HONG KONG - Hong Kong jumped at the open Monday after US President Donald Trump on Friday stopped short of specifying tough sanctions over a new national security law for Hong Kong.

Hong Kong stocks gained 771.05 points, or 3.36 percent, to close Monday’s session at 23,732.52 points.

The benchmark Hang Seng Index opened 578.44 points higher and rose as much as 3.7 percent in the morning on volume that was almost three times the 30-day average for this time of day. By mid-morning, the Hang Seng was trading 3.38 percent higher, having earlier gained as much as 3.7 percent. The Hang Seng's China enterprises index rose 3 percent, and the HSI property sector sub-index added 4.31 percent. Real estate firms, which had borne the brunt of selling in recent days, led the rally. Sun Hung Kai Properties Ltd. surged the most since September, while Swire Pacific Ltd. jumped 6 percent.

“Trump’s comments gave no immediate measures on Hong Kong and leave room for negotiations with Beijing,” said Castor Pang, head of research at Core Pacific- Yamaichi International. “Trump’s comments have eased investors’ concern about the impact of potential sanctions on the Hong Kong economy.”

The Hong Kong Special Administrative Region government hit back at Trump's decision to revoke the city's preferential trade status, saying US sanctions are unlikely to undermine Hong Kong's advantages under the "one country, two systems" principle. A spokesman made it clear that Hong Kong's trade status is guaranteed by multiple international agreements, instead of being a "gift" from another jurisdiction.

ALSO READ: SAR govt unconcerned over US sanctions

The Hang Seng Index rose as much as 3.7% Monday morning on volume that was almost three times the 30-day average for this time of day

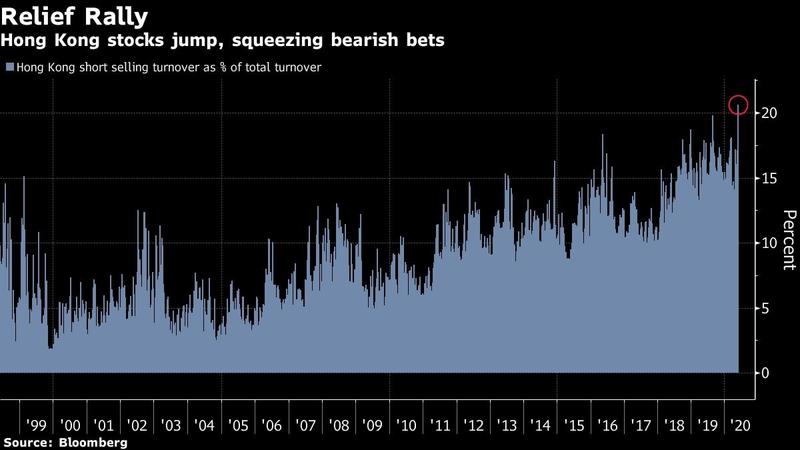

Traders had increased their hedges at the end of last week due to concern over Trump’s speech. Short selling volume on Hong Kong’s main board climbed to 21 prcent of total turnover Friday, the highest proportion in data going back more than two decades.

The Hang Seng Index is trading below its price-to-book value, near a record low. It fell almost 7 percent in May, clocking up the biggest drop relative to the MSCI All-Country World Index since the Asian financial crisis in 1998.

Waves of mainland capital have flooded into equities listed in Hong Kong, especially megacap mainland banks, countering losses. The stakes are high: a panicked business community could trigger cascading outflows that crash its markets and cause runs on its banks.

The US$4.9 trillion stock market, the world’s fourth largest, is now the most volatile since 2012, according to a measure of historical 100-day swings on the Hang Seng Index.

READ MORE: Mainland traders are buying HK stocks like never before