In this Dec 13, 2018 photo, Singapore Airlines Ltd aircraft stand on the tarmac at Changi Airport in Singapore. (NICKY LOH / BLOOMBERG)

In this Dec 13, 2018 photo, Singapore Airlines Ltd aircraft stand on the tarmac at Changi Airport in Singapore. (NICKY LOH / BLOOMBERG)

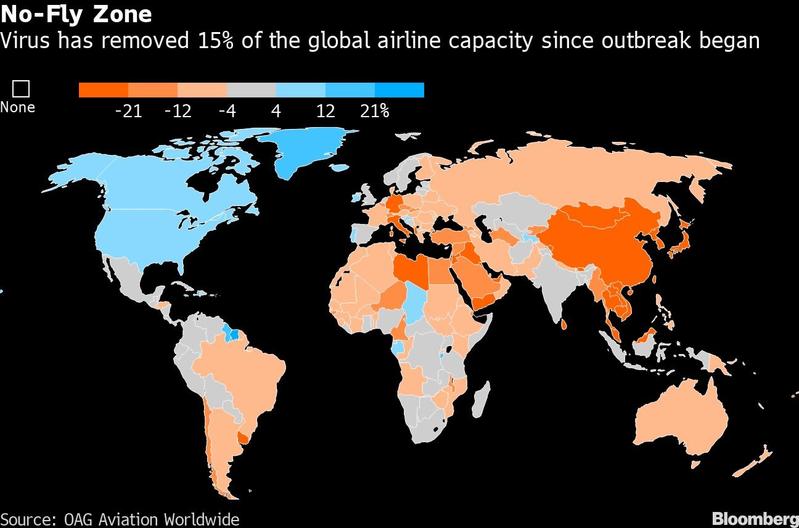

The crisis engulfing the aviation industry deepened after some of the world’s biggest international carriers announced drastic measures to cope with the coronavirus outbreak, with giants Emirates and Singapore Airlines Ltd among the latest to slash flights.

This (travel curbs) will result in the grounding of around 138 SIA and SilkAir aircraft, out of a total fleet of 147, amid the greatest challenge that the SIA Group has faced in its existence.

Singapore Airlines Ltd

Dubai-based Emirates, the world’s largest long-haul airline, is suspending passenger flights to most destinations from Wednesday because travel restrictions imposed by governments have put many nations off limits to visitors. Singapore Airlines said Monday it’s cutting 96 percent of its capacity through April, mirroring an announcement by Hong Kong’s Cathay Pacific Airways Ltd on Friday.

"This will result in the grounding of around 138 SIA and SilkAir aircraft, out of a total fleet of 147, amid the greatest challenge the SIA Group has faced,” Singapore Airlines said in a statement.

ALSO READ: Governments offer financial lifelines to airlines, at a price

The company has drawn on its credit lines in the last few days to meet immediate cash flow requirements and is in talks with financial institutions over future funding needs, it added.

Low-cost carrier Scoot will also suspend most of its network, leading to the grounding of 47 of its fleet of 49 aircraft, the airline said.

"It is unclear when the SIA Group can begin to resume normal services, given the uncertainty as to when the stringent border controls will be lifted," the airline said.

Airlines across the globe, estimated to be facing more than US$100 billion in lost revenue this year, are being forced to make unprecedented groundings and furloughing staff. Though large carriers should have adequate liquidity to ride out the crisis through June, smaller and less liquid operators may collapse without more support from shareholders and governments, according to Moody’s Investors Service.

“The severity and abruptness of deterioration in the operating environment will precipitate similarly paced erosion of what looked like perfectly adequate excess liquidity just a few weeks ago,” Moody’s analysts including Jonathan Root and Russell Solomon wrote in a report dated March 20.

“Most companies will emerge from the crisis with weaker credit fundamentals that may not be readily restorable to pre-coronavirus levels” -- Moody’s

The chief executive officer of Emirates, Sheikh Ahmed bin Saeed Al Maktoum, said in a memo to staff that some of the airline’s competitors and supply-chain partners may not survive the crisis caused by the virus, which has infected about 330,000 people and killed nearly 14,500. Singapore Airlines said it was unclear when it could resume normal services after grounding 185 of 196 aircraft.

Other major carriers including Delta Air Lines Inc. and American Airlines Group Inc are waiting for a bailout package to be cleared, while in China, the government has lowered fees and may back mergers of struggling smaller airlines into the bigger state-backed ones. The government has started taking steps to control the parent of Hainan Airlines Holding Co.

The International Air Transport Association, which represents 290 carriers around the world, forecasts the global airline industry needs government aid and bailout measures of as much as US$200 billion to survive the crisis

The International Air Transport Association, which represents 290 carriers around the world, forecasts the global airline industry needs government aid and bailout measures of as much as US$200 billion to survive the crisis. Manufacturing giants Boeing Co and Airbus SE are also in talks about state support, while Embraer SA is placing some workers on unpaid leave.

Regional Express Holdings Ltd, which flies to smaller towns and remote parts of Australia, said the country’s airlines may need a bailout of A$4.6 billion (US$2.6 billion), which is six times the amount the government has provided thus far. Qantas Airways Ltd and Virgin Australia Holdings Ltd. have axed international flights and slashed capacity.

Moody’s forecasts industry capacity could be cut by more than 60 percent on average in the second quarter, or over 75 percent in some cases on a year-on-year basis, depending on the airline’s geographic base and if its operating model is domestic, long-haul or both. Some may cut services altogether in April, Moody’s said. Cathay’s low-cost unit Hong Kong Express, which it acquired last year, said Friday it would suspend all flights from March 23 to April 30.

READ MORE: IATA chief calls on govts to save airlines from 'financial peril'

Reshaping airline industry

Reshaping airline industry

Assuming the spread of the virus slows by the end of June and demand rebounds, airline capacity globally will fall 25 percent to 35 percent this year, Moody’s said, noting that there is still a high degree of uncertainty around forecasts because virus-related events are unfolding so rapidly. Long-term demand for travel should be robust and grow steadily, but the virus may have a lasting impact that reshapes the industry, according to the report.

“As behaviors are forced to change during the crisis, some patterns will become more permanent,” it said. “Corporate travel is the most likely casualty as businesses ramp up their investments in remote working and see the costs savings from limited travel.”

With Reuters inputs