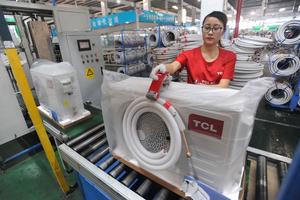

An employee works on a TCL air conditioner production line in Wuhan, capital of Hubei province, in 2018. (PHOTO PROVIDED TO CHINA DAILY)

An employee works on a TCL air conditioner production line in Wuhan, capital of Hubei province, in 2018. (PHOTO PROVIDED TO CHINA DAILY)

China Star Optoelectronics Technology Co Ltd will further increase its investment in Wuhan, capital of Hubei province and the hardest-hit Chinese city during the novel coronavirus epidemic. The leading television panel supplier and subsidiary of home appliances giant TCL said its sales revenue rose by 25 percent on a yearly basis during the first three months of this year.

"The revenue growth mainly came from our Shenzhen and Huizhou plants, and the sales from the Wuhan plant, which has returned to normal production and remained at the same level as that of last year," said Li Dongsheng, TCL founder and chairman. Li said he is confident that the company's business will maintain double-digit growth this year.

Chinese companies have gained an upper hand in large-screen LCD displays. South Korea's Samsung and LG have announced they will exit from the LCD sector, which means Chinese panel makers will take a dominant position

Li Dongsheng, TCL founder and chairman

ALSO READ: Internet TV sector buoyant as online demand surges

Currently, CSOT has two panel production lines in Wuhan. As China's first Gen 6 LTPS (low temperature polysilicon) LCD line, the T3 project produces both small and medium-sized panels targeting smart end devices, with a 20 percent global market share.

With a total investment of 39 billion yuan (US$5.5 billion), the T4 project-the Gen 6 flexible AMOLED display panel production line achieved mass production on Jan 1, with 48,000 modules set to be manufactured each month.

Compared to traditional LCD or liquid crystal display panels, AMOLED or active matrix/organic light-emitting diode is more flexible with faster responses, high contrast and wide visual angles, and can be used for highend smartphones and wearables.

According to Li, the company plans to build a new air conditioner plant in Wuhan, in a bid to boost the production capacity from 3 million units to 5 million units every year. It is also exploring the medium-sized panel market, such as computer displays and vehicle-mounted displays to expand sales revenue.

"Chinese companies have gained an upper hand in large-screen LCD displays. South Korea's Samsung and LG have announced they will exit from the LCD sector, which means Chinese panel makers will take a dominant position," said Li, adding that the South Korean firms will focus on OLED and QLED(quantum dot light-emitting diode) displays.

Li said the epidemic will accelerate the reshuffle in the display industry, as supply has surpassed demand in the past few years and competition has become fierce. "The outbreak has caused a periodic drop in demand in the global display market and sped up the restructuring of the entire industry. Chinese enterprises are in a favorable position and I believe that they will further enhance their competitiveness."

READ MORE: Testing times for domestic LCD makers

The global AMOLED display market is dominated by South Korean companies. According to market research firm Omdia, worldwide smartphone shipments are expected to plunge by 13 percent this year as COVID-19 has affected both consumer demand and supply-chain availability. However, the market for AMOLED smartphone displays is expected to rise by 9 percent this year.

"The demand for AMOLED panels will witness rapid growth. Domestic smartphone makers, such as Huawei and Xiaomi, are using AMOLED panels in their flagship high-end products," said Li Yaqin, vice-president of Sigmaintell Consulting Co Ltd, a panel industry consultancy.

Li said that apart from smartphones and tablets, AMOLED has broad application in wearables, virtual reality or augmented reality devices, and other emerging display areas.