In a banner year for share sales in Asia, one bank has pulled far ahead of the rest: Morgan Stanley.

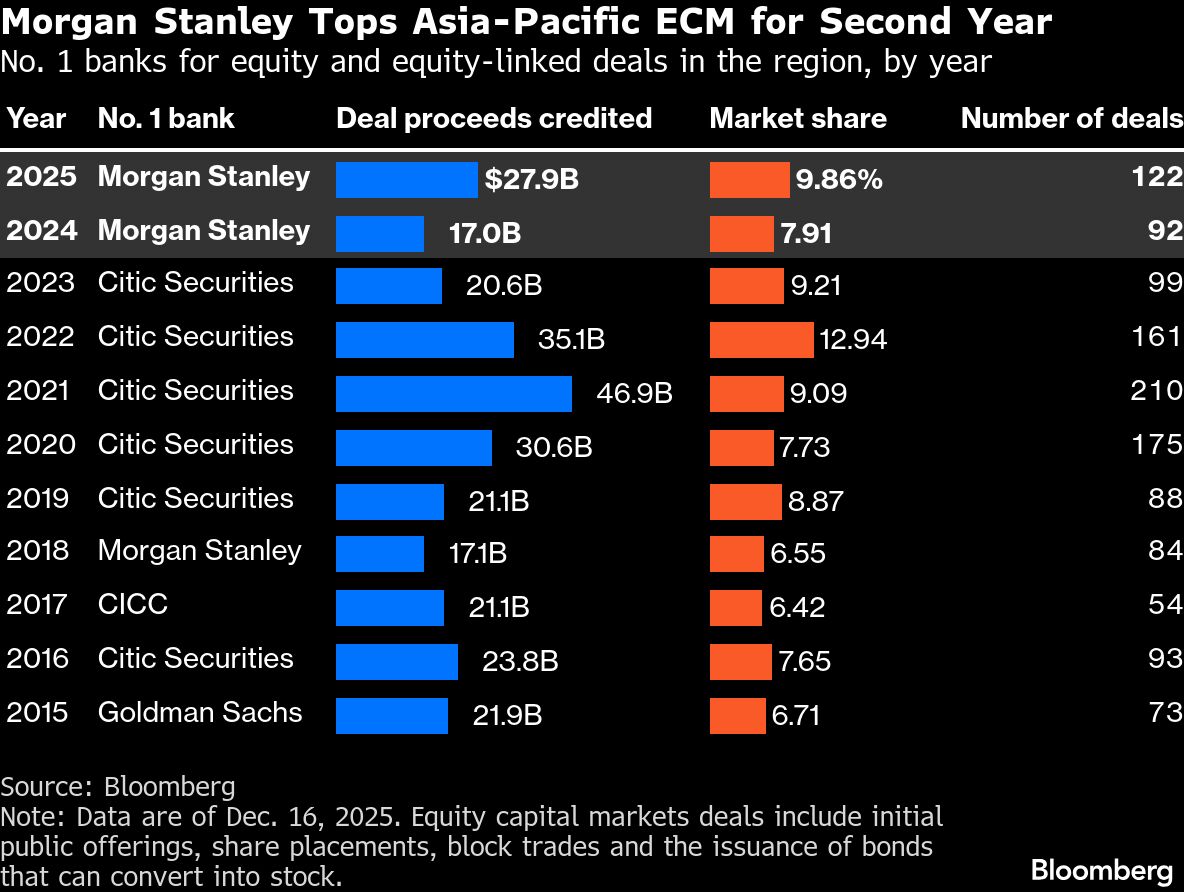

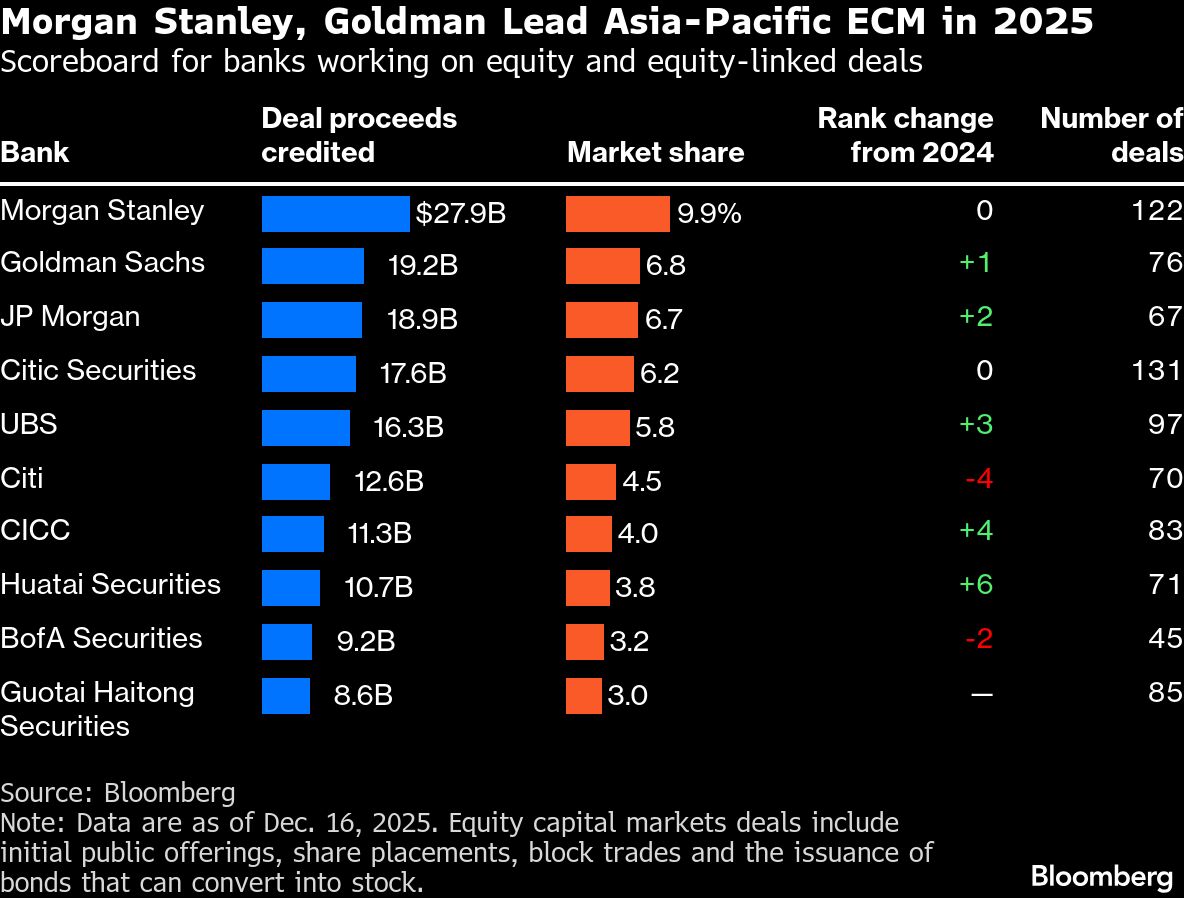

The Wall Street bank is well on track to be the top arranger of equity capital markets deals in the Asia-Pacific region for the second year running, with a market share of almost 10 percent and a big lead over rival Goldman Sachs Group Inc.

Morgan Stanley has been credited with $27.9 billion in initial public offerings, primary placements, block trades and bonds that can convert into stock, almost $9 billion more than Goldman Sachs in second, Bloomberg league tables show. Its 9.86 percent market share is the second-highest for a top-placed bank in the past decade.

ALSO READ: Capital diversification, mainland growth drive HK market rebound

Morgan Stanley worked on several multibillion-dollar Asian deals this year, as share sales returned in force in the Hong Kong Special Administrative Region and India notched a record year for IPOs. Four of the year’s five biggest venues for share sales are in Asia — the HKSAR, the Chinese mainland, India and Japan.

“I definitely see Hong Kong volume growth continuing next year,” said Saurabh Dinakar, head of APAC global capital markets at Morgan Stanley. “India will see a similar trend and issuance volumes will increase compared to this year because there are obviously a number of very large IPOs.”

Share sales in Hong Kong have raised over $74 billion in 2025, a four-year high. APAC companies also raised about $73 billion from sales of convertible and exchangeable bonds, on track for the highest proceeds since 2021.

ALSO READ: HashKey is said to price Hong Kong IPO near high end of range

Morgan Stanley’s strong showing comes despite missing out on Asia’s two biggest deals earlier in the year and ending the first half with Goldman in the lead. Share placements by electric-vehicle maker BYD Co and EV-to-smartphones giant Xiaomi Corp both raised over $5 billion. Morgan Stanley wasn’t on either.

Still, it got back in front in early July after working as the sole bank on a $3.4 billion block trade in insurer AIA Group Ltd. Morgan Stanley was also the only arranger on Ping An Insurance (Group) Co of China Ltd’s HK$11.8 billion ($1.5 billion) convertible bond offering in June, giving it a hefty league table bump.

“We had a few gaps coming into this year and we tried very hard to close some of those gaps through hiring people or through enhancing our coverage footprint,” Dinakar said.

A rebound in health-care share sales in Hong Kong also benefited Morgan Stanley, which claimed a 37 percent market share in the sector and worked on many offerings on a sole basis, particularly those involving WuXi XDC Cayman Inc.

Despite strong competition from local banks and geopolitical tensions casting a shadow on some deals, international lenders were still able to come out on top and increase their market share.

JPMorgan Chase & Co rounds out the top three with a 6.7 percent share, climbing two places from a year ago, the tables show. Citic Securities Co comes in fourth, followed by UBS Group AG, which gained three places this year

READ MORE: Hong Kong's IPO market seen to sustain momentum

There are still areas in the SAR at least where Chinese banks are clearly pulling ahead, despite fees being compressed. The top four IPO arrangers in the city are all Chinese banks. Morgan Stanley squeezes into fifth place. A decade ago, Goldman, Morgan Stanley and UBS all made it into the top five.

With lively deal activity rolling into next year, Dinakar expects all banks to have their fair share of deals to work on.

“The pie is expanding; there’s enough for everyone to do,” he said.