An employee turns a valve at the Hammar Mushrif new Degassing Station Facilities site inside the Zubair oil and gas field, north of the southern Iraqi province of Basra on May 9, 2018. HAIDAR MOHAMMED ALI/AFP/GETTY IMAGES)

An employee turns a valve at the Hammar Mushrif new Degassing Station Facilities site inside the Zubair oil and gas field, north of the southern Iraqi province of Basra on May 9, 2018. HAIDAR MOHAMMED ALI/AFP/GETTY IMAGES)

Iraq is seeking an upfront payment of about US$2 billion in exchange for a long-term crude-supply contract, the latest sign of Baghdad’s growing desperation for cash as its economy unravels.

The Middle Eastern country is grappling with a crisis brought to a head by low oil prices and OPEC+ output cuts. As state coffers dwindle and school teachers go unpaid, the country risks a repeat of upheaval last year that brought down the government and saw hundreds of protesters killed.

Cash-strapped oil producers have often relied on pre-payments deals to raise money, but Baghdad hasn’t done so until now

In a letter to oil companies seen by Bloomberg News, the Iraqi government sought to mitigate its dire financial position by proposing a five-year supply contract delivering 4 million barrels a month, or about 130,000 barrels a day. The buyer would pay upfront for one year of supply, which at current prices would bring in just above US$2 billion, according to Bloomberg calculations.

READ MORE: Iraq protests take toll on economy, vulnerable suffer most

The letter from SOMO, the Iraqi state-owned agency in charge of petroleum exports, was first reported by the Iraq Oil Report.

“SOMO, on behalf of the Ministry of Oil, has the interest to propose a long-term crude-supply deal in exchange for prepayment for a fraction of the total allocated quantity,” according to the letter, which was marked strictly confidential. It asked potential buyers to respond by Nov 27, which may be too soon for some buyers to get internal approvals.

Loan security

Cash-strapped oil producers have often relied on pre-payments deals to raise money, but Baghdad hasn’t done so until now. The semi-autonomous Kurdistan Regional Government in northern Iraq has used similar contracts in the past, as have Chad and the Republic of Congo.

In a pre-payment deal, the oil buyer effectively becomes a lender to the country. The barrels are a security for the loan, much as borrowers use their homes as collateral for a mortgage.

For Iraq’s federal government, the loan could help Prime Minister Mustafa Al-Kadhimi, who came to power in May and has warned that the government will struggle to pay civil servants without raising more debt.

In a pre-payment deal, the oil buyer effectively becomes a lender to the country. The barrels are a security for the loan, much as borrowers use their homes as collateral for a mortgage

“They need the money,” said Ahmed Mehdi, an expert on the Iraqi petroleum industry at the Oxford Institute for Energy Studies. “On a monthly basis, the government is short around US$3.5 billion to pay for salaries, imports, pensions and debts.”

Iraq’s monthly revenue has shriveled to roughly US$4 billion this year, barely half what it was in 2019.

Crude sweeteners

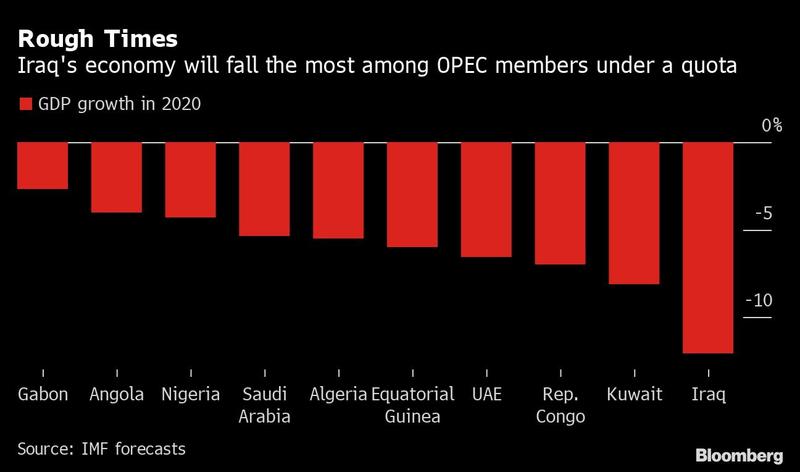

All OPEC+ countries have suffered economic hardship, but Iraq’s position is among the weakest. Although crude prices have recovered from the worst of this year’s slump, they are still down 30 percent this year at around US$46.50 a barrel.

Members of OPEC+ — an alliance of the Organization of Petroleum Exporting Countries and others such as Russia — also have less oil to sell because of deep production cuts the cartel agreed to in April during the height of the coronavirus pandemic. Iraq, along with other nations such as Nigeria, has pumped above its quota on several occasions since then, angering OPEC’s de facto leader, Saudi Arabia.

ALSO READ: US companies unveil Iraq investments before premier's visit

Iraq’s gross domestic product will contract 12 percent this year, more than that of any other OPEC member under a production quota, according to International Monetary Fund forecasts. The country pumped 3.87 million barrels a day last month, according to data compiled by Bloomberg. Average output of 4.18 million barrels daily so far this year is down 12 percent from last year.

In the letter, Baghdad asked the potential buyer to pay, on signature of the contract, for 48 million barrels to be shipped between July 2021 and June 2022. It sweetened the proposal by allowing the crude to be shipped to any facility in the world during that one-year period.

Traditionally, Middle Eastern nations restrict where buyers can deliver their crude, limiting the ability of traders to exploit price disparities between Asia, Europe and the US They also limit re-selling, forcing buyers to refine the barrels themselves, which can also curb potential profits.