Chinese one-hundred yuan banknotes. (PAUL YEUNG/BLOOMBERG)

Chinese one-hundred yuan banknotes. (PAUL YEUNG/BLOOMBERG)

The economy is crashing like never before, yet Hong Kong’s interest rates are expected to stay relatively elevated. That’s bad news for pretty much everyone apart from those betting on prolonged strength in the city’s currency.

The city’s economy shrank 8.9 percent in the first quarter from a year earlier, a government report showed Monday..It marks the third straight quarterly contraction for the city, which experienced widespread disruptions as anti-government protests broke out in the second half of 2019

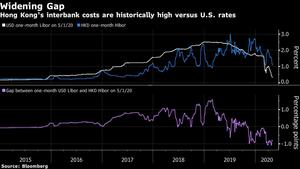

Liquidity tightness in Hong Kong, partly caused by Hong Kong Monetary Authority (HKMA) moves to drain cash from the interbank market several years ago, contrasts with US moves to slash borrowing costs. The resulting gap in interest rates - near the widest since 1999 for the one-month tenor - makes selling the greenback to buy the Hong Kong dollar a profitable trade due to the city’s currency peg.

While the HKMA is now adding funds when it intervenes to defend the peg at the strong end, the amounts are insufficient to do much to shift the gap. The spread widened last month even as the HKMA injected US$2.7 billion.

ALSO READ:HK deep in recession as GDP dives 8.9%

“For the interest-rate gap to narrow significantly enough, Hong Kong needs to see strong capital inflows from overseas funds,” said Carie Li, an economist at OCBC Wing Hang Bank Ltd. in Hong Kong. “But investor confidence won’t return until the pandemic is over, and that won’t happen in the near term.”

The city’s economy shrank 8.9 percent in the first quarter from a year earlier, a government report showed Monday. That’s the worst drop in data going back to 1974, according to the Census and Statistics Department Hong Kong. It marks the third straight quarterly contraction for the city, which experienced widespread disruptions as anti-government protests broke out in the second half of 2019.

ALSO READ:HK set for deeper economic slump as companies shed jobs

Elevated funding costs, which underpin things like mortgages and corporate lending, may make companies and households less willing to borrow, according to Eddie Cheung, an emerging-market strategist at Credit Agricole SA. The HKMA last lowered its benchmark rate in March by 64 basis points, less than the 1 percentage-point cut deployed by the US Federal Reserve.

The distortions are a side effect of maintaining the currency peg. While the city has benefited from the stability the peg provides, the trade off is a loss of control over monetary policy. In the years after the global financial crisis, while Hong Kong’s economy was booming, ultra-low borrowing costs helped fuel a property bubble. Now, it faces the reverse, despite falling US rates.

The one-month borrowing cost in the first quarter of 2011 - when the economy grew at a blistering 7.6 percent - never rose above 0.2 percent. It currently stands at 1.1 percent, versus about 0.3 percent for the US equivalent.

READ MORE:Tourism in HK suffers sharp drop for holiday

Hong Kong dollar bears like Crescat Capital’s Kevin Smith say the currency peg is unsustainable due to the city’s diminishing role as an international banking haven. He’s holding on to his short-Hong Kong dollar positions despite the recent strength, betting it will depreciate all the way to the weak end of the band.

Questions have been raised about the durability of the peg since it was created in 1983 to stabilize confidence and outflows during uncertainty over the then-British colony’s future. The UK and Chinese governments agreed on the city’s return to mainland control the following year.

George Soros tried and failed to bet against the peg in 1998, while Bill Ackman’s wager on a dramatic strengthening in 2011 also proved fruitless.