An employee counts Hong Kong one-thousand dollar banknotes at the Hang Seng Bank Ltd headquarters in Hong Kong, China, on April 16, 2019. (PHOTO / BLOOMBERG)

An employee counts Hong Kong one-thousand dollar banknotes at the Hang Seng Bank Ltd headquarters in Hong Kong, China, on April 16, 2019. (PHOTO / BLOOMBERG)

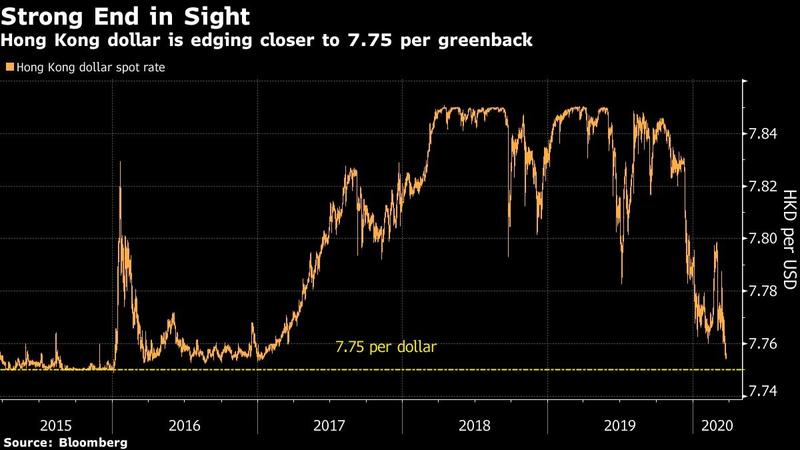

The Federal Reserve’s decision to slash interest rates to zero is having one unintended consequence in Hong Kong, where the currency is near its strongest since 2017.

Borrowing in dollars to buy the Hong Kong dollar has been Asia’s most profitable carry trade in the past month. That’s because the gap between its one-month interbank borrowing costs, known as Hibor, and the corresponding US Libor rate is near the widest since 1999. That makes higher-yielding Hong Kong dollar assets more attractive, pushing the pegged currency toward the strong end of its trading band with the greenback.

The general expectation is that Hong Kong interest rates cannot catch up with those in the US in the near term

Eddie Cheung, Emerging markets strategist at Credit Agricole CIB in Hong Kong

ALSO READ: Dollar sheds status as king after Fed ushers in return of risk

The Hong Kong Monetary Authority last week reduced its base rate by 64 basis points to 0.86 percent, hours after the Fed cut its rate by 100 basis points. Also pushing up Hong Kong rates is tighter liquidity, with banks hoarding cash for quarter-end regulatory checks. Twenty-two days of flows into Hong Kong’s stock market from the mainland have also increased demand to own the local currency.

A breach of the strong end may prompt the city’s de-facto central bank to buy the US currency to keep the local dollar within its permitted range, an operation that hasn’t been seen since the fall of 2015. Such a move would also replenish the interbank liquidity pool, which has shrunk by 70 percent over the past two years.

“The general expectation is that Hong Kong interest rates cannot catch up with those in the US in the near term,” said Eddie Cheung, an emerging markets strategist at Credit Agricole CIB in Hong Kong. “So the gap stays wide, and favorable for a strong Hong Kong dollar.” He said the currency could probably touch the strong end in the second quarter.

The Hong Kong dollar was little changed at 7.7550 per greenback on Tuesday. Its one-month Hibor climbed 3 basis points to 1.87643 percent, widening its premium over Libor to about 90 basis points. The local currency is allowed to trade in a narrow band of 7.75 to 7.85 against the dollar.

The currency of the former British colony has been the best performing Asian exchange rate over the past month. The Sharpe ratio -- a measure of returns adjusted for price swings -- shows that the Hong Kong dollar versus the greenback has been the top carry trade in the region over the period.

This marks a sharp reversal from a month ago when the long Hong Kong dollar strategy lost its luster. It’s also a far cry from the most of the past two years, when the Hong Kong dollar repeatedly touched the weak end of its trading band, prompting the HKMA to buy the local currency to defend the peg.

READ MORE: Stock crashes in US, Europe signal end of boom

READ MORE: Stock crashes in US, Europe signal end of boom

Traders are betting the interest-rate differential between Hong Kong and the US will widen, as Hibor may stay elevated due to the city’s small pool of interbank liquidity while Libor could stabilize thanks to the Fed’s measures to keep borrowing costs low, according to Carie Li, an economist at OCBC Wing Hang Bank Ltd.

The aggregate balance -- an indicator of interbank cash supply in Hong Kong -- is at HK$54 billion, close to the smallest since late 2008. That amplifies rises in the local interest rates and thus the Hong Kong dollar.

“The market is speculating on a wider yield differential,” Li said. “If US dollar funding stress eases and the currency falls along with Libor, we do expect to see some further strength in the Hong Kong dollar. And the possibility of touching 7.75 cannot be ruled out.”