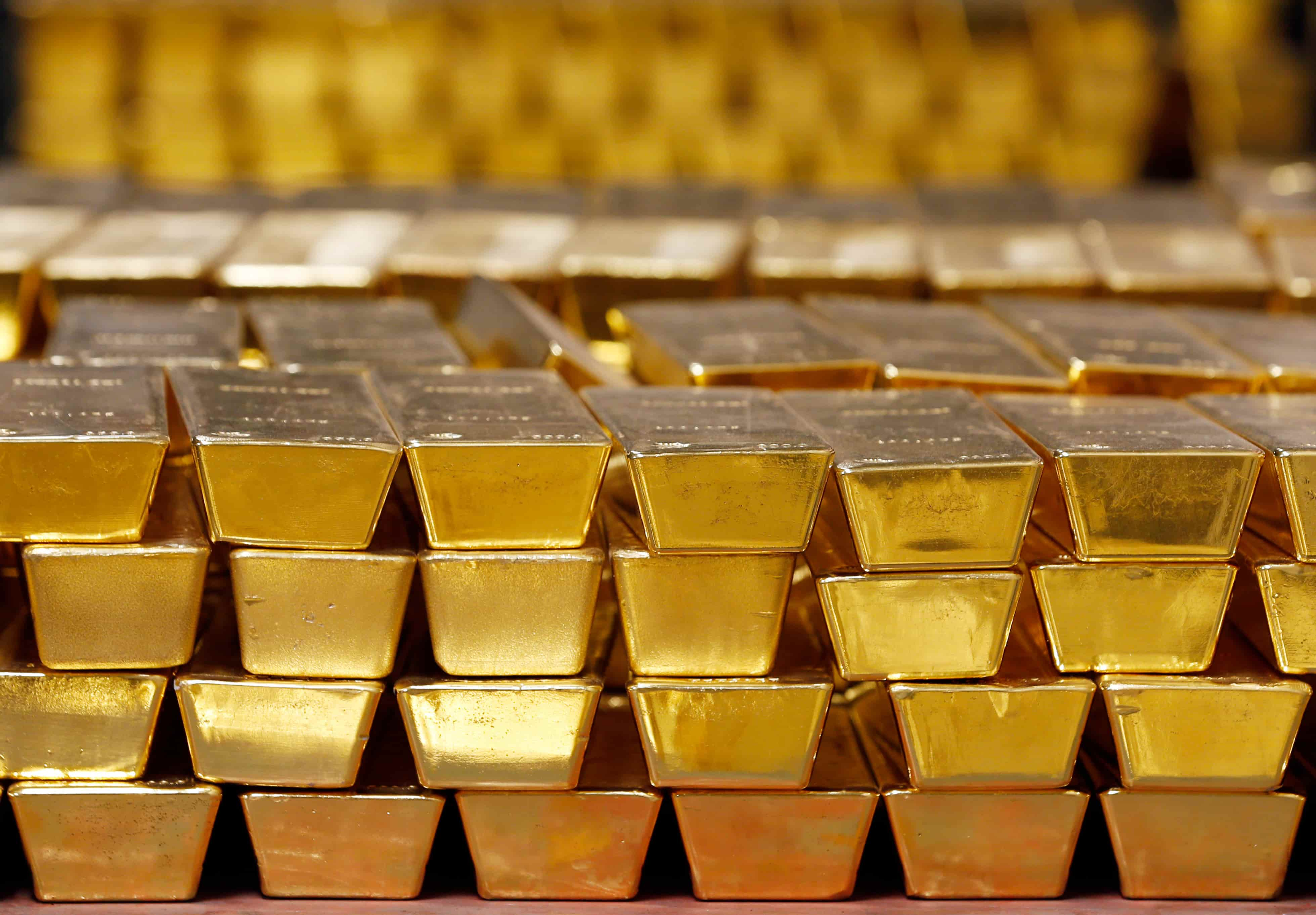

Gold prices surged to a historic high above $4,500 an ounce, fueled by the precious metal’s safe-haven allure amid rising tensions between Venezuela and the United States, as well as mounting expectations of fresh US Federal Reserve rate cuts next year.

On the Commodity Exchange, front-month gold futures topped $4,500 per ounce early on Wednesday in China, while February delivery contracts advanced further, at more than $4,512.

Spot bullion traded at $4,492.80 an ounce at 5:17 pm on Wednesday, China Standard Time, after reaching a record $4,525.77 earlier, according to Bloomberg data.

Gold has staged a remarkable rally this year, surging over 70 percent and gearing up for its strongest annual performance since 1979.

ALSO READ: Gold climbs above $4,500 in historic rally for precious metals

The persistent rally has sparked buying from consumers and long-term investors alike. Jewelry stores in Hong Kong have been bustling recently, with flocks of Chinese-mainland buyers snapping up gold products at bargain prices, due to a favorable exchange rate between the yuan and the Hong Kong dollar.

The yuan on Wednesday logged a high since late September, strengthening to around 0.9 yuan to each Hong Kong dollar. Price differences for similar gold ornaments at a same brand’s mainland versus Hong Kong branches reached as much as HK$200 ($25.71) per gram.

The buoyant performance has been supported by heightened geopolitical and economic uncertainty, which has sent investors rushing to gold as a haven asset amid fears of broader trade disruptions.

READ MORE: The golden link

Meanwhile, global markets are betting heavily on the Fed to continue its rate-cutting cycle into 2026 to ease the borrowing costs further. “Lower policy rates reduce the opportunity cost of holding a nonyielding asset, while Fed cuts may trigger some reallocation from money market funds,” analysts at State Street Investment Management said in a report.

“Fed easing and a weaker US dollar create a dual tailwind for gold, both directly through lower real yields and via denomination effects,” they added.

Also bolstering the precious metal’s appeal was the increasing physical demand, as central banks have maintained their buying spree, and financial institutions keep ramping up purchases in the past months.

READ MORE: Record-high gold price to boost HK’s bid to be a global gold trading hub

“Central banks’ gold as a percentage of reserves right now is about 20 percent, and that’s the highest in the past two decades,” said Aidan Yao, senior investment strategist for Asia at Amundi Investment Institute.

Yao said he sees the possibility of both the official and private sectors raising their gold allocations.

“If you look at fundamentals, valuations, historical comparison, and market positioning, we think this is a secular bull in gold that has more room to run,” he said. Volatility may occur, but the short-term consolidation is “healthy”, and upward trend will continue in the long run, he added.

Goldman Sachs earlier projected that gold prices will rise 14 percent to $4,900 per ounce by December 2026, but warned there were upside risks to this forecast, citing the possibility of broader diversification demand from investors.

Morgan Stanley also predicted the metal would continue to see gains in 2026, forecasting gold prices at $4,800 an ounce by the fourth quarter next year.

Contact the writer at gabylin@chinadailyhk.com