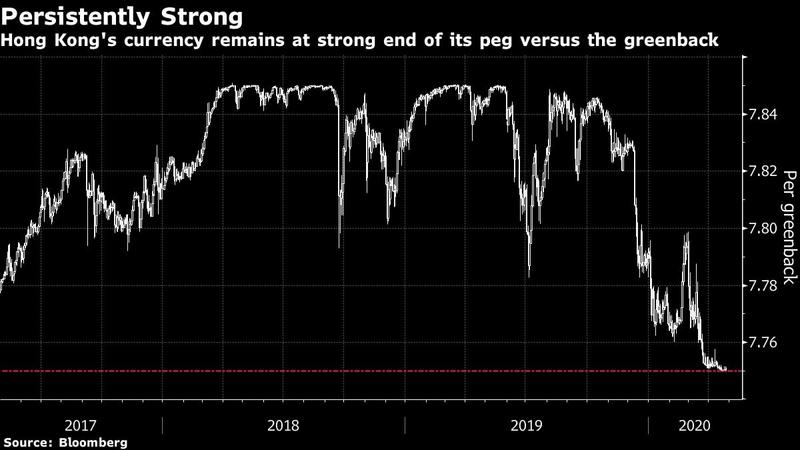

The Hong Kong Monetary Authority (HKMA) intervened again to defend the local dollar’s peg, after the currency returned to the strong end of its trading band.

The HKMA sold HK$13 billion (US$1.68 billion) of the city’s currency in exchange for US dollars as of Tuesday local time, according to its page on Bloomberg

The HKMA sold HK$13 billion (US$1.68 billion) of the city’s currency in exchange for US dollars as of Tuesday local time, according to its page on Bloomberg. It sold HK$7.71 billion of local dollars in multiple actions last week, its first such intervention since October 2015.

The Hong Kong dollar traded at 7.7510 per greenback as of 9:22 am in the city, according to data compiled by Bloomberg. It has strengthened 0.5 percent this year, the second-best performer after the yen among 31 major currencies.

ALSO READ: Hong Kong sells US$300m more of local dollars to defend peg

Funds have flowed into the Hong Kong dollar to take advantage of higher interest rates relative to the greenback. The selling of Hong Kong dollars by the HKMA will add to liquidity in the city, which is suffering from the effects of the coronavirus pandemic. One-month interbank borrowing costs in the local currency, known as Hibor, were at 1.46 percent on Monday, compared with 0.44 percent for Libor.

"Moderate intervention is expected for coming sessions and over the coming months, until the interest rate gap narrows further to reduce carry-trade activities,” said Carie Li, an economist at OCBC Wing Hing Bank. Carry trades, which look to take advantage of the rate spread, and broader weakness in the US dollar gave the Hong Kong currency a lift Monday, she added.

Li expects the city’s gauge of interbank cash supply to top HK$100 billion in May, versus the current HK$66.8 billion.

READ MORE: How HK's intervention battle will chill the carry trade