The HSBC Holdings Plc headquarters building, center, stands illuminated at dusk in Hong Kong on April 27, 2020. (ROY LIU / BLOOMBERG)

The HSBC Holdings Plc headquarters building, center, stands illuminated at dusk in Hong Kong on April 27, 2020. (ROY LIU / BLOOMBERG)

Fear of owning HSBC Holdings Plc shares is turning into a fear of missing out on a major rally.

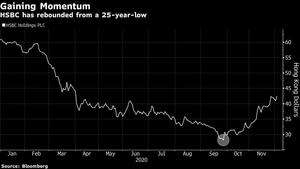

Europe’s biggest lender is up 55 percent in the Hong Kong Special Administrative Region (HKSAR) since touching its 25-year low in September, and is the best-performing stock on the Hang Seng Index this quarter. Just two months ago, investors were fretting over how mounting regulatory and economic pressures would squeeze the firm’s key businesses in Asia.

HSBC is up 55 percent in the HKSAR since touching its 25-year low in September, and is the best-performing stock on the Hang Seng Index this quarter

But a lot has changed since then. British regulators have signaled they would consider softening their stance on a dividend ban imposed on banks in March at the height of the pandemic. Also, HSBC recorded better-than-expected third quarter results on cost savings while investors have piled into financial stocks as part of a sector rotation.

Shares of HSBC rose as much as 3.1 percent on Thursday in the HKSAR to hit a fresh eight-month high. They gained 3 percent in London on Wednesday.

ALSO READ: HSBC shares surge on dividend bets as turnaround gains steam

“HSBC’s fortunes have improved with a US presidency change likely to ease trade and China-US tensions, as well as increasing cost savings expectations and a likely return to dividends in 2021,” said Jonathan Tyce, an analyst at Bloomberg Intelligence.

HSBC’s Hong Kong-listed stock has punched through several major resistance levels and is now trading above its 50-day, 100-day and 200-day moving averages. Its 14-day relative strength index is at 76, a level indicating the stock is in overbought territory.

Still, most analysts have yet to soften their stance on the bank’s outlook. Just this week, Deutsche Bank AG and Credit Suisse Group AG analysts reiterated negative ratings on the firm’s shares in London, according to data compiled by Bloomberg. Only six of the 31 analysts tracked by Bloomberg who follow HSBC recommend buying and 13 give it a sell.

ALSO READ: HSBC lets HK staff work up to 4 days a week from home

On the other hand, Citigroup Inc raised its price target for HSBC by 24 percent late last month saying that it’s better positioned than other HKSAR banks going into 2021 on stronger earnings recovery and an expected dividend restart. Goldman Sachs Group Inc recommended a buy rating.

HSBC has some hurdles ahead, with the ongoing pandemic forcing the firm to step up cost-cutting plans to contain debt. The firm also mulled plans to offload its US consumer franchise.

Beyond the company’s strengthening outlook, the bank has also been a beneficiary of investors piling into bank stocks in a move widely attributed as sector rotation. Standard Chartered has gained about 47 percent so far this quarter, while Industrial & Commercial Bank of China Ltd. is up 25 percent in the HKSAR.

READ MORE: HSBC revives plan to cut 35,000 jobs to boost growth