The Hong Kong Special Administrative Region government is expediting the development of the Northern Metropolis as a new engine for economic diversification, a key base for innovation and technology industries, and a source of quality employment opportunities, the city’s finance chief said on Tuesday.

To accelerate planning, construction, and industry development, the SAR is adopting a more flexible and proactive approach in developing the Northern Metropolis, including streamlining land allocation, importing talent, and co-investment arrangements, Paul Chan Mo-po said during the opening ceremony of the Future Investment Initiative Summit in Riyadh, Saudi Arabia.

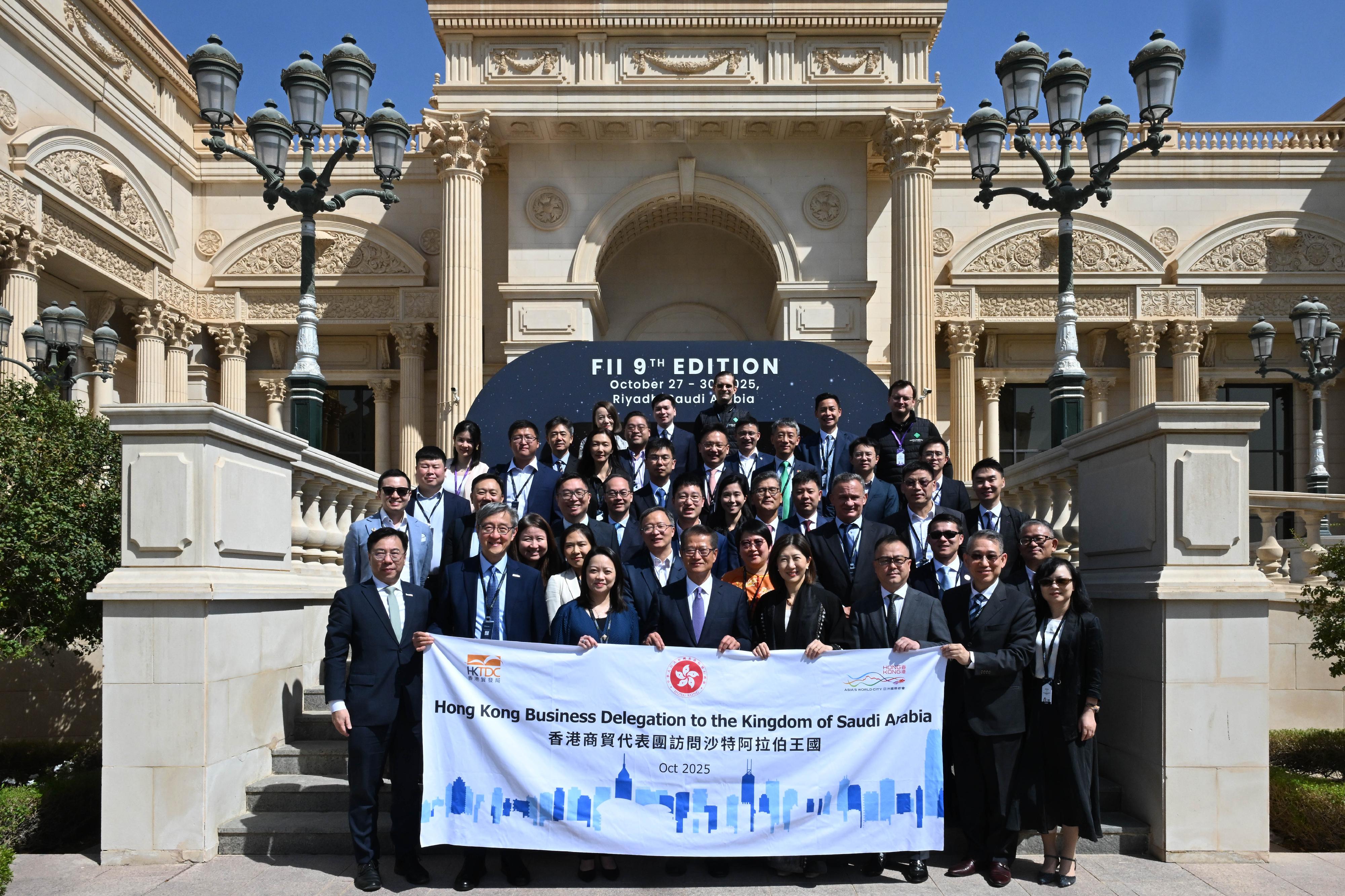

He is currently leading a delegation from Hong Kong’s financial and innovation sectors on a visit to the Saudi capital, according to a government statement.

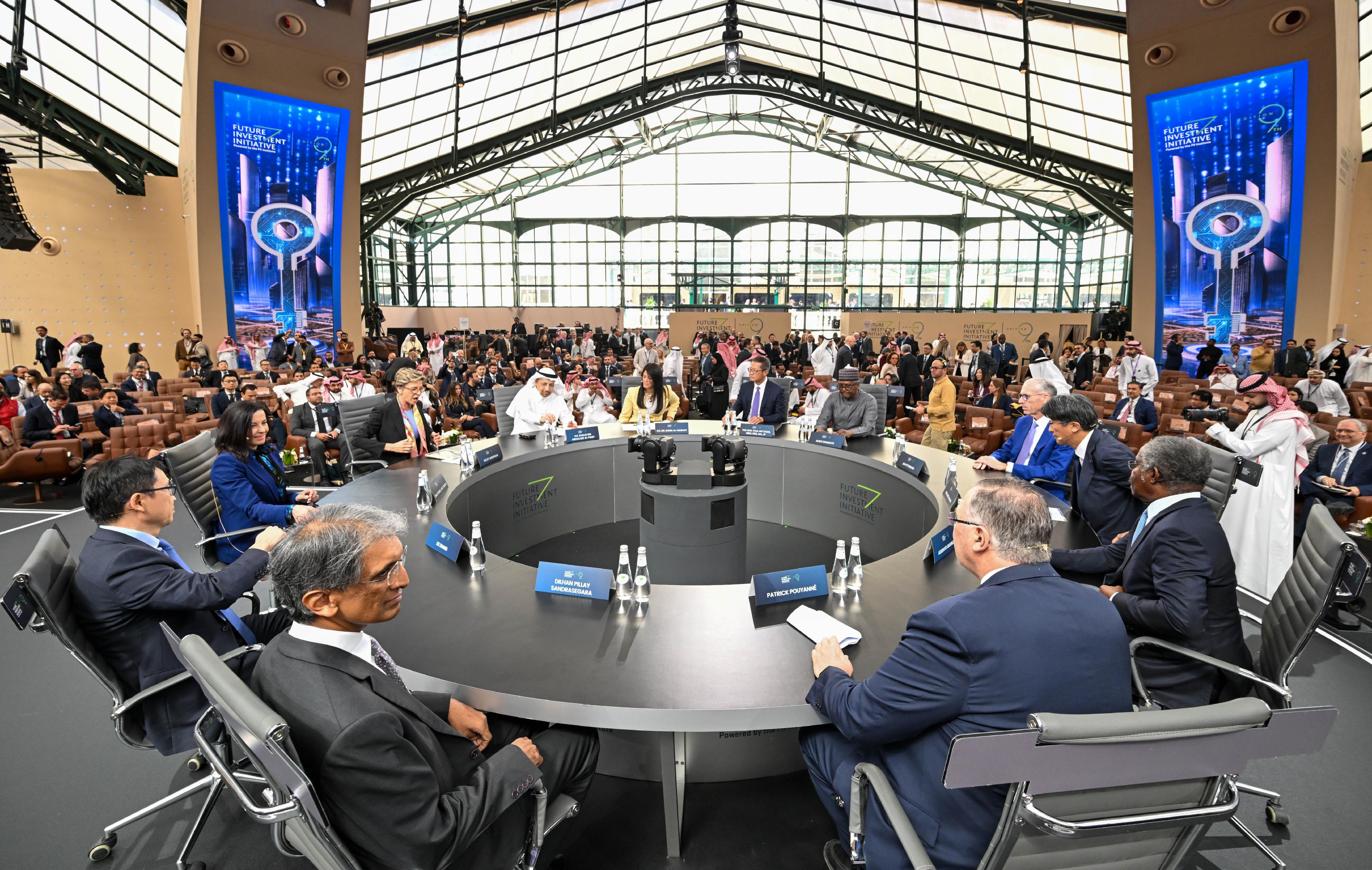

Speaking at a session titled "Board of Changemakers: Public–Private Powerbrokers", he shared the city’s experience in promoting various public-private partnership models, including the Build-Operate-Transfer model and the "Rail-plus-Property" model, which have incentivized private sector participation in infrastructure development.

RELATED ARTICLES

- HK eyes great gains as gateway for mainland’s Middle East trade

- Saudi-HK ‘flourishing ties’ highlighted at 95th Saudi National Day

- Hong Kong business delegation optimistic about Middle East trip

- Hong Kong-UAE trade ties boosted

Citing the establishment of the Hong Kong Investment Corporation (HKIC) Limited by the SAR government as another example of PPP, he said as patient capital, the HKIC supports the landing of companies and ecosystem building through co-investment and other means and partners with other funds in the market to channel capital into industries of strategic value, helping enhance Hong Kong's long-term competitiveness and create quality jobs for society.

Saudi Minister of Investment Khalid bin Abdulaziz Al-Falih, Egypt’s Minister of Planning and Economic Development and Minister of International Cooperation Dr Rania Al-Mashat, and chairpersons and chief executive officers of various multinational corporations also spoke during the session.

Chan also attended other thematic sessions, including a keynote speech delivered by Chinese Vice-President Han Zheng.

He also held bilateral meetings with local political and business leaders, including Saudi Vice Minister of Finance Abdulmuhsen bin Saad Alkhalaf, Group Chief Executive Officer of Diriyah Company Jerry Inzerillo, Chief Executive Officer of New Murabba Development Company under the Saudi Public Investment Fund Michael Dyke, and Chief Financial Officer of Red Sea Global Martin Greenslade.

Delivering a keynote speech at a business seminar hosted by China Investment Corporation, the financial secretary invited more Saudi and Middle Eastern enterprises and institutions to leverage Hong Kong's platform and join hands to open a new chapter in cooperation between Asia and the Middle East.

While the Middle East has set out an ambitious development vision and possesses strong growth momentum, China is pursuing high-quality development, including a high-level two-way opening-up, he said.

There is vast room for collaboration between the two regions in areas such as capital, technology, and industrial connectivity, he added.

As the world's No. 3 international financial center, the HKSAR is not only an international fundraising and professional services platform for mainland enterprises going global, but also an ideal gateway for Middle Eastern businesses to access the mainland market, he pointed out.

Around 300 mainland enterprises are in the pipeline for listing in Hong Kong, many of which plan to expand into the Middle East, Chan added.

Highlighting the SAR’s leading position in offshore Renminbi business, asset and wealth management, and the family office sector, he said that with increasing trade between China and Saudi Arabia settled in local currencies, the demand for RMB-denominated assets and risk management products is expected to grow.

Hong Kong is also Asia's premier center for asset and wealth management, with assets under management exceeding $4.5 trillion and a vibrant ecosystem for family offices, he said.