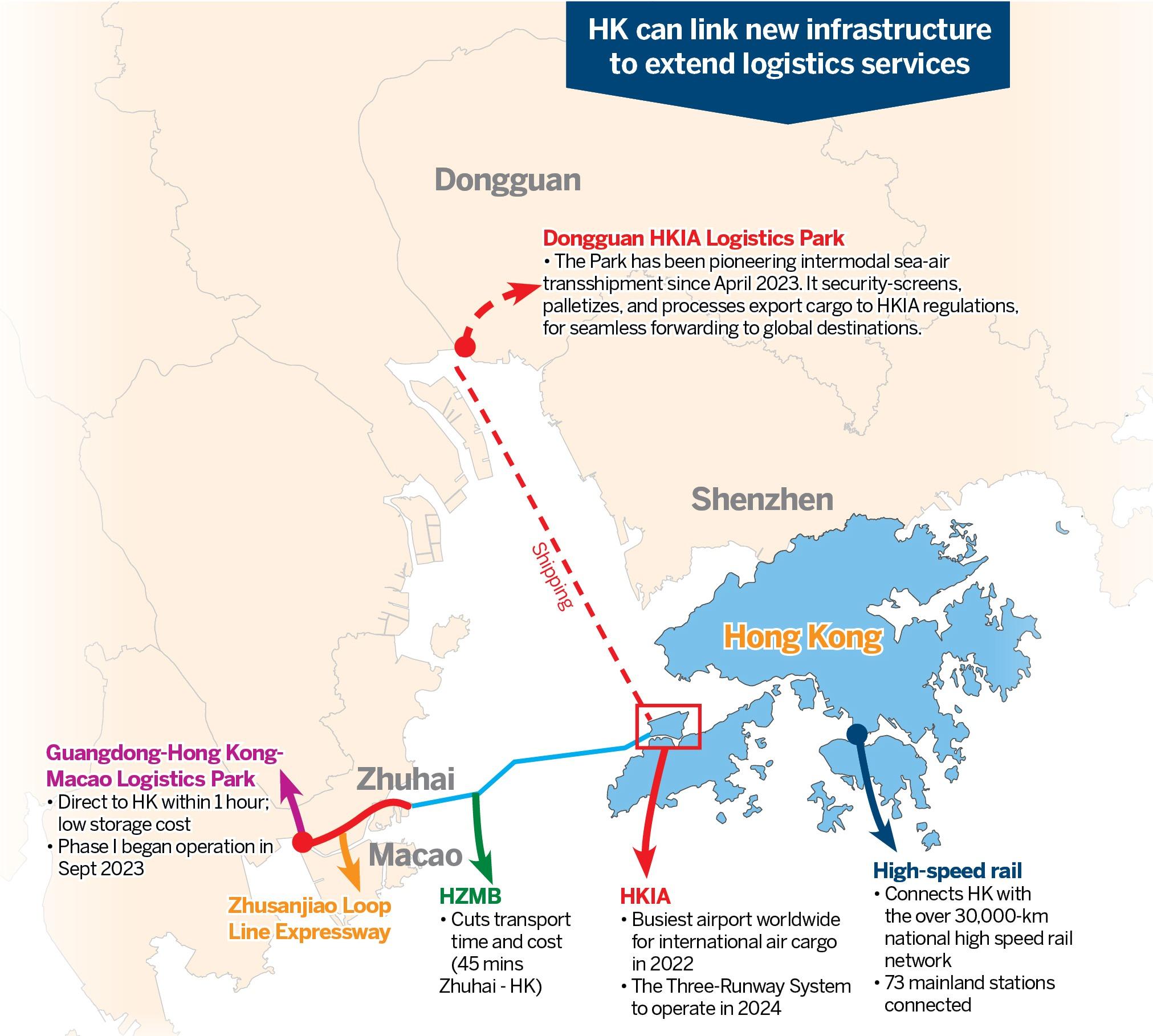

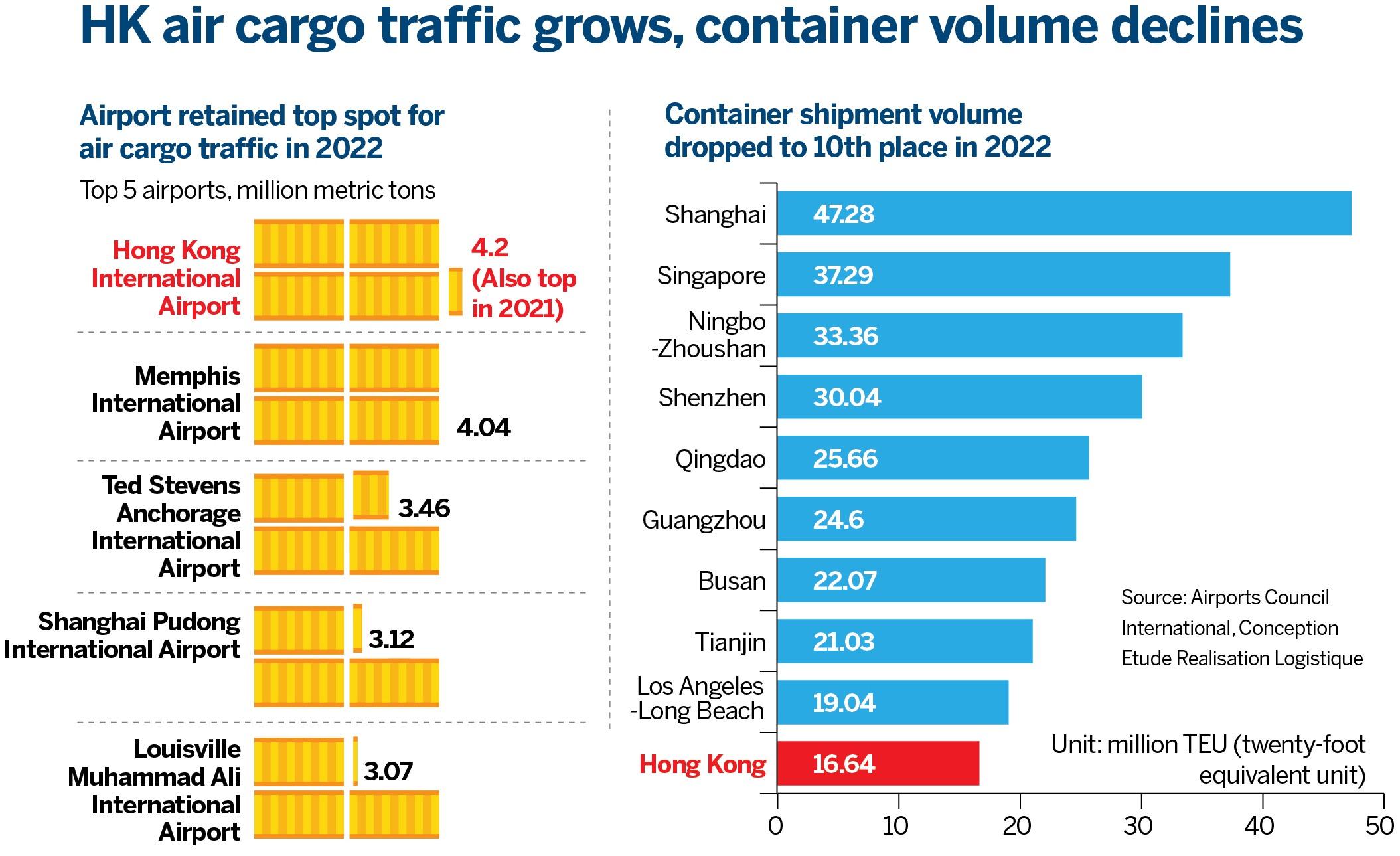

For hard infrastructure, Hong Kong awaits completion of large-scale cross-boundary projects, such as the Guangzhou-Shenzhen-Hong Kong Express Rail Link and the Hong Kong-Zhuhai-Macao Bridge to complement the Hong Kong International Airport, which was the world’s busiest airport for international air cargo in 2022, for an intermodal logistics network of sea, land and air routes. The Three-Runway System, to operate in 2024, will strengthen the air cargo freight capability.

Hong Kong’s air cargo volume reached 4.2 million metric tons last year, accounting for just 2 percent of the total freight volume handled, but contributing 48 percent of the city’s total trade value, according to government data.

The Central Asia Hub project undertaken by the Airport Authority Hong Kong and global express cargo carrier DHL, as well as the high-end logistics center built and managed by a joint venture company led by Cainiao Network, will increase the airport’s annual air cargo volume.

The Dongguan-Hong Kong International Airport Logistics Park in Dongguan is also an example of intermodal transport. The park enables security checks, as well as packing, palletizing and receiving procedures for mainland exports, to be completed in Dongguan, before the freight is conveyed to HKIA by sea, and immediately shipped to all parts of the world, without repeating the screening procedure. International cargo may also be imported into the mainland through the reverse process. This would reduce operating costs by about half and loading and unloading time by one-third.

Yick hopes that some logistics operations facilities can be built in Zhuhai Aviation Industrial Park, a proposal which is being mulled by Airport Authority Hong Kong and Zhuhai authorities. If there are such logistics facilities, manufactured goods from the west Guangdong region can be transported to Zhuhai for final assembly before they are shipped overseas via the Hong Kong-Zhuhai-Macao Bridge. Overseas imports can follow the same logistics process in the reverse direction.

What's next

1. Consider a statutory body to formulate and execute strategies

2. Provide adequate, contiguous land for logistics development

3. Incentivize digital transformation in the trade and logistics industry

4. Train industry talent with market knowledge and technology

5. Learn ASEAN and Middle East market characteristics

6. Leverage cross-border physical and digital connectivity

Contact the writer at oswald@chinadailyhk.com