A woman walks past a KFC restaurant in Shanghai, China, on March 19, 2019. (PHOTO/BLOOMBERG)

Yum China Holdings Inc is seeking to raise as much as HK$19.6 billion (US$2.5 billion) from a second listing in Hong Kong, adding to the list of mega stock offerings in the Asian financial hub.

The company, China’s largest restaurant operator, plans to sell 41.91 million shares in the offering, it said in a US regulatory filing Friday. The portion of the deal being marketed to Hong Kong retail investors will be priced at a maximum of HKUS$468 per share, according to the filing.

The portion of the deal being marketed to Hong Kong retail investors will be priced at a maximum of HKUS$468 per share, according to the filing.

The top-end price represents a 9.4 percent premium to Yum China’s closing level Thursday in New York. Yum China, which operates KFC and Pizza Hut in the world’s most populous country, received approval from the stock exchange of the Hong Kong Special Administrative Region for the proposed listing, people with knowledge of the matter said earlier.

READ MORE: Yum China sees opportunities in corp catering after call for safe dining

Yum China shares were up 2.3 percent to US$56.48 at 12:38 pm Friday in New York.

The company plans to use about 45 percent of the proceeds to expand its restaurant network, according to the filing. Another 45 percent will be earmarked for spending on its technology systems, supply chain and food innovation as well as investments in “high-quality assets” and brands that can bring growth opportunities, it said. The remainder will go toward working capital and general corporate purposes.

Yum China plans to set the final price around Sept 4, the filing shows. Goldman Sachs Group Inc. is sole sponsor of the listing, while Citigroup Inc, CMB International Capital Ltd and UBS Group AG are joint global coordinators.

ABC International Holdings Ltd, AMTD International Inc, BOC International Holdings Ltd., China International Capital Corp, CLSA Ltd, HSBC Holdings Plc and ICBC International Holdings Ltd also have a role on the deal as joint bookrunners.

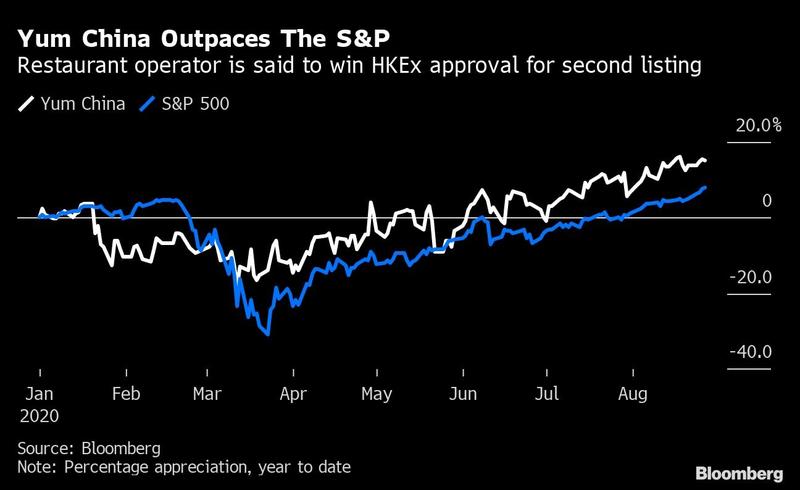

Yum China outpaces the S&P

Yum China would join a growing slate of companies aiming for a trading foothold in the HKSAR as relations between the US and China come under significant strain. US regulators are threatening to restrict Chinese firms’ access to American capital markets if they do not allow authorities to review their audits.

ALSO READ: HK's global IPO crown will be difficult to sustain in 2020

The HKSAR is riding a wave of investor enthusiasm, which encompasses second listings as well as debuts such as the planned initial public offering by mainland bottled water giant Nongfu Spring Co. The company plans to price its IPO in the city at the top of its marketed range, people familiar with the matter said.

Yum China operates 10,000 restaurants in over 1,400 cities across the Chinese mainland, according to its website. The company reported a sputtering recovery from the effects of the coronavirus pandemic, with sales improving in April and May but weakening again in June, according to its latest earnings. It said comparable sales in the second quarter fell 11 percent from the previous year, and it expects them to remain under pressure in the third quarter.

China’s economy is recovering from the COVID 19-induced slump faster than many other countries. Consumer spending on items such as cars outpaced that of catering, which was down 11 percent in July.