Hong Kong one-hundred dollar banknotes are arranged for a photograph in Hong Kong, April 15, 2019. (PAUL YEUNG / BLOOMBERG)

Hong Kong one-hundred dollar banknotes are arranged for a photograph in Hong Kong, April 15, 2019. (PAUL YEUNG / BLOOMBERG)

In a world convulsed by market volatility, there’s one surety (for now): Hong Kong’s currency will continue outperforming the greenback.

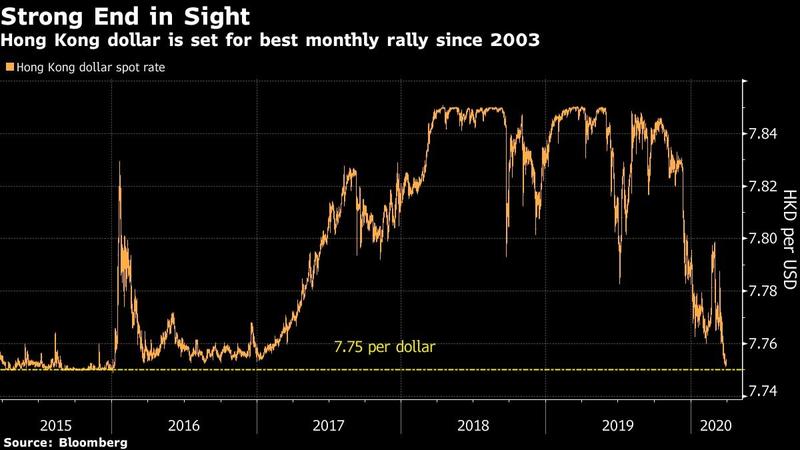

Elevated local rates relative to the US have made the city’s currency the best carry trade in Asia, and propelled it to a 0.51 percent gain this month - set for its best in more than 16 years. The strength will likely be sustained as local borrowing costs are expected to stay higher than US rates in the near term, while Hong Kong’s interbank liquidity pool remains small. The Hong Kong dollar traded at 7.7535 versus the greenback as of 4:50 pm local time.

Even as Hong Kong cut its base interest rate twice in March, liquidity remains so tight in the city that the local dollar is edging closer to the strong end of its trading band at 7.75. Demand for the currency has been increased by local banks hoarding cash before quarter-end regulatory checks, and more than 20 days of net local stock purchases by Chinese mainland investors. In addition, a global shortage of US dollars could boost the Hong Kong dollar as a proxy.

ALSO READ: HK dollar yields near highest since 1999 versus greenback

The Hong Kong dollar’s performance is a standout at a time when most currencies in the world witness a sell-off as the outbreak of the coronavirus damages confidence on global economic growth

“The Hong Kong dollar may hit 7.75 in the short term,” said Carie Li, an economist at OCBC Wing Hang Bank Ltd. “Hong Kong rates won’t follow the US borrowing costs to decline quickly even after the quarter-end because the local liquidity pool is small, and that will help maintain a wide yield differential.”

The rally follows an expansion of the gap between the Hong Kong dollar’s borrowing costs and the corresponding US rates to the widest since 1999, a move that makes being long the city’s currency a lucrative strategy. The aggregate balance in the city - an indicator of interbank cash supply - has shrunk 70 percent over the past two years to HK$54 billion.

READ MORE: Hong Kong dollar is as strong as it can get thanks to Fed cuts

The Hong Kong dollar’s performance is a standout at a time when most currencies in the world witness a sell-off as the outbreak of the coronavirus damages confidence on global economic growth. It’s the best-performing exchange rate in emerging markets over the past month.

Its strength is a far cry from most of the past two years, when it repeatedly touched the weak end of its trading band as investors sold the currency due to its ultra-low interest rates. In response, the Hong Kong Monetary Authority had to sell US dollars to prevent the currency from falling beyond 7.85 - the weak end of its trading band.