Hong Kong's richest man Li Ka-shing smiles during a press conference in Hong Kong on March 16, 2018, during which he announced his retirement from CK Hutchison. (Anthony WALLACE / AFP)

Hong Kong's richest man Li Ka-shing smiles during a press conference in Hong Kong on March 16, 2018, during which he announced his retirement from CK Hutchison. (Anthony WALLACE / AFP)

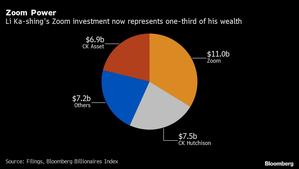

Li Ka-shing’s Hong Kong business empire may be struggling, but he’s managed to remain the city’s richest man. That’s largely thanks to an early bet on Zoom Video Communications Inc and Solina Chau, his long-time confidante who co-founded the billionaire’s venture-investment arm.

On Monday, the US-listed company reported a 355 percent jump in sales for the three months ended July 31, the second-best result among Nasdaq 100 Index members last quarter. That boosted the stock a further 41 percent Tuesday, with Li’s stake gaining US$3.2 billion in just one day

The tycoon, who’s best known for building some of the most iconic skyscrapers to dot Hong Kong’s skyline, first invested in the video-conferencing app in 2013. The 92-year-old now holds 8.5 percent of the San Jose, California-based company, a stake that’s worth US$11 billion, or one-third of his wealth.

ALSO READ: US$4b in just hours: Zoom CEO's wealth jumps on results

Zoom has been on a tear this year as the coronavirus shuttered offices and schools, forcing people to hold virtual meetings and classes. On Monday, the US-listed company reported a 355 percent jump in sales for the three months ended July 31, the second-best result among Nasdaq 100 Index members last quarter. That boosted the stock a further 41 percent Tuesday, with Li’s stake gaining US$3.2 billion in just one day. He’s now worth US$32.6 billion, according to the Bloomberg Billionaires Index.

While Zoom has surged this year, Li’s conglomerates, CK Hutchison Holdings Ltd and CK Asset Holdings Ltd, have struggled amid the COVID-19 crisis and the anti-government protests that have hit Hong Kong. The shares have lost more than a quarter of their value in 2020, and the tycoon who for decades profited by expanding in times of crisis is now scaling back, seeking cost cuts.

ALSO READ: Li Ka-shing's CK Group to cap costs as profit outlook dims

After reporting first-half profit dropped 29 percent, CK Hutchison warned last month that net income may fall at its core ports and retail businesses in the second half of the year. Meanwhile, CK Asset said earnings sank 58 percent in the six months through June.

The Zoom investment is partly thanks to Chau, who in 2002 co-founded Horizons Ventures Ltd, which manages Li’s venture investments.

The vehicle was an early backer of Facebook Inc, Spotify Technology SA and Siri, and has also invested in plant-based meat producer Impossible Foods Inc.

It participated in Zoom funding rounds in 2013 and 2015, and when the company went public last year, Li’s stake was worth about US$850 million. Horizons Ventures declined to comment.

Li’s returns from investments through Horizons Ventures are allocated to his charity, the Li Ka Shing Foundation, which Li has referred to as his third son. He put one-third of his wealth in it in 2006, or more than US$9 billion, according to a 2015 statement from his business group. Chau, 59, is the foundation’s executive director.

READ MORE: CK Hutchison brushes off pandemic threat citing diversification