A collection of U.S. one dollar bills sit in this arranged photograph in London, UK, on Jan 29, 2016. (CHRIS RATCLIFFE / BLOOMBERG)

A collection of U.S. one dollar bills sit in this arranged photograph in London, UK, on Jan 29, 2016. (CHRIS RATCLIFFE / BLOOMBERG)

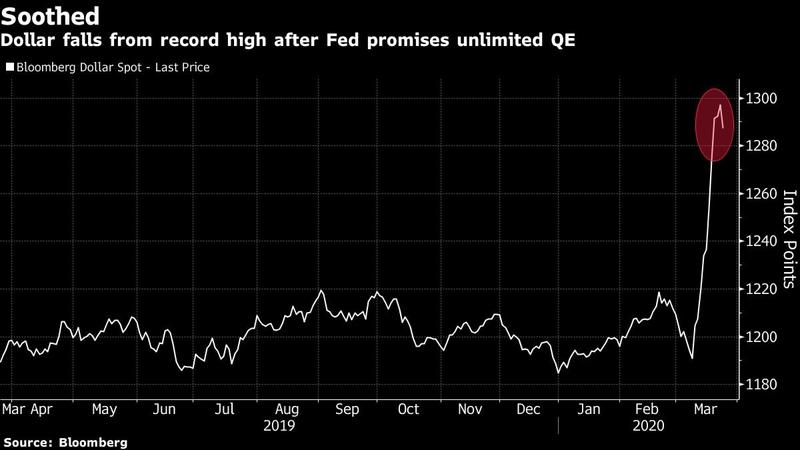

The dollar has suffered a swift reversal of fortunes as the latest Federal Reserve stimulus prompts traders to dump the greenback.

A gauge of the dollar fell from an all-time peak as the Fed’s unlimited quantitative easing prompted traders to return to risk assets. Emerging currencies including the South African rand and the Mexican peso jumped while bonds in Australia rallied as investors bet that the Fed’s move could ease a liquidity crunch and lower the odds of a global recession.

A gauge of the dollar fell from an all-time peak as the Fed’s unlimited quantitative easing prompted traders to return to risk assets

“Markets are going to start feeling the full tsunami of liquidity the Fed is providing now,” said Nathan Sheets, head of macroeconomic research at PGIM Fixed Income and former FOMC economist. “The liquidity they’ve provided from their first line of defense -- swap lines -- to other domestic measures are all about the Fed making it clear to markets that they will play the role as an international lender of last resort in a time of crisis.”

READ MORE: Stock crashes in US, Europe signal end of boom

The Fed is leading a charge among central banks from Japan to Australia in enacting emergency measures to prevent liquidity from drying up across virus-stricken markets. The bid for shelter reached fever pitch last week as investors sold everything from Treasuries to gold in a rush for the dollar in anticipation of a prolonged pandemic.

In the latest move on Monday, the Fed said it would intervene in the corporate bond market and expand its Money Market Mutual Fund Liquidity Facility. It had earlier extended its dollar-liquidity swaps to central banks including those in Australia and Brazil.

ALSO READ: Policymakers rush in to shore up panic-hit global financial system

While the measures helped to put a floor under jittery markets on Tuesday, it was by no means clear that the worst was over.

“The Fed’s action is effective in giving relief to markets, but if the damage of economic stalling lasts longer, current measures may not be sufficient,” said Tohru Sasaki, head of Japan markets research at JPMorgan Chase & Co. in Tokyo. “How effective they are will ultimately depend on how long the spread of coronavirus infection continues.”