Hong Kong one-hundred dollar banknotes are arranged for a photograph in Hong Kong, April 23, 2020. (PAUL YEUNG / BLOOMBERG)

Hong Kong one-hundred dollar banknotes are arranged for a photograph in Hong Kong, April 23, 2020. (PAUL YEUNG / BLOOMBERG)

Fears that capital will flee Hong Kong are visible just about everywhere in the city’s financial markets, yet the currency remains resistant for now.

Speculators are betting on significant depreciation with derivatives, sending a measure of bearishness to near its highest level of the year. Volume on Hong Kong dollar options soared to US$3.7 billion on Friday, with a third of the trades betting the pegged currency would hit or break the weak end of its trading band.

Volume on Hong Kong dollar options soared to US$3.7 billion on Friday, with a third of the trades betting the pegged currency would hit or break the weak end of its trading band

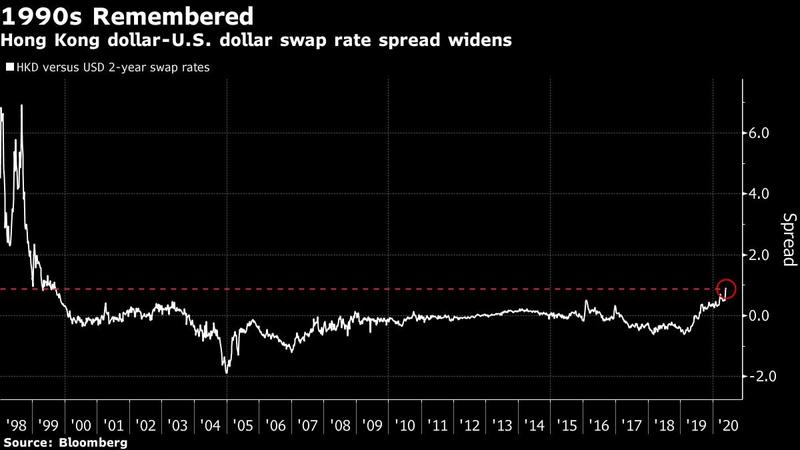

Conviction that turbulence will get worse is also evident in the swaps market, where the spread between local and US rates reached levels last seen in the 1990s. One-year forward points closed at the highest since 1999, suggesting a spike in demand to hedge against depreciation in the currency, which remains close to the strong end of its trading band against the greenback.

ALSO READ: As HK economy sinks, scant liquidity underpins dollar

The sudden bearishness is crashing against the city’s elevated borrowing costs, which have kept the long Hong Kong dollar carry trade profitable since November. Liquidity in the financial system remains relatively tight for now, keeping the city’s interbank rates wide versus those in the US. Plans from some of the Chinese mainland's biggest companies to sell shares in Hong Kong in June should make that more pronounced by increasing the demand for cash.

The key question is how the Hong Kong dollar’s yield advantage over the greenback can act as a support for the currency.

“Some capital inflows chasing new listings in the city could offset some fund outflows this quarter,” said Ken Cheung, chief Asian currency strategist at Mizuho Bank Ltd.

The Hong Kong dollar had traded near the strong side of its narrow band since April largely thanks to a popular trade where hedge funds sold the greenback for the city’s higher-yielding dollars

The Hong Kong dollar’s recent strength was upended last week. The currency had traded near the strong side of its narrow band since April largely thanks to a popular trade where hedge funds sold the greenback for the city’s higher-yielding dollars.

READ MORE: Hong Kong intervention reaches US$2.7 billion to defend peg

As long as that strategy remains profitable and popular, weakness in the currency will be limited. Share sales from NetEase Inc and JD.com Inc in June will mop up liquidity as traders set aside funds to buy stock, driving up borrowing costs in Hong Kong. The premium between one-month Hibor and the US equivalent is near the widest since 1999, meaning traders will still lose money if they sell the city’s currency against the greenback.

June will also be a month when local banks hoard cash to meet quarter-end regulatory checks, driving up demand for Hong Kong dollars. Listed mainland companies will buy the city’s currency to pay dividends in the summer, also pushing up interest rates. The Hong Kong dollar traded 20 pips from the strong end on Tuesday, down from 78 pips last week.