The Chinese national flag and the flag of the Hong Kong Special Administrative Region fly in front of the Lippo Center, Far East Finance Center (center) and Admiralty Center, in Admiralty, Hong Kong, June 12, 2020. (ROY LIU / BLOOMBERG)

The Chinese national flag and the flag of the Hong Kong Special Administrative Region fly in front of the Lippo Center, Far East Finance Center (center) and Admiralty Center, in Admiralty, Hong Kong, June 12, 2020. (ROY LIU / BLOOMBERG)

Hong Kong’s distinctive Lippo Centre - twin glass-fronted octagonal towers whose facade some say resembles koala bears climbing a tree - has long been a gauge for the health of the world’s most expensive office market.

Right now, it’s barely showing a pulse.

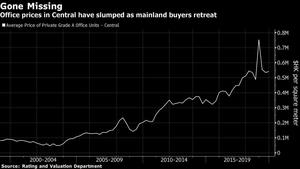

Office valuations in the city may slump as much as 20 percent this year, according to Jones Lang LaSalle Inc

In a market where buying and selling individual floors, or even just suites in a building, can lead to quick profits, just three deals have been done in the Lippo Centre this year, with the average price dropping 17 percent from a year earlier. The number of deals is down from as many as 18 in the first half of 2017 - the most active of recent years.

There’s no shortage of reasons for the downturn. Hong Kong is in its deepest economic funk on record as last year’s investment-chilling anti-government protests were followed by the coronavirus shutdowns.

ALSO READ: Outlook for HK's prime office market is grim due to coronavirus

The dearth of activity augurs poorly for the broader office market, where these strata-title transactions for a portion of a building typically account for about 40 percent of all deals by value. Office valuations in the city may slump as much as 20 percent this year, according to Jones Lang LaSalle Inc.

Prices have already fallen for the few deals in the Lippo Centre, with the average price at HK$27,380 (US$3,533) per square foot, data from Midland Holdings Ltd. show.

With vacancy rates in premium buildings in Hong’s Kong Central hub reaching a 12-year high of 5 percent in May, according to JLL, investors are also wary of buying office space when there’s no guarantee they will find a tenant.

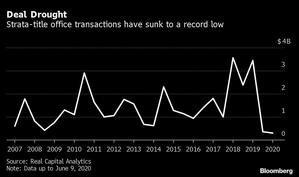

The city is set for the lowest strata-title transactions by both value and volume since the data was first collated in 2007, according to Real Capital Analytics

The Lippo Centre’s strata-title structure, which allows individuals to own part of a property, along with its prime location and long-term tenants, including Taiwan's representative office and Mongolian and Brunei embassies, make it popular with property speculators. They can play the market without having to put together multi-billion dollar deals needed to buy entire buildings.

Yvonne Lui, the former girlfriend of tycoon Joseph Lau, turned a HK$55 million (US$7 million) profit in 2018 by flipping two office units in the Lippo Centre less than two years after buying them, local media reported at the time.

The lack of transactions in the Lippo Centre this year is being replicated across the market. The city is set for the lowest strata-title transactions by both value and volume since the data was first collated in 2007, according to Real Capital Analytics.

A key reason for the downturn is the retreat of mainland investors, who have kept away since anti-government protests broke out more than a year ago, said Benjamin Chow, an analyst at Real Capital Analytics. Mainland buyers had been a major force behind the market’s run-up in 2018, he said.

Hong Kong’s strata office market "has quietened down dramatically,” due in part to the withdrawal of cross-border investors, including those from the mainland, Chow said.

The last strata office investment in Hong Kong by an overseas investor was struck just over a year ago, he added.

READ MORE: Hong Kong's rich get richer flipping floors in property frenzy

While mainland buyers have disappeared from the sales market, some financial firms are active in leasing space. CMB International Capital Corp., and China Minsheng Banking Corp. recently expanded their footprint in Central, according to people familiar with the matter. They joined tech giants ByteDance Ltd. and Alibaba Group Holding Ltd., which took up more space in Causeway Bay.

With few strata deals being done, Centaline’s Siu said he would focus on leasing to get through the downturn.

“There’s barely four deals a month,” he said. “That isn’t enough to feed our team; we just have to cross over to do everything from office leasing to home sales.”