A pedestrian using a smartphone is silhouetted as buildings stand in the background in the Central district of Hong Kong, Nov 3, 2019. (CHAN LONG HEI / BLOOMBERG)

A pedestrian using a smartphone is silhouetted as buildings stand in the background in the Central district of Hong Kong, Nov 3, 2019. (CHAN LONG HEI / BLOOMBERG)

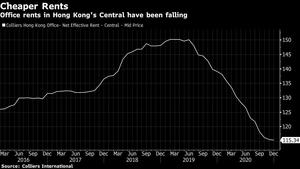

International banks in the Hong Kong Special Administrative Region are relinquishing space to bring down costs, threatening to suppress rents that are already dropping in the world’s most expensive office market.

Lenders including BNP Paribas SA and Standard Chartered Plc recently decided to give up floors in their headquarters in the city. UBS Group AG made a similar move late last year to let go of a floor in Sheung Wan’s Li Po Chun Chambers, according to people familiar with the matter, who asked not to be identified discussing private information.

Multinational companies constituted 75 percent of the total surrender of 628,000 square feet (58,343 square meters) of office stock in the HKSAR in 2020, according to Cushman & Wakefield

ALSO READ: Outlook for HK's prime office market is grim due to coronavirus

Multinational companies constituted 75 percent of the total surrender of 628,000 square feet (58,343 square meters) of office stock in the HKSAR in 2020, according to Cushman & Wakefield.

That has pushed vacancies in the city’s traditionally sought-after offices to the highest in years. The vacancy rate for the Central district’s premium office buildings reached the highest since 2004 in December, Jones Lang LaSalle Inc said.

ALSO READ: HK crisis deals US$7.7 billion blow to property tycoons

Foreign companies are likely to keep trimming space in 2021, according to Rosanna Tang at Colliers International.

“I will not be surprised to see this wave” continue, particularly among large multinationals with bulk-area leases that are struggling to curtail costs, said Tang, who is head of research for the HKSAR and the Greater Bay Area.

Office rents will fall by 7 percent in 2021 while cost optimization will remain the main concern for tenants, according to Tang. Rental value in the city plunged 17 percent last year, the most since 2009, data from Savills show.

UBS’s move was first reported by Sing Tao Daily. A spokesperson for the Swiss bank declined to comment.

READ MORE: HK's office market lifeless as buyers absent, tenants cautious

Chinese mainland companies have steadily increased their presence in the past few years to occupy 22 percent of overseas offices set up in the HKSAR, topping firms from Japan and the US, according to government data.

Last year, Bloomberg reported that Nomura Holdings Inc and Macquarie Group Ltd gave up space in Central.