A picture taken on Feb 6, 2018 shows a visual representation of the digital cryptocurrency Bitcoin, at the "Bitcoin Change" shop in the Israeli city of Tel Aviv. (JACK GUEZ / AFP)

A picture taken on Feb 6, 2018 shows a visual representation of the digital cryptocurrency Bitcoin, at the "Bitcoin Change" shop in the Israeli city of Tel Aviv. (JACK GUEZ / AFP)

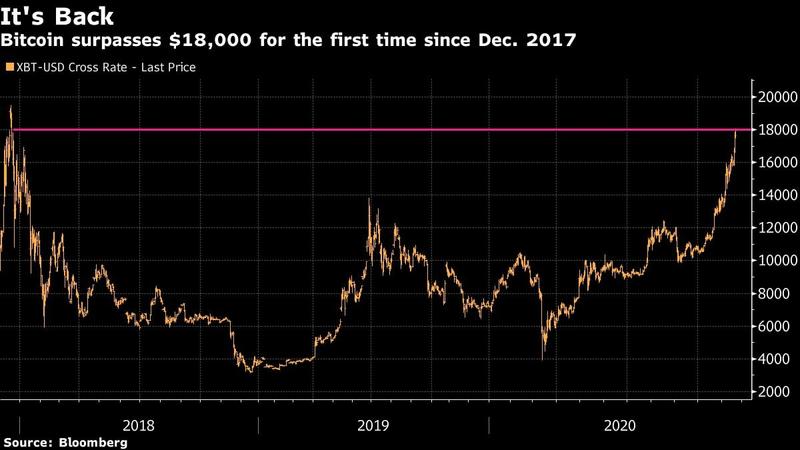

Bitcoin is quickly approaching the record highs that spurred a mania among investors almost three years ago that ended in a violent crash.

The controversial digital asset, which was originally promoted as an alternative to national currencies such as the dollar, surged as much as 4.8 percent to US$18,480 on Wednesday -- before tumbling by US$1,000 within about 20 minutes after 1:30 pm. Hong Kong time. It has more than doubled this year, spurring memories of the 1,375 percent rally in 2017 that preceded a 70 percent decline the following year. Still, advocates and even skeptics are saying it may continue to push higher.

“This Bitcoin thing is crazy,” said Matt Maley, chief market strategist at Miller Tabak + Co. “This is the third parabolic move. God only knows where it’s going to top out.”

Its gains this year follow a wider embrace from Wall Street linchpins, including Fidelity Investments, which launched a Bitcoin fund over the summer. Some prominent money managers also became crypto converts, with macro investor Paul Tudor Jones buying the coin as a hedge against potential inflation. And PayPal Holding Inc. said in October it would allow customers to access cryptocurrencies, which spurred bets more people could start to use digital tokens.

The controversial digital asset, which was originally promoted as an alternative to national currencies such as the dollar, surged as much as 4.8 percent to US$18,480 on Wednesday

ALSO READ: Bitcoin tests 15-month highs after 10% weekend jump

Not all established investors are convinced. Bridgewater Associates LP founder Ray Dalio said Tuesday that he “might be missing” something.

Even some people in crypto are skeptical about the rapid run higher.

“We’re overextended here and due for pullback,” said Vijay Ayyar, head of business development with crypto exchange Luno. “Anywhere from between US$18,000-US$19,000 is potentially a top. We should have many people selling at these levels, especially those that bought at the top in 2017-18. Major rallies in the past always had 30-40 percent corrections. No reason to believe this time is different.”

But crypto fans have been watching Bitcoin tick higher all year, with many setting their sights on December 2017’s record of almost US$20,000, while others are targeting even higher levels.

“Bitcoin has consistently been one of the world’s top-performing assets since its creation,” said Mati Greenspan, founder of Quantum Economics. “This latest surge comes as larger players enter the market sapping up what little supply remains for sale.”

While some die-hard crypto fans have stuck with it through its ups and downs, others have become newly enchanted by it amid the pandemic. Bitcoin this week got a star-power boost when Maisie Williams, the actress who portrayed Arya Stark in HBO’s Game of Thrones, asked her 2.7 million Twitter followers whether she should invest in the coin. The inquiry prompted answers from noted crypto investor Mike Novogratz as well as Tesla Inc.’s Elon Musk.

Advocates argue the cryptocurrency can act as a safe haven during times of turbulence and can be a hedge against rampant central-bank money printing. Still others have been lured by its spectacular advance this year -- the digital coin is up close to 150 percent in 2020 though it is still more than 5 percent off its all-time high.

READ MORE: Twitter hack snags Obama, Biden, Gates accounts in bitcoin scam

But the institutional embrace has been slow to come about amid elevated crypto volatility and some high-profile instances of hacking and theft. The Justice Department said this month it is suing for the forfeiture of more than US$1 billion in Bitcoins it says are linked to the criminal marketplace Silk Road it shut down seven years ago. And earlier in the summer, the Twitter accounts of some of the most prominent US political and business leaders were hacked in an apparent effort to promote a Bitcoin scam.

Bitcoin has seen an average daily move of 2.6 percent this year, according to data compiled by Bloomberg. That compares with swings of 0.9 percent for the price of gold, which is sometimes contrasted with digital assets.

Hugo Rogers, chief investment officer at Deltec Bank & Trust, bought Bitcoin when it traded around US$9,300 in June and used any price weakness since then to add it to his portfolio. Bitcoin now makes up about 5 percent of his Global Absolute Return Fund, which is big on high-growth tech and biotech companies. He’s probably not going to stop at the 5 percent threshold, he said.

“A small position in Bitcoin can go a long way,” Rogers said by phone earlier this month. “There’s a lack of an alternative in real assets that can show a comparable return. If you’re going to diversify your portfolio anyway, this is a good place to go.”