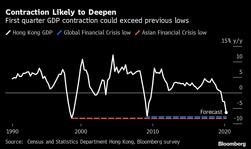

Hong Kong is on course for a recession potentially worse than the Asian financial crisis of the 1990s, with the trade-dependent city expected to reveal Monday that the slump deepened markedly in the first quarter.

Economists forecast a drop in output of 6.5 percent in the three months to March from the same period a year earlier. On Sunday, Financial Secretary Paul Chan Mo-po warned of the worst full-year performance on record with a contraction of as much as 7 percent.

ALSO READ: Financial chief: Unity crucial to HK's economic revival

Financial Secretary Paul Chan Mo-po had signaled that the reading for the first quarter this year could be even worse than the -8.3% plunge in the third quarter of 1998 and the 7.8% contraction in the first quarter of 2009

Even as the city prepares to ease some social distancing measures amid a steady improvement in the local outbreak situation, the hit to global commerce and the threat of renewed anti-government unrest stemming from the extradition bill incident means activity is likely to remain depressed. Unemployment is rising with tourism, retail, transport and other industries decimated.

“Faced with a collapse in global demand, Hong Kong’s small, open economy is taking a severe hit,” said Qian Wan, economist with Bloomberg Intelligence, in an April 28 note ahead of the results.

The city’s economy fell a record -8.3 percent in the third quarter of 1998 and contracted 7.8 percent in the first quarter of 2009, the two worst quarterly readings for the measure in year-over-year data going back to 1974, according to the Census and Statistics Department Hong Kong.

Chan, the city’s top economic policy official, signaled that the reading for the first quarter this year could be even worse. The city’s economy already contracted in the second half of last year amid anti-government protests.

The extended downturn’s impact can be especially seen across the city’s struggling small and medium-sized businesses, which have borne the brunt of the impact from protests since last year and now the coronavirus.

“Hong Kong has been a risk-taking society relative to starting a business, but the situation going on the last year will create long memories in people’s minds,” said Todd Handcock, chairman of the Canadian Chamber of Commerce. “It’s been a very challenging year for SMEs in Hong Kong. The unfortunate reality is some of these will not survive and others will struggle for a very long time.”

As of December, 340,000 SMEs accounted for more than 98 percent of all business units and employed some 1.3 million people or about 45 percent of the total excluding civil service, according to government data.

READ MORE: HKMA: SMEs can defer loan payments May-Oct

Sentiment among small businesses is sitting near a record low while those reporting need for credit have jumped to an almost four-year high of 8.8 percent, March government data show.

“If we all fold, the unemployment levels are going to skyrocket in this city,” said Bella Dobie, co-founder and managing director of Hong Kong branding and marketing firm Orijen. The firm has six full-time staff including Dobie and has been in business since 2000.

The government has taken steps to address the looming employment crisis through multiple rounds of stimulus spending, most prominently through an HK$80 billion wage subsidy program that is not expected to begin distribution until June.

Those businesses that do survive will likely emerge with smaller, leaner operations, with lasting implications on the wider economy as jobs that once existed may not return. Total employment in the city shrank by a record 3.6 percent in March.

As of December, the number of job vacancies in the private sector of Hong Kong totaled about 54,000, down 30 percent from a year ago, according to government data. Vacancies in retail and accommodation and food services plummeted 44 percent and 65 percent respectively.

The looming threat of returning protests once the virus fades and measures forbidding group gatherings ease could also further extend the pain for businesses and the economy.

“The COVID-19 impact could be longer lasting than expected globally and the local civil unrest could intensify again, both of which will impose major downside risks to Hong Kong’s economic growth,” said Tommy Wu, senior economist with Oxford Economics in Hong Kong.

READ MORE: Cheung: Lawlessness, violence hinder HK economic recovery