A pedestrian crosses a street in Tokyo on February 14, 2021. (CHARLY TRIBALLEAU / AFP)

A pedestrian crosses a street in Tokyo on February 14, 2021. (CHARLY TRIBALLEAU / AFP)

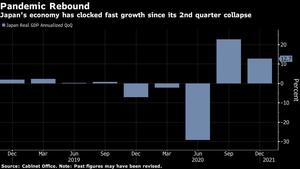

Japan’s economy clocked another quarter of double-digit growth and finished the pandemic year in better shape than initially expected, signaling potential for a more sure-footed recovery once a damaging state of emergency ends.

Gross domestic product grew an annualized 12.7 percent from the prior quarter in the three months through December, the Cabinet Office reported Monday. The result was better than 22 of 24 forecasts from surveyed economists and defied a winter surge of the coronavirus.

The fourth-quarter expansion helped the economy survive the pandemic year with a 4.8 percent contraction, better than forecast by economists and a smaller hit than the 5.7 percent drop in 2009 following the global financial crisis

The fourth-quarter expansion helped the economy survive the pandemic year with a 4.8 percent contraction, better than forecast by economists and a smaller hit than the 5.7 percent drop in 2009 following the global financial crisis.

Surging trade and gains in household spending continued to lift growth. The fourth quarter also saw businesses ramping up investment again, with outlays by firms increasing at the fastest pace in more than five years.

ALSO READ: Japan's new stimulus package 'to include funds for tourism drive'

More spending by firms, after six months of pullback, suggests corporate Japan now sees better prospects ahead once the country ends a state of emergency that is forecast to drive the economy back into a bruising contraction this quarter.

“It looks like business spending is finally being drawn out as a result of the exports recovery,” said economist Hiroaki Muto at Sumitomo Life Insurance Co. “The first quarter will decline again, but we’re on a recovery trend.”

Monday’s report showed that on a quarterly basis Japan’s economy ended 2020 having regained most of the lost output since last March when the coronavirus rocked markets and froze global commerce, a faster recovery than expected.

The Nikkei 225 Stock Average was up 1.1 percent, briefly climbing above 30,000 for the first time since 1990, following the growth report and as Prime Minister Yoshihide Suga confirmed Japan’s vaccine drive will start Wednesday.

Economy minister Yasutoshi Nishimura said the results show the economy’s capacity to recover, though the country still isn’t out of the woods. Consumer spending remains below average, he said, and exports could soften if the virus triggers more restrictions in Europe or other important markets.

ALSO READ: Suga vows stimulus focusing on green, digital innovation

The immediate outlook now depends on how long Japan’s state of emergency lasts. Falling case numbers offer hope that restrictions might be lifted in some areas before March 7, the planned end-date, but with hospital capacity still stretched that decision has yet to come.

Suga earlier Monday said Japan will start giving shots to medical personnel this week using the vaccine from Pfizer Inc., the first batch of which arrived in Japan late last week.

“The GDP shows the economy can recover if the virus doesn’t disrupt things,” said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities Inc. “The pandemic didn’t break supply chains or production capacities like an earthquake and many households are ready to spend given the low unemployment rate.”

Government spending, Bank of Japan loan support and a corporate and employee culture that has traditionally put job security ahead of high wages have helped keep unemployment at just 2.9 percent, a fraction of the rates in the US and parts of Europe.

READ MORE: Suga pledges carbon neutral Japan by 2050 in policy speech

Still, the trade off has been wage cuts that could limit the size of any consumer spending revival after the emergency ends and pent up demand exhausts itself, even if households have a floor beneath them.

“What would be best is if wages improve and consumption rises, but we’re not there yet,” said Muto at Sumitomo Life.